- Canada

- /

- Metals and Mining

- /

- TSXV:CAN

Canadian Gold Resources Insiders May Regret Not Buying More, Market Cap Hits CA$8.1m

Last week, Canadian Gold Resources Ltd. (CVE:CAN) insiders, who had purchased shares in the previous 12 months were rewarded handsomely. The shares increased by 19% last week, resulting in a CA$1.3m increase in the company's market worth, implying a 33% gain on their initial purchase. As a result, their original purchase of CA$364.0k worth of stock is now worth CA$485.4k.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

Canadian Gold Resources Insider Transactions Over The Last Year

In fact, the recent purchase by David Hennigar was the biggest purchase of Canadian Gold Resources shares made by an insider individual in the last twelve months, according to our records. That means that an insider was happy to buy shares at around the current price of CA$0.22. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. The good news for Canadian Gold Resources share holders is that insiders were buying at near the current price.

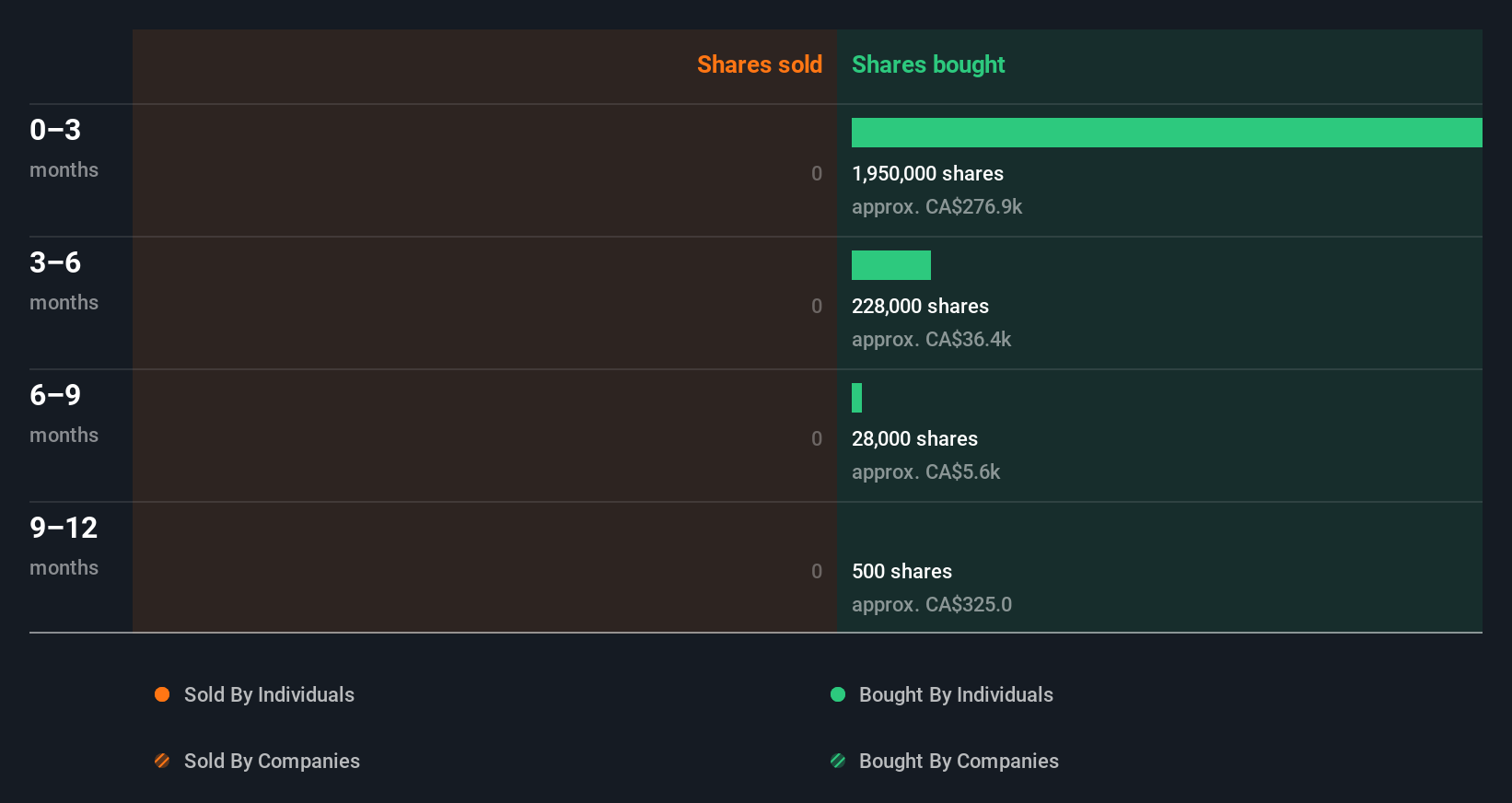

In the last twelve months Canadian Gold Resources insiders were buying shares, but not selling. The average buy price was around CA$0.16. We don't deny that it is nice to see insiders buying stock in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

See our latest analysis for Canadian Gold Resources

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Insiders At Canadian Gold Resources Have Bought Stock Recently

It's good to see that Canadian Gold Resources insiders have made notable investments in the company's shares. Not only was there no selling that we can see, but they collectively bought CA$326k worth of shares. This is a positive in our book as it implies some confidence.

Does Canadian Gold Resources Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 32% of Canadian Gold Resources shares, worth about CA$2.6m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About Canadian Gold Resources Insiders?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. But we don't feel the same about the fact the company is making losses. Given that insiders also own a fair bit of Canadian Gold Resources we think they are probably pretty confident of a bright future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To that end, you should learn about the 5 warning signs we've spotted with Canadian Gold Resources (including 3 which are concerning).

But note: Canadian Gold Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CAN

Canadian Gold Resources

Engages in acquisition and exploration of mineral and natural resource properties in Canada.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026