- Canada

- /

- Metals and Mining

- /

- TSXV:TIN

3 TSX Penny Stocks With Market Caps Over CA$4M To Consider

Reviewed by Simply Wall St

The Canadian market has been navigating the aftermath of a decisive U.S. election outcome, which has removed a layer of uncertainty and sparked a notable rally in stocks, including several record highs for the TSX. In this context, investors are refocusing on long-term fundamentals and exploring opportunities across various sectors. Despite its somewhat outdated terminology, the concept of penny stocks remains relevant as these smaller or newer companies can offer significant potential when underpinned by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.72 | CA$285.18M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.67M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.77 | CA$190.72M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.5M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.38 | CA$317.69M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Boat Rocker Media (TSX:BRMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boat Rocker Media Inc. is an entertainment company that creates, produces, and distributes television and film content in Canada, the United States, and internationally with a market cap of CA$48.21 million.

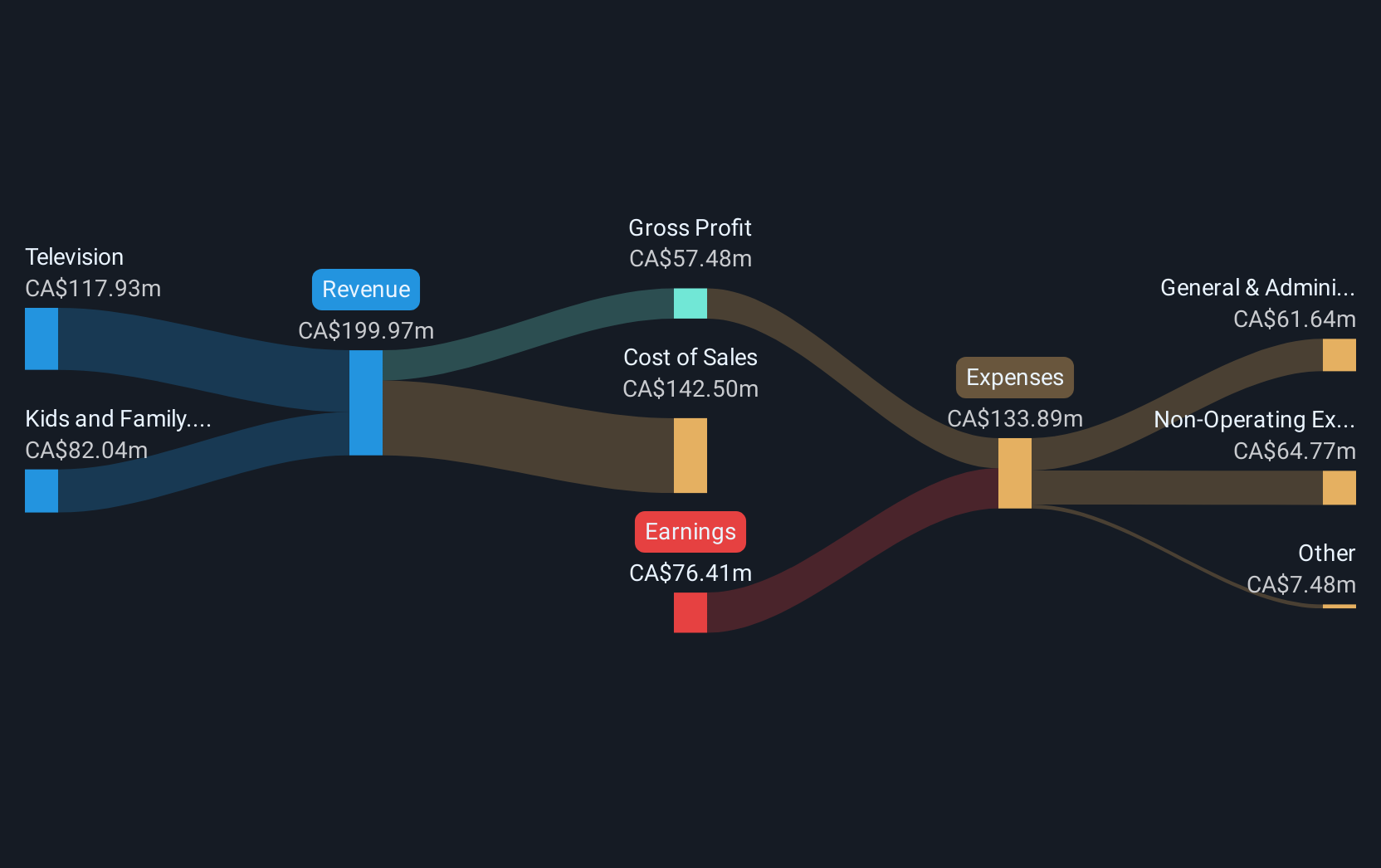

Operations: The company's revenue is primarily derived from its Television segment, which generated CA$297.11 million, and its Kids and Family segment, contributing CA$47.98 million.

