Aluula Composites Leads Our Trio Of TSX Penny Stock Highlights

Reviewed by Simply Wall St

As Canada navigates the economic implications of recent U.S. policy changes, including energy reform and tariff uncertainties, the TSX index has shown resilience with a notable uptick since Inauguration Day. Amidst these broader market dynamics, penny stocks continue to capture investor interest due to their potential for growth at lower price points. Despite being a somewhat outdated term, penny stocks can still offer compelling opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.29 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.33 | CA$432.92M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.42 | CA$124.04M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.26 | CA$231.32M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.495 | CA$13.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$632.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.61M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.16 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Aluula Composites (TSXV:AUUA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aluula Composites Inc. manufactures and sells composite materials for various industries including wind sports, aerospace, outdoor, airship, and sailing across multiple international markets with a market cap of CA$11.28 million.

Operations: The company generates revenue of CA$5.57 million from its composite materials segment.

Market Cap: CA$11.28M

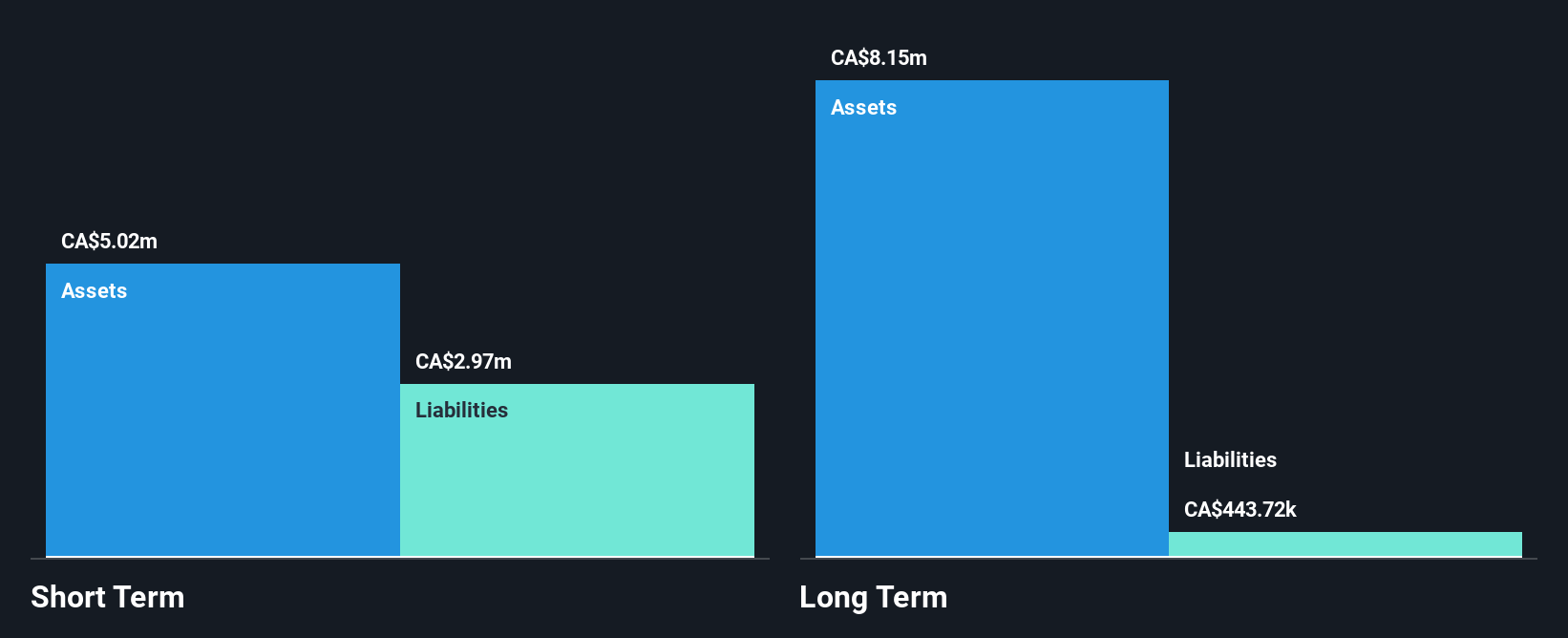

Aluula Composites Inc., with a market cap of CA$11.28 million, has shown significant revenue growth, reaching CA$5.57 million from its composite materials segment. Despite being unprofitable and having a negative return on equity, the company's short-term assets exceed both its short-term and long-term liabilities, indicating solid financial management. Recent strategic moves include raising CA$2.51 million through a follow-on equity offering and appointing Dr. Tyler Cuthbert as Chief Scientific Officer to strengthen their R&D capabilities in sustainable materials. The addition of industry experts to the advisory board aligns with Aluula's focus on circularity in advanced materials development.

- Jump into the full analysis health report here for a deeper understanding of Aluula Composites.

- Learn about Aluula Composites' historical performance here.

Neptune Digital Assets (TSXV:NDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada with a market cap of CA$304.66 million.

