- Canada

- /

- Metals and Mining

- /

- TSXV:BTU

BTU Metals And 2 More TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As we move into the year, Canadian markets are navigating a complex landscape marked by persistent inflation and solid corporate earnings, while European equities show unexpected strength. In such a climate, identifying promising investment opportunities requires careful consideration of financial fundamentals and growth potential. Penny stocks, though an older term, continue to highlight smaller or emerging companies that can offer both value and growth when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.19 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

BTU Metals (TSXV:BTU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BTU Metals Corp. is involved in the identification, exploration, and evaluation of mineral properties in Canada and Ireland, with a market cap of CA$5.18 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$5.18M

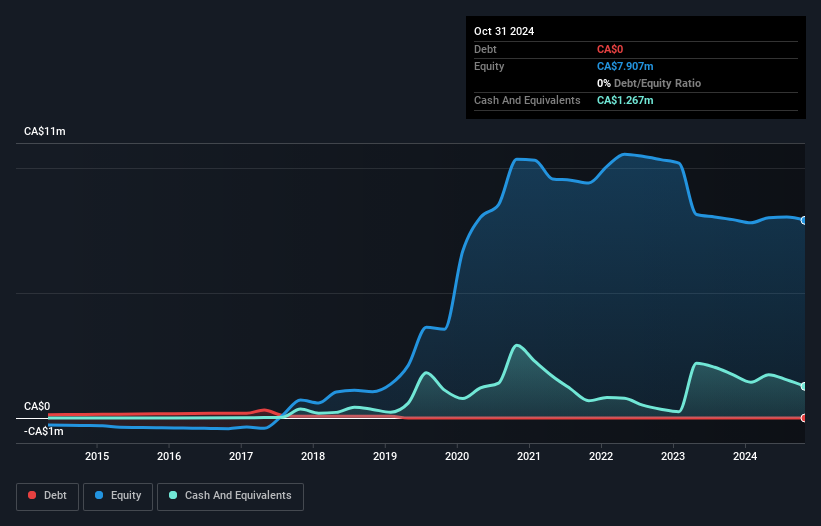

BTU Metals Corp., with a market cap of CA$5.18 million, is a pre-revenue exploration company focused on mineral properties in Canada and Ireland. Recent updates highlight its exploration efforts at the Echum project in Ontario's Wawa gold area, supported by non-dilutive funding from the Ontario Junior Exploration Program. Despite being debt-free and having sufficient cash runway for over a year, BTU remains unprofitable with increasing losses. The company's share price has been highly volatile, though short-term assets exceed liabilities. Its experienced management and board are steering extensive exploration activities to potentially unlock value from their significant land holdings.

- Take a closer look at BTU Metals' potential here in our financial health report.

- Evaluate BTU Metals' historical performance by accessing our past performance report.

CANEX Metals (TSXV:CANX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CANEX Metals Inc. is engaged in the exploration and development of mineral properties in Canada and the United States, with a market cap of CA$6.12 million.

Operations: CANEX Metals Inc. currently does not report any revenue segments.

Market Cap: CA$6.12M

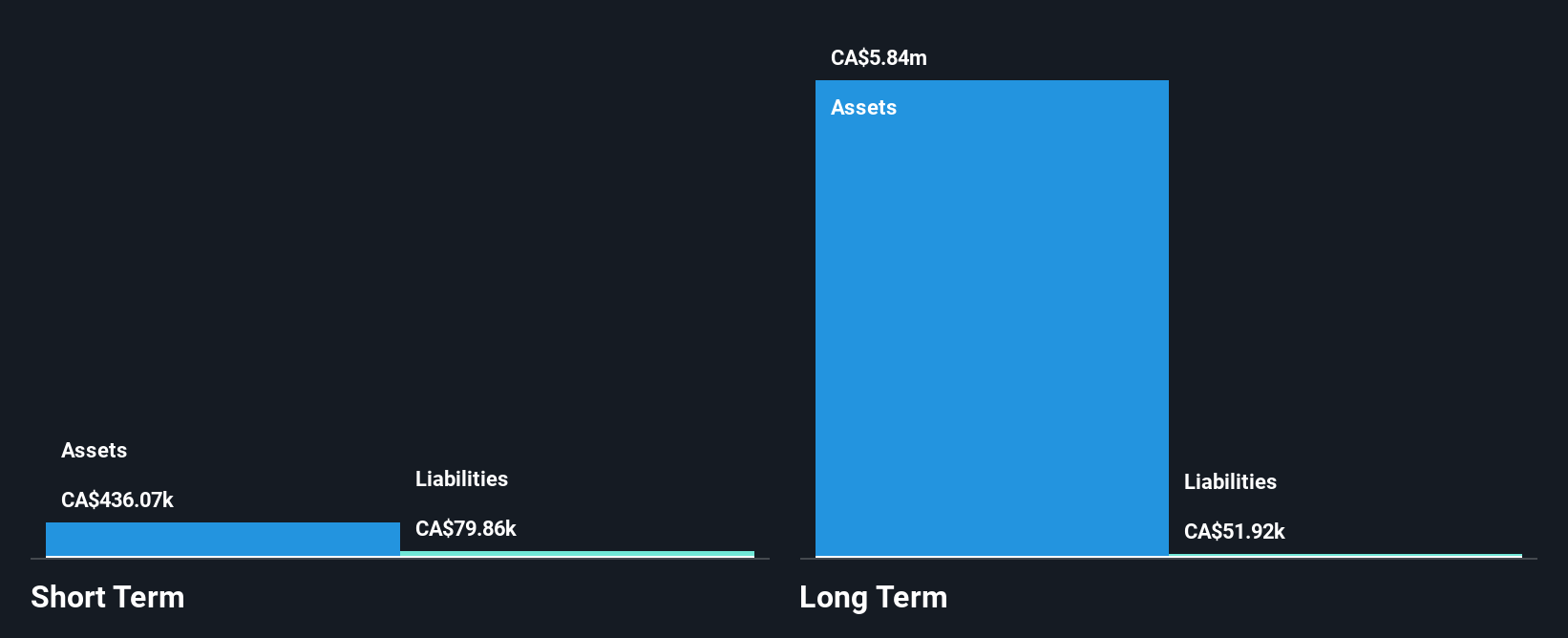

CANEX Metals Inc., with a market cap of CA$6.12 million, is a pre-revenue exploration company focused on mineral properties in Canada and the U.S. Despite being unprofitable, the company has not diluted shareholders significantly over the past year and remains debt-free. Recent developments include securing an exploration permit for its Louise Copper-Gold Porphyry project in British Columbia, with plans for geophysical surveying fully funded following an oversubscribed financing round. However, auditors have expressed doubt about its ability to continue as a going concern. The board is highly experienced, averaging 21.9 years of tenure per member.

- Navigate through the intricacies of CANEX Metals with our comprehensive balance sheet health report here.

- Gain insights into CANEX Metals' historical outcomes by reviewing our past performance report.

Quisitive Technology Solutions (TSXV:QUIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quisitive Technology Solutions, Inc. offers Microsoft solutions through its subsidiaries in North America and South Asia, with a market cap of CA$157.97 million.

Operations: The company generates revenue of $118.65 million from its Global Cloud Solutions segment.

Market Cap: CA$157.97M

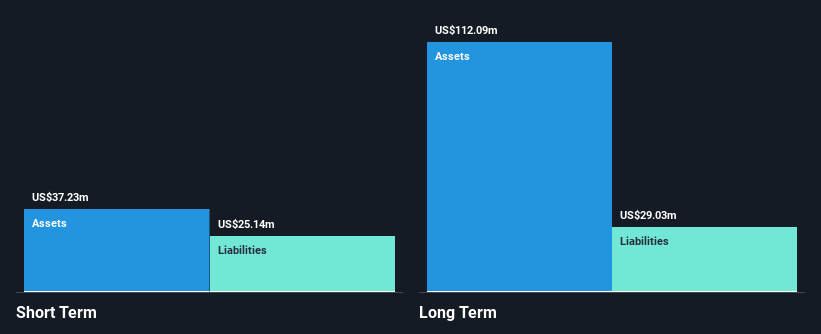

Quisitive Technology Solutions, with a market cap of CA$157.97 million, is undergoing significant changes following an acquisition agreement by H.I.G. Capital valued at CA$170 million. The company reported third-quarter sales of US$30.72 million and achieved net income compared to a loss in the previous year, indicating some financial improvement despite being unprofitable overall. Quisitive has reduced its debt to equity ratio significantly over five years and maintains sufficient cash runway for over three years due to positive free cash flow growth. The board and management team are experienced, with average tenures of 3 years each.

- Click here to discover the nuances of Quisitive Technology Solutions with our detailed analytical financial health report.

- Learn about Quisitive Technology Solutions' future growth trajectory here.

Turning Ideas Into Actions

- Get an in-depth perspective on all 940 TSX Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BTU Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BTU

BTU Metals

Engages in the identification, exploration, and evaluation of mineral properties in Canada and Ireland.

Flawless balance sheet slight.

Market Insights

Community Narratives