- Canada

- /

- Metals and Mining

- /

- TSXV:AUMB

How 1911 Gold’s C$23 Million Flow-Through Financing At 1911 Gold (TSXV:AUMB) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this month, 1911 Gold Corporation closed a large private placement, issuing various flow-through and non-flow-through units to raise about C$23,001,103 in gross proceeds.

- The mix of Canadian development and exploration expense flow-through units, alongside insider participation, signals a clear focus on funding both near-term project work and longer-term exploration.

- Next, we’ll examine how this substantial capital raise, particularly the flow-through financing structure, shapes 1911 Gold’s evolving investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is 1911 Gold's Investment Narrative?

For 1911 Gold, you have to believe in the company turning exploration success at True North into a real mining business, despite currently generating no revenue and posting a year‑to‑date loss of about C$12.3 million. The roughly C$23.0 million just raised through a mix of flow‑through and non‑flow‑through units materially shifts the near‑term picture: funding risk around drilling, resource upgrades and preparing for potential test mining now looks less pressing, which supports the recent very large share price move. At the same time, the financing adds to an already dilutive year and comes at a point when the stock trades at a rich price‑to‑book multiple versus peers. In other words, the core risks have not disappeared, they have just changed shape.

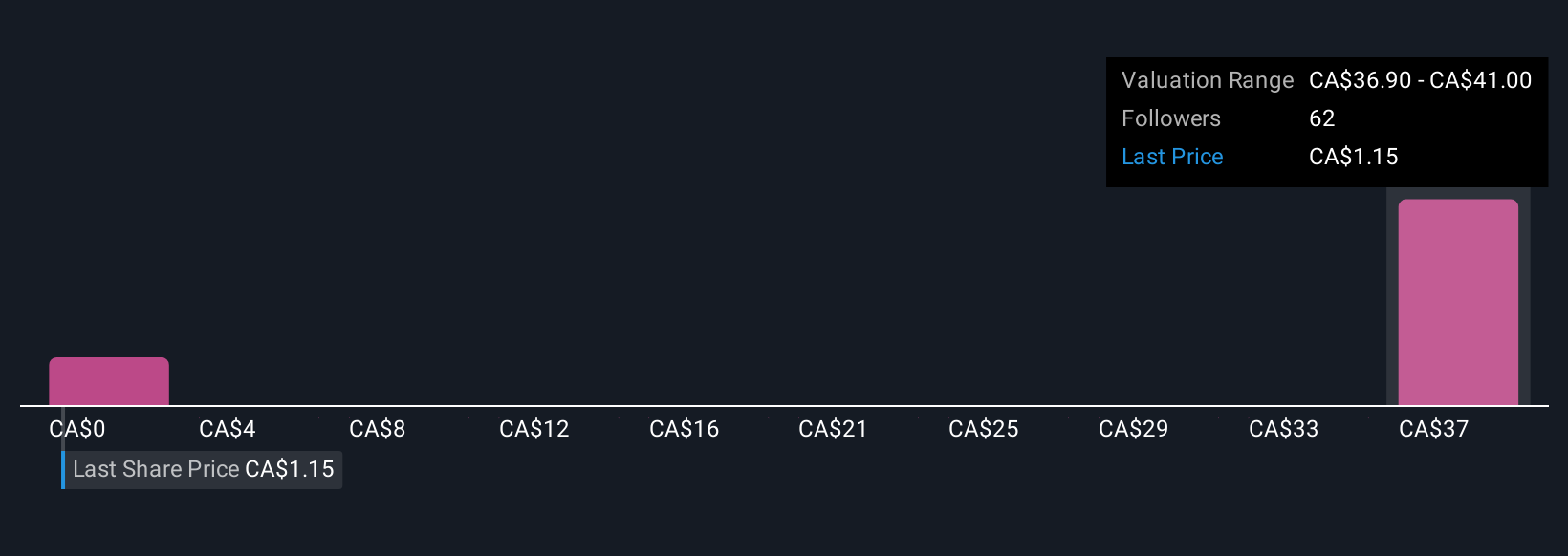

However, one risk around ongoing dilution and valuation is something investors should not overlook. 1911 Gold's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 8 other fair value estimates on 1911 Gold - why the stock might be worth just CA$4.10!

Build Your Own 1911 Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 1911 Gold research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free 1911 Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 1911 Gold's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AUMB

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026