- Canada

- /

- Metals and Mining

- /

- TSXV:OGN

3 TSX Penny Stocks With Market Caps Under CA$300M

Reviewed by Simply Wall St

The Canadian market recently saw a positive shift, with the TSX gaining over 2% amid ongoing tariff uncertainties that continue to influence economic growth and inflation expectations. For investors looking beyond well-known stocks, penny stocks—typically smaller or newer companies—remain an intriguing area of exploration. Despite being considered an outdated term, these stocks can still present valuable opportunities when built on strong financial foundations; in this article, we explore three such Canadian penny stocks that stand out for their potential and resilience.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.58 | CA$71.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.63 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.32 | CA$685.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.67 | CA$279.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$185.35M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$521.62M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.60 | CA$71.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.75M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.19 | CA$44.67M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 927 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Cabral Gold (TSXV:CBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cabral Gold Inc. is a mineral exploration and development company primarily focused on gold properties in Brazil, with a market cap of CA$84.06 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration and development company focused on gold properties in Brazil.

Market Cap: CA$84.06M

Cabral Gold Inc., a pre-revenue company with a market cap of CA$84.06 million, has recently been added to the S&P/TSX Venture Composite Index, reflecting increased visibility. The company is actively exploring its Cuiu Cuiu gold district in Brazil, with promising drill results such as 12m at 27.7 g/t gold at Machichie NE and new mineralized zones identified at Machichie Main. Despite being unprofitable and having a short cash runway, Cabral has raised additional capital through a CA$100 million shelf registration to support ongoing exploration efforts and potential resource upgrades for its heap-leach starter operation.

- Get an in-depth perspective on Cabral Gold's performance by reading our balance sheet health report here.

- Evaluate Cabral Gold's historical performance by accessing our past performance report.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$116.33 million.

Operations: The company's revenue is derived entirely from its royalties and stream interests, totaling $2.83 million.

Market Cap: CA$116.33M

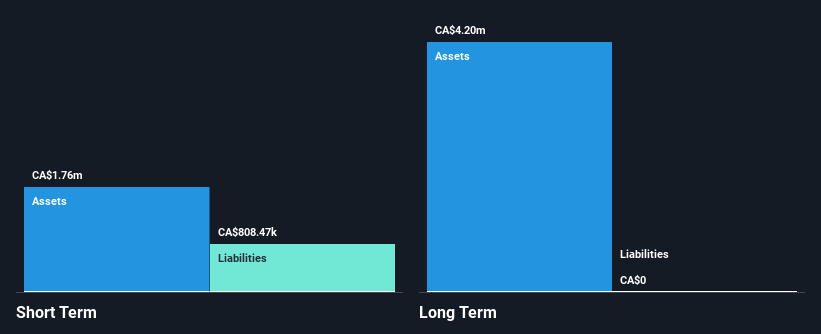

Sailfish Royalty Corp., with a market cap of CA$116.33 million, has transitioned to profitability over the past year, although its earnings growth is expected to decline by 17.8% annually over the next three years. The company's debt-to-equity ratio improved significantly from 27.2% to 11.7% in five years, and short-term assets of US$5.6 million comfortably cover both short- and long-term liabilities. Despite stable weekly volatility at 5%, Sailfish's dividend yield of 3.76% is not well-supported by earnings or cash flow, raising sustainability concerns despite recent dividend affirmations for April 2025 payouts.

- Take a closer look at Sailfish Royalty's potential here in our financial health report.

- Gain insights into Sailfish Royalty's outlook and expected performance with our report on the company's earnings estimates.

Orogen Royalties (TSXV:OGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orogen Royalties Inc. is a mineral exploration company active in Canada, the United States, Mexico, Argentina, and Kenya with a market cap of CA$292.49 million.

Operations: The company generates revenue from its mineral exploration activities, amounting to CA$7.33 million.