Operations: The company's revenue segment includes CA$2.19 million from data processing.

Market Cap: CA$304.66M

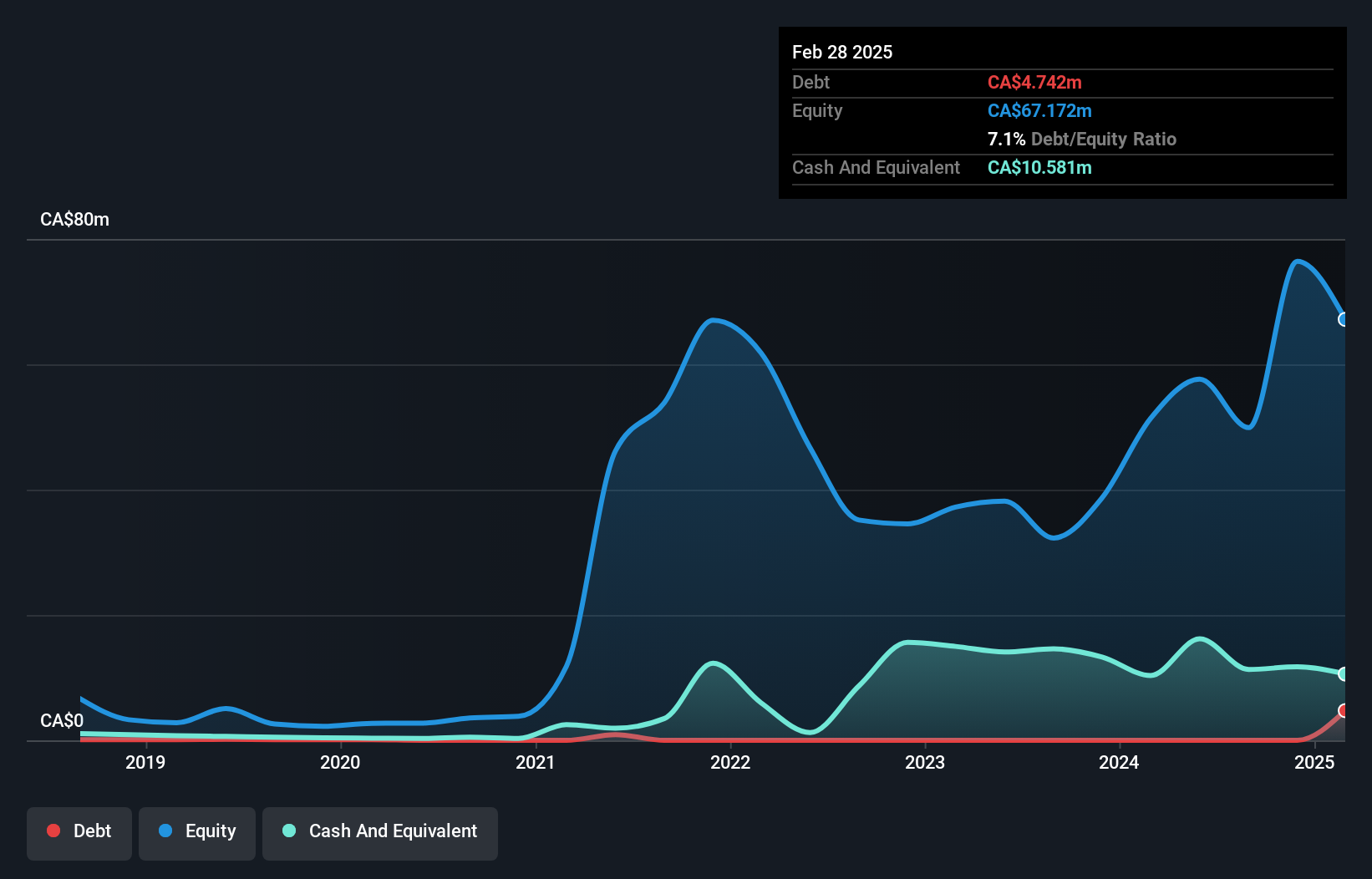

Neptune Digital Assets Corp., with a market cap of CA$304.66 million, has transitioned to profitability, reporting a net income of CA$4.69 million for the recent quarter despite limited revenue of CA$0.45 million. The company remains debt-free but has secured a strategic borrowing relationship with Sygnum Bank for up to US$25 million, leveraging its Bitcoin holdings to expand crypto-related investments. Neptune's innovative financial strategies include expanding Fantom holdings and utilizing put options, potentially earning substantial returns if market conditions remain favorable. The company's experienced management and board further support its strategic initiatives in the digital currency ecosystem.

- Dive into the specifics of Neptune Digital Assets here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Neptune Digital Assets' track record.

Palisades Goldcorp (TSXV:PALI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Palisades Goldcorp Ltd. is a resource investment company and merchant bank that invests in junior companies within the resource and mining sector, with a market cap of CA$95.81 million.