Market Cap: CA$48.21M

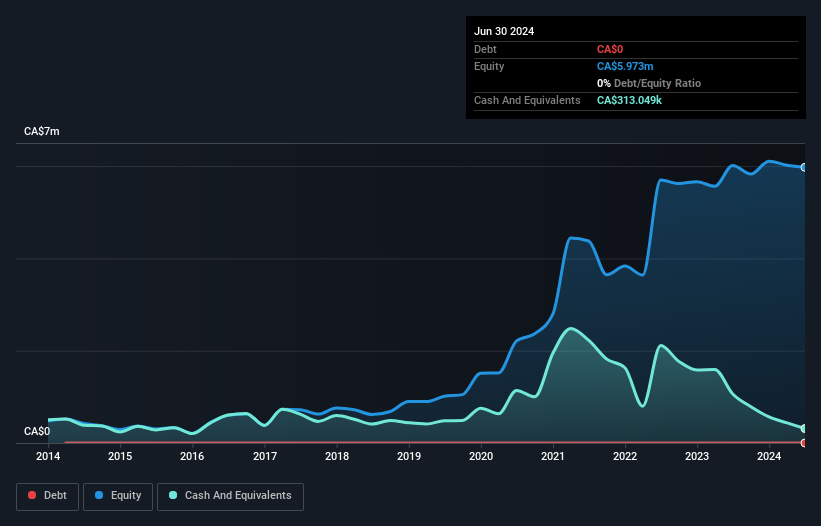

Boat Rocker Media Inc., an entertainment company with a market cap of CA$48.21 million, has shown resilience despite being unprofitable. The firm reported significant improvements in net income for the second quarter of 2024, with CA$38.69 million compared to a net loss the previous year, although sales dropped to CA$47.49 million from CA$120.89 million a year earlier. Its financial stability is bolstered by more cash than debt and sufficient cash runway for over three years due to positive free cash flow growth. Additionally, its board and management teams are experienced, enhancing its strategic direction amidst industry challenges.

- Dive into the specifics of Boat Rocker Media here with our thorough balance sheet health report.

- Examine Boat Rocker Media's earnings growth report to understand how analysts expect it to perform.

CANEX Metals (TSXV:CANX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CANEX Metals Inc. is a junior exploration company focused on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$4.58 million.

Operations: Currently, there are no reported revenue segments for this junior exploration company focused on mineral properties in Canada and the United States.

Market Cap: CA$4.58M

CANEX Metals Inc., with a market cap of CA$4.58 million, remains pre-revenue and unprofitable, though its balance sheet shows short-term assets exceeding liabilities. Despite recent shareholder dilution by 8.4%, the company is debt-free and has raised CA$300,000 through private placements to support exploration activities. The Louise Cu-Au Porphyry project in British Columbia presents promising copper and gold grades with potential for further discoveries through planned deep induced polarization surveys. Although the stock is highly volatile, the seasoned board provides stability as CANEX navigates its exploration-focused strategy amidst limited cash runway challenges.

- Jump into the full analysis health report here for a deeper understanding of CANEX Metals.

- Examine CANEX Metals' past performance report to understand how it has performed in prior years.

Tincorp Metals (TSXV:TIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tincorp Metals Inc. is involved in the exploration and development of mineral properties, with a market cap of CA$10.04 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$10.04M

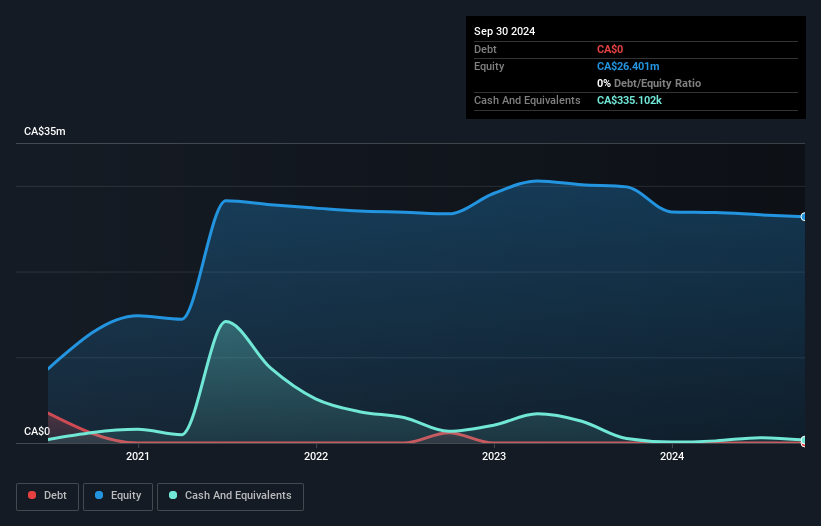

Tincorp Metals Inc., with a market cap of CA$10.04 million, is pre-revenue and unprofitable, as reflected in its negative return on equity. The company reported a reduced net loss for the second quarter and first half of 2024 compared to the previous year, indicating some improvement in financial performance. Despite having no debt, Tincorp's short-term assets (CA$690.3K) fall short of covering its liabilities (CA$2.4M), highlighting liquidity challenges. The management team has limited experience with an average tenure of 1.9 years, while the experienced board offers some governance stability amidst ongoing exploration activities.

- Click here and access our complete financial health analysis report to understand the dynamics of Tincorp Metals.

- Assess Tincorp Metals' previous results with our detailed historical performance reports.

Key Takeaways

- Reveal the 958 hidden gems among our TSX Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tincorp Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TIN

Tincorp Metals

Engages in the exploration and development of mineral properties.

Adequate balance sheet slight.