Market Cap: CA$292.49M

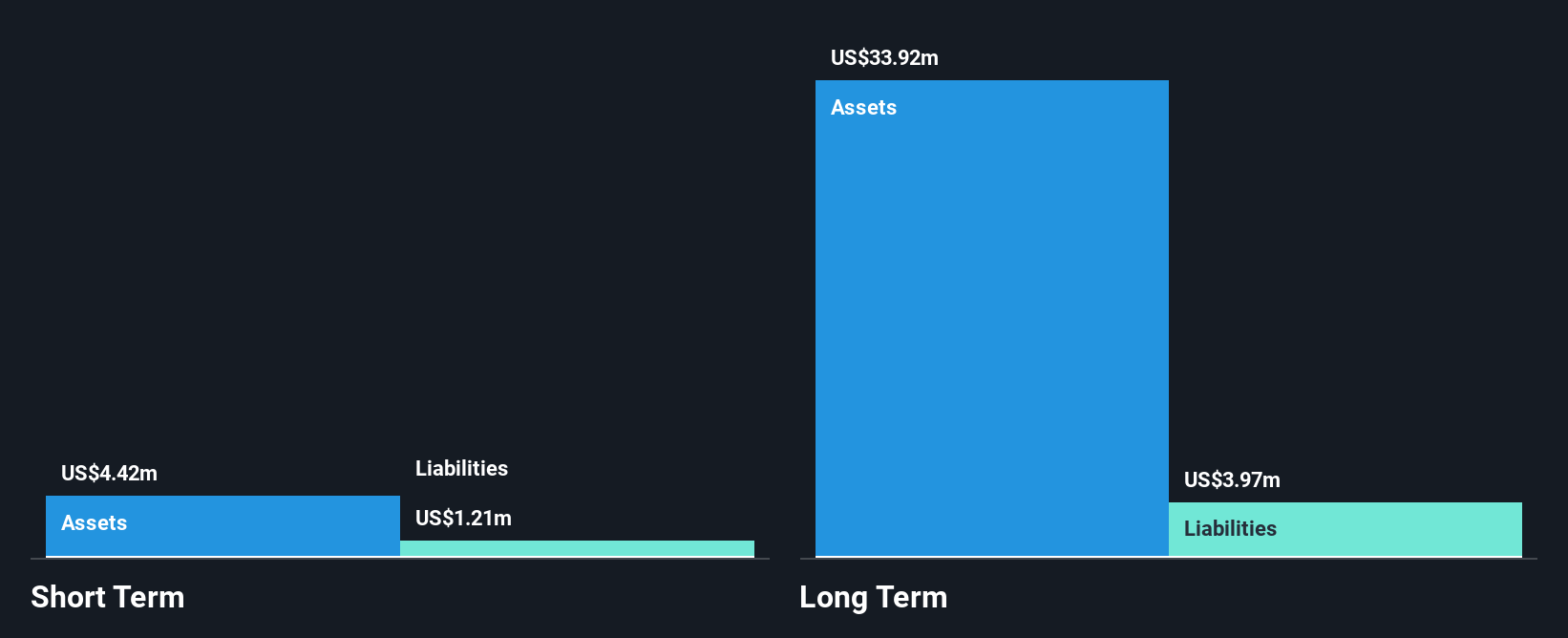

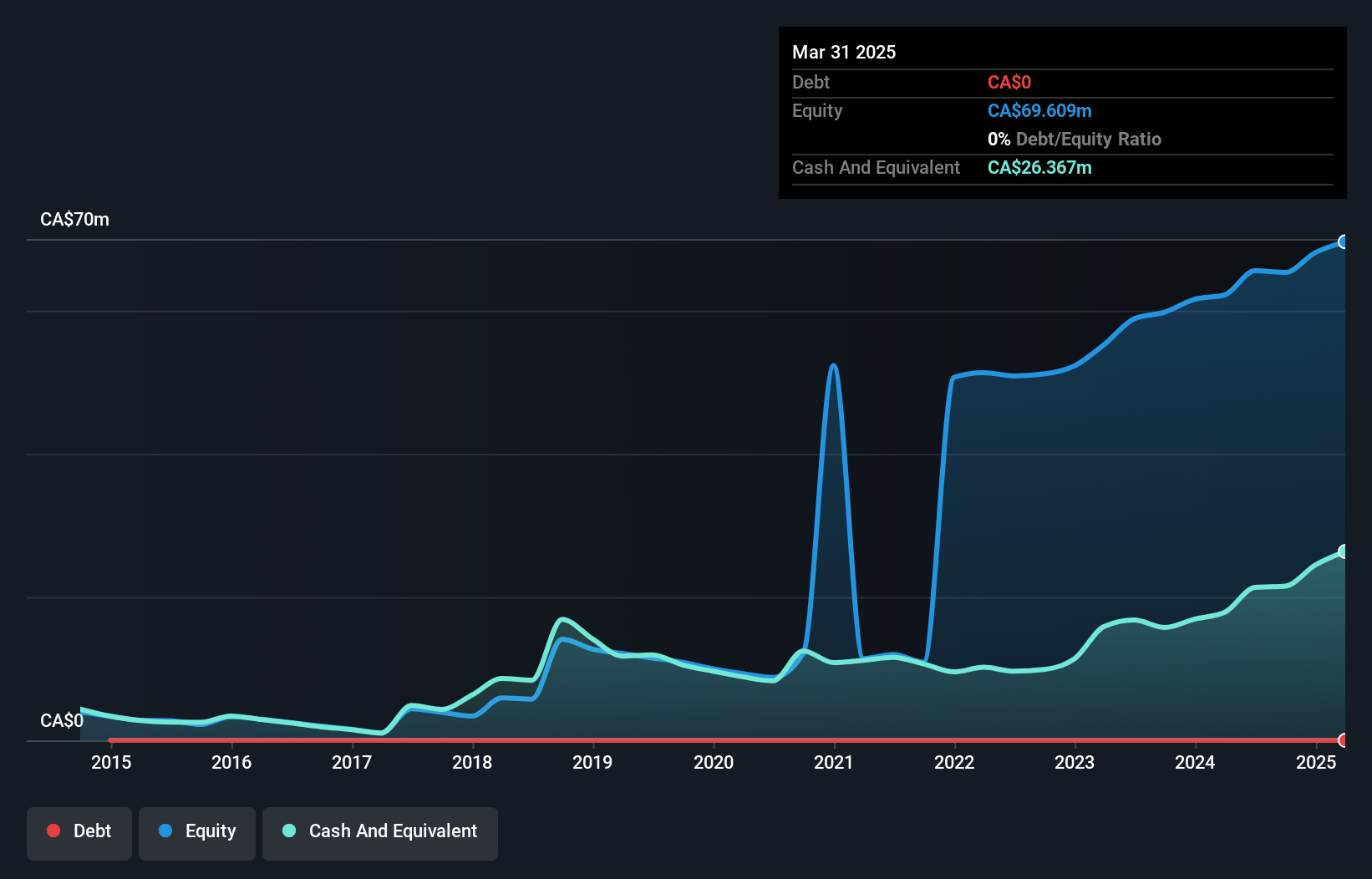

Orogen Royalties Inc., with a market cap of CA$292.49 million, has shown steady financial management by remaining debt-free, although its profit margins have decreased from 47% to 22.4% over the past year. Despite experiencing a significant one-off loss of CA$623.9K, the company maintains strong liquidity with short-term assets of CA$24.5 million covering liabilities comfortably. Recent updates include expanded mineral reserves at the Ermitano mine in Mexico and new resource estimates at the Expanded Silicon project in Nevada, enhancing Orogen's royalty portfolio potential despite recent negative earnings growth and low return on equity at 2.5%.

- Navigate through the intricacies of Orogen Royalties with our comprehensive balance sheet health report here.

- Examine Orogen Royalties' earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Take a closer look at our TSX Penny Stocks list of 927 companies by clicking here.

- Seeking Other Investments? We've found 26 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OGN

Orogen Royalties

Operates as a mineral exploration company in Canada, the United States, Mexico, Argentina, Kenya, and Colombia.

Flawless balance sheet with poor track record.

Market Insights

Community Narratives