- Canada

- /

- Metals and