- Canada

- /

- Metals and Mining

- /

- TSXV:AUMB

A Look at 1911 Gold (TSXV:AUMB) Valuation After Launching First Underground Drilling and Upsizing Financing

Reviewed by Kshitija Bhandaru

1911 Gold (TSXV:AUMB) has kicked off its first underground drill program at the True North Gold Project in Manitoba, marking a meaningful step in advancing resource expansion and potential mine restart plans.

This move, along with the company’s decision to boost the size of its financing offerings due to robust market demand, signals heightened investor attention and a new phase of development for 1911 Gold.

See our latest analysis for 1911 Gold.

1911 Gold’s recent underground drilling launch and upsized capital raise have landed just as momentum has quietly built in the background. The company has seen a 5.6% share price return year-to-date and a 6.4% total shareholder return over the past year. While the news has turned more industry eyes toward the stock, the gradual pickup in performance suggests sentiment is improving alongside project progress and renewed growth potential.

If you’re curious where else investor interest is heating up, this could be the perfect time to discover fast growing stocks with high insider ownership

With these recent developments in mind, investors are left wondering whether 1911 Gold’s stock still offers untapped value at current levels or if the market is already factoring in all its future growth prospects.

Most Popular Narrative: 97.5% Undervalued

The latest narrative from the community points to tremendous upside, with the narrative fair value vastly exceeding the recent $1.03 close. With such a gulf between price and fair value, all eyes are on the pivotal catalysts that could reshape sentiment.

1911 Gold has turned the corner from concept to formal economic work with a PEA underway and a trial mining / bulk-sample plan for mid-2026, taking the right de-risking steps before construction. With a current basic share count of approximately 262.3 million, the project shows strong torque at US$4,500 to US$5,000 gold under your AISC/oz path, but outcomes hinge on PEA/PFS results, bulk-sample performance, financing, and execution.

The valuation narrative is built on an aggressive production ramp and gold price scenario, hinting that just one variable could drive dramatic value shifts. Want to know which number holds the power? The underlying math will surprise you, and so will the timeline for it all to play out.

Result: Fair Value of $41.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, early-stage studies and uncertain production costs remain critical swing factors. These factors could quickly reshape the current upside narrative for 1911 Gold.

Find out about the key risks to this 1911 Gold narrative.

Another View: Caution from Book Value Multiples

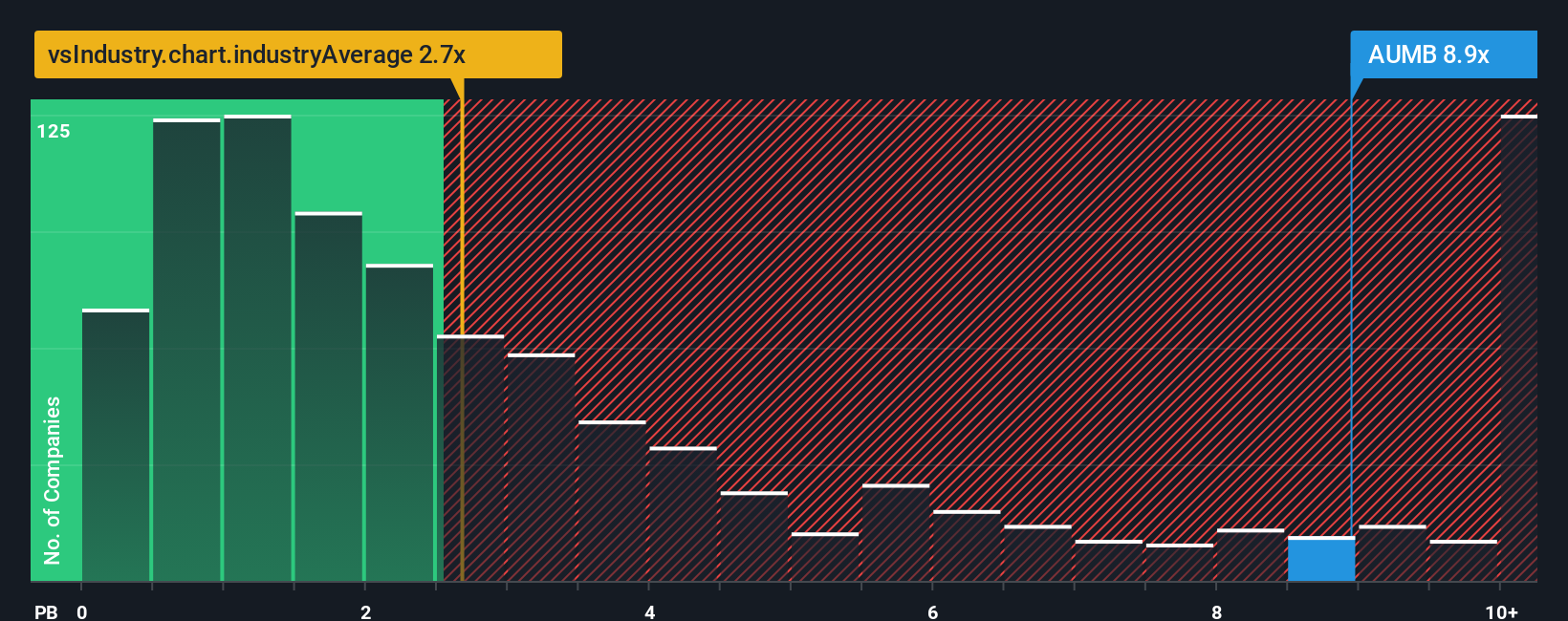

Looking at 1911 Gold’s price-to-book ratio, the story changes. At 9.4 times book value, shares are far more expensive than both the Canadian Metals and Mining industry average of 2.5x and the peer average of 7.3x. This premium suggests investors are already pricing in a lot of optimism, which could mean less margin for error if things do not go as planned. Should valuation risk worry potential buyers more than the narrative suggests?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 1911 Gold Narrative

If you see things differently or prefer your own research approach, you can dig into the numbers and shape your own perspective in minutes with Do it your way.

A great starting point for your 1911 Gold research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let the next winning idea pass you by. Use these powerful tools to spot stocks set to make waves before the crowd catches on.

- Unlock potential market disruptors by checking out these 909 undervalued stocks based on cash flows, which is packed with companies trading well below their intrinsic value.

- Target a steady stream of income and growth when you review these 19 dividend stocks with yields > 3%, offering strong yields above 3% from reliable payers.

- Spot tomorrow’s artificial intelligence leaders early by scanning these 24 AI penny stocks for standout opportunities in one of the hottest tech frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AUMB

Adequate balance sheet with low risk.

Market Insights

Community Narratives