Operations: The company's revenue is solely derived from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to CA$1.44 million.

Market Cap: CA$95.81M

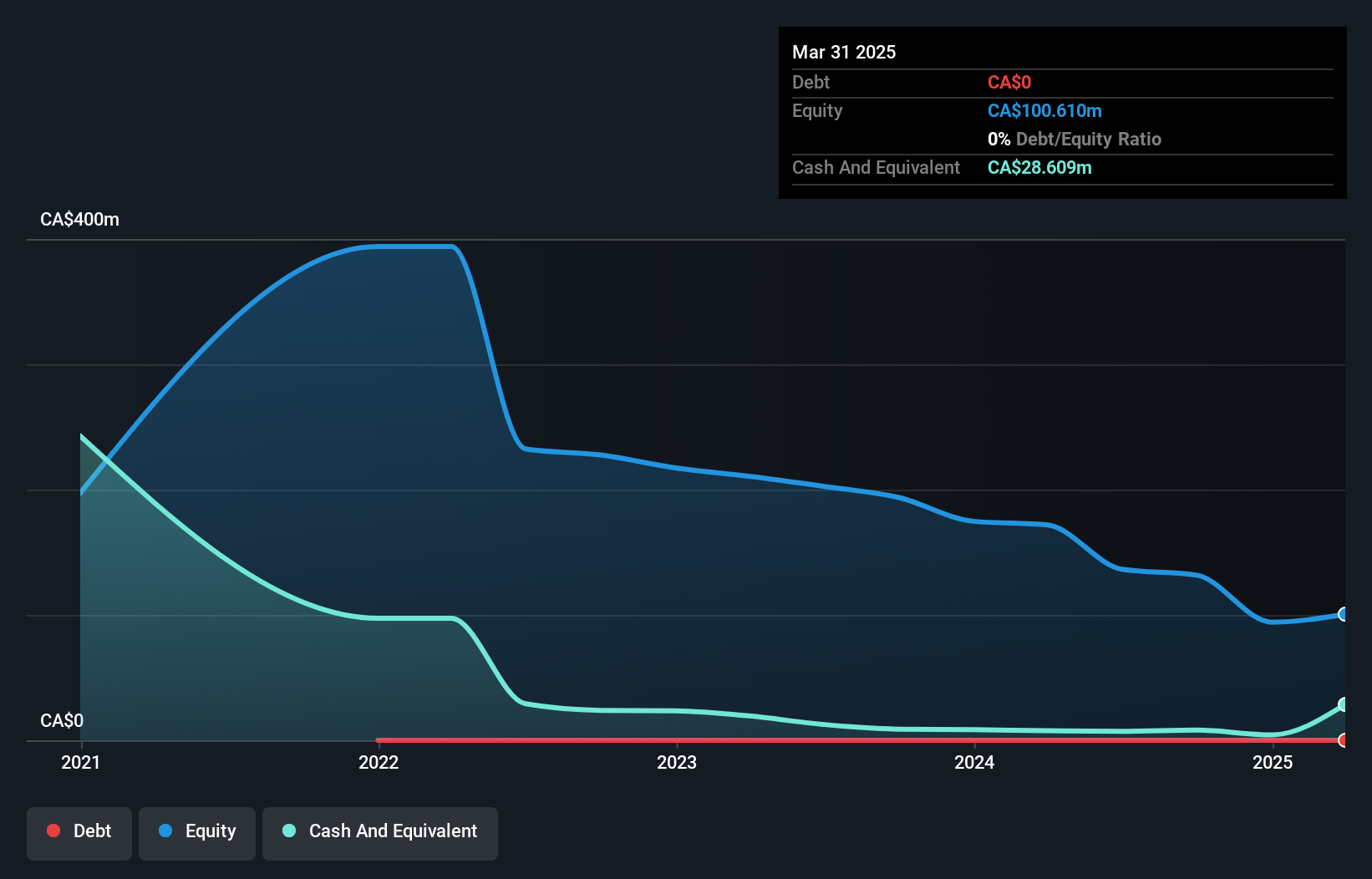

Palisades Goldcorp Ltd., with a market cap of CA$95.81 million, operates in the resource and mining sector but remains pre-revenue with its primary focus on junior companies. Despite having short-term assets of CA$8.1 million that exceed its short-term liabilities, the company faces challenges with negative equity returns and unprofitability. Recent earnings show an improvement in revenue to CA$1.26 million for Q3 2024, yet net losses persist at CA$4.79 million for the same period. The board's experience is notable, averaging 5.3 years tenure, providing stability amidst financial volatility and strategic buyback activities.

- Click to explore a detailed breakdown of our findings in Palisades Goldcorp's financial health report.

- Assess Palisades Goldcorp's previous results with our detailed historical performance reports.

Summing It All Up

- Gain an insight into the universe of 935 TSX Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neptune Digital Assets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NDA

Neptune Digital Assets

Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada.

Flawless balance sheet low.

Market Insights

Community Narratives