- Canada

- /

- Metals and Mining

- /

- TSXV:CBG

Spotlight On TSX Penny Stocks For December 2024

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of evolving economic trends and strategic investment opportunities, investors are increasingly looking beyond traditional sectors. Penny stocks, though often considered a throwback to earlier market phases, continue to attract attention for their potential in offering affordability and growth. In this article, we explore three penny stocks on the TSX that stand out for their financial strength and resilience.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.28 | CA$116.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.31 | CA$907.23M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.02 | CA$391.6M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$483.37M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$224.43M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.27 | CA$168.47M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

Click here to see the full list of 952 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Christina Lake Cannabis (CNSX:CLC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Christina Lake Cannabis Corp. operates in the research and development, cultivation, processing, production, and sale of cannabis in British Columbia, Canada with a market cap of CA$3.28 million.

Operations: The company generates revenue from the cultivation and production of cannabis-related derivatives, amounting to CA$12.49 million.

Market Cap: CA$3.28M

Christina Lake Cannabis Corp. has a market cap of CA$3.28 million and generates revenue from cannabis-related derivatives, amounting to CA$12.49 million. Despite reporting a net income of CA$4.26 million for the recent quarter, the company remains unprofitable overall, with increased losses over the past five years at 8.1% annually and a high debt-to-equity ratio of 99%. The company's short-term assets exceed its liabilities, providing some financial cushion, but it faces volatility in share price and limited cash runway without further capital infusion—recently addressed by a private placement raising nearly CAD 3.6 million.

- Click here to discover the nuances of Christina Lake Cannabis with our detailed analytical financial health report.

- Gain insights into Christina Lake Cannabis' past trends and performance with our report on the company's historical track record.

Minco Silver (TSX:MSV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Minco Silver Corporation is involved in the exploration, evaluation, and development of precious metal and other mineral properties, with a market cap of CA$10.98 million.

Operations: Minco Silver Corporation has not reported any revenue segments.

Market Cap: CA$10.98M

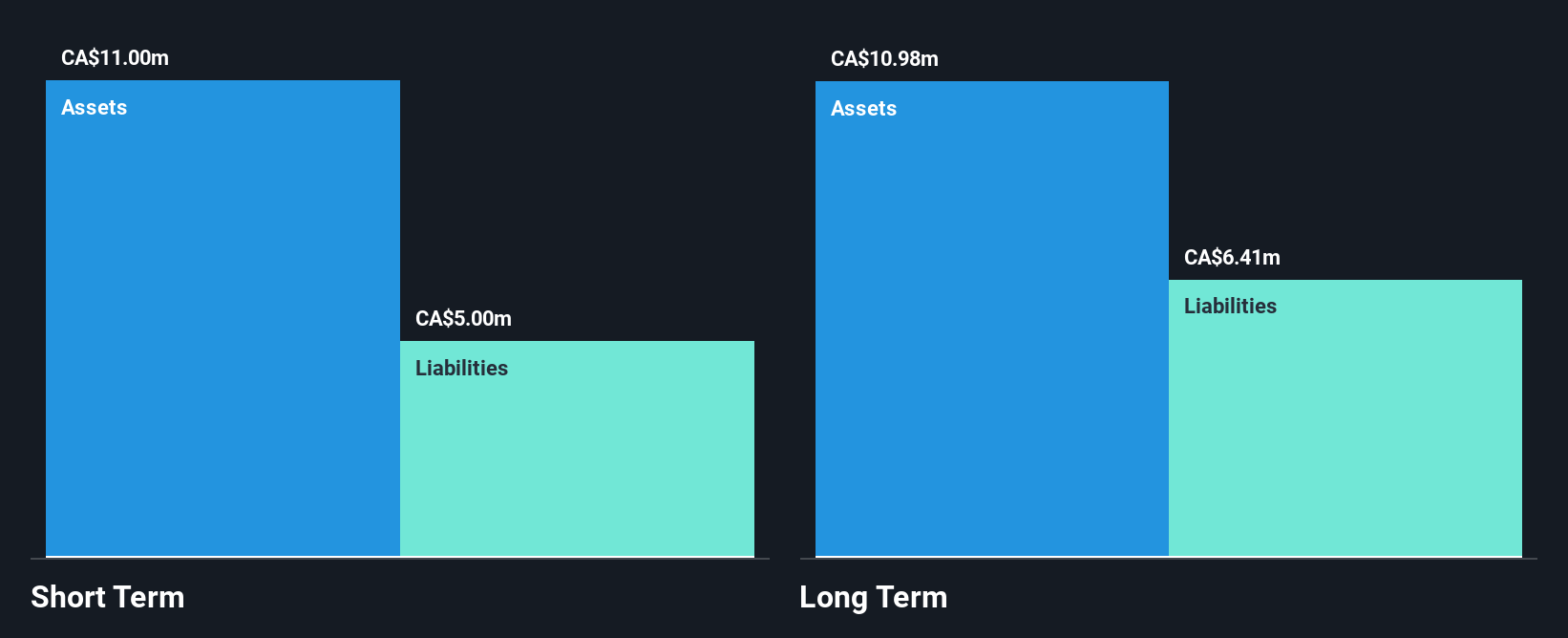

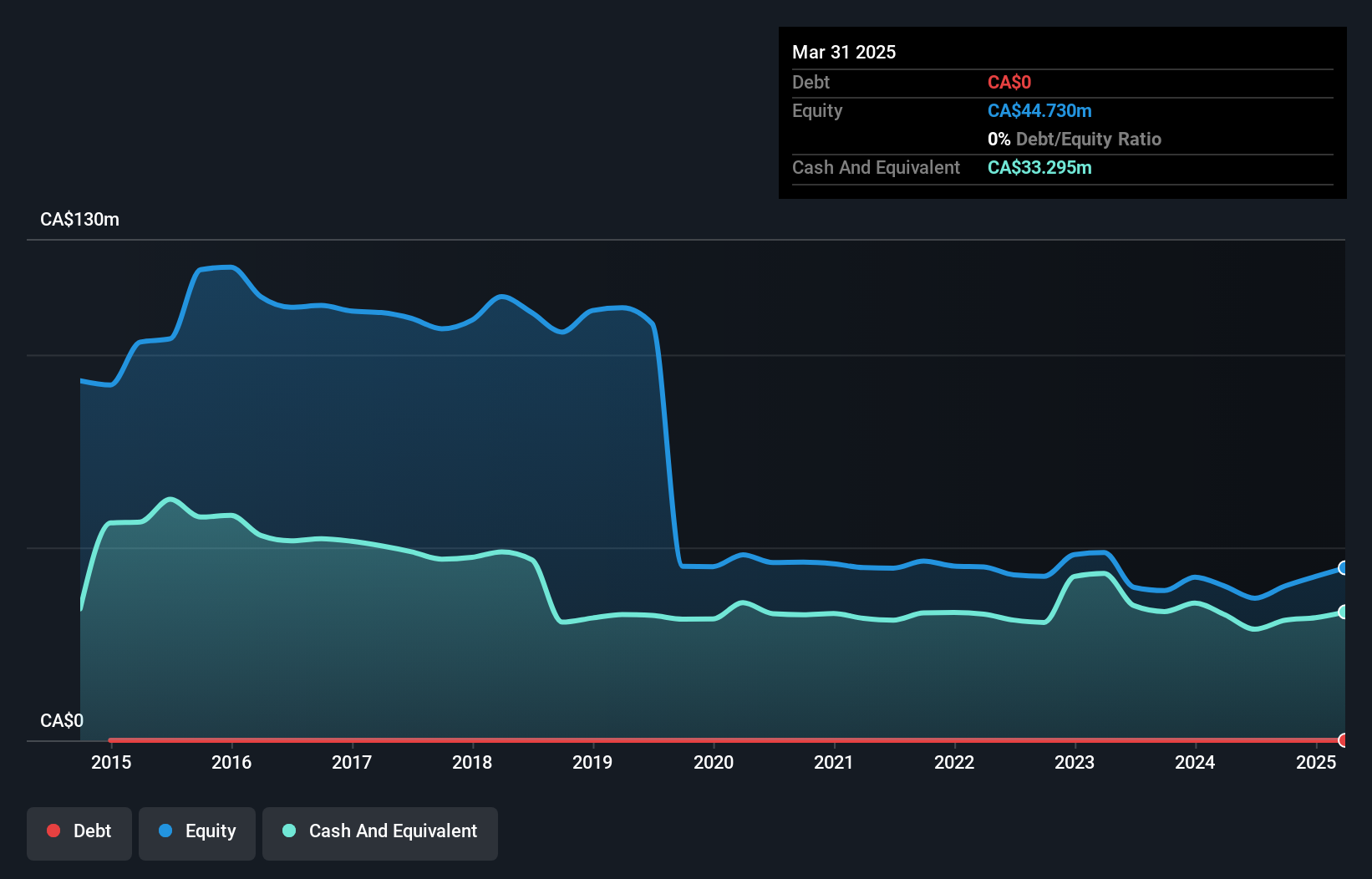

Minco Silver Corporation, with a market cap of CA$10.98 million, is pre-revenue but has shown significant progress in reducing losses by 71.4% annually over the past five years. The company reported a net income of CA$2.41 million for the recent quarter, marking an improvement from a loss in the previous year. Minco Silver's financial stability is supported by short-term assets of CA$40.8 million surpassing both short and long-term liabilities, and it remains debt-free with a cash runway exceeding three years if free cash flow continues to grow at historical rates. The board's average tenure is 14.1 years, indicating seasoned leadership amidst stable weekly volatility levels at 11%.

- Click to explore a detailed breakdown of our findings in Minco Silver's financial health report.

- Review our historical performance report to gain insights into Minco Silver's track record.

Chibougamau Independent Mines (TSXV:CBG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chibougamau Independent Mines Inc. focuses on the exploration and development of natural resource properties in the Chibougamau mining district of Québec, Canada, with a market cap of CA$7.63 million.

Operations: The company generates CA$0.02 million in revenue from its mineral exploration activities.

Market Cap: CA$7.63M

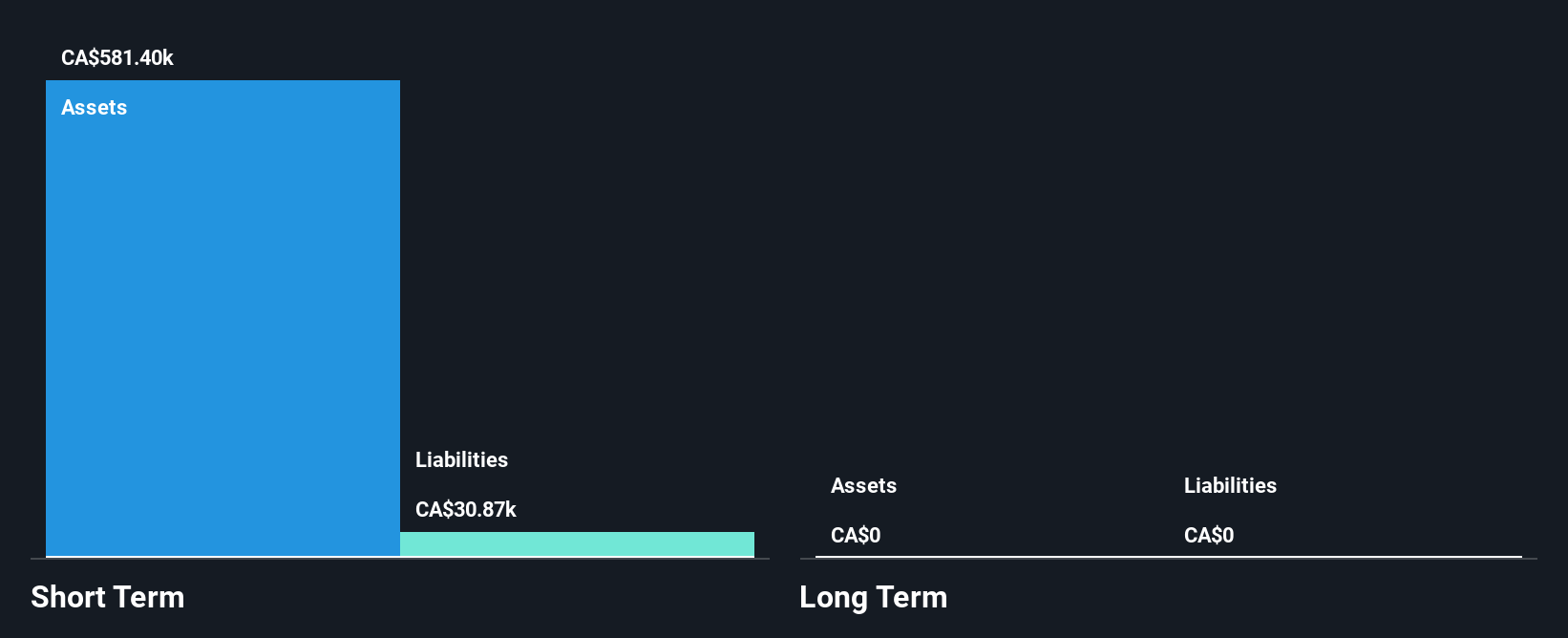

Chibougamau Independent Mines Inc., with a market cap of CA$7.63 million, is pre-revenue, generating minimal income from its exploration activities. The company maintains a 2% royalty on the Mont Sorcier Iron Project, which is undergoing feasibility studies expected to conclude by early 2026. Despite being unprofitable, Chibougamau has reduced its losses over the past five years by 16.7% annually and holds more cash than debt, indicating prudent financial management. Short-term assets cover liabilities comfortably, while shareholder dilution has been minimal recently. The board's extensive experience offers stability amid high share price volatility in recent months.

- Dive into the specifics of Chibougamau Independent Mines here with our thorough balance sheet health report.

- Learn about Chibougamau Independent Mines' historical performance here.

Taking Advantage

- Click here to access our complete index of 952 TSX Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CBG

Chibougamau Independent Mines

Engages in the reviving production in the Chibougamau gold-copper mining camp.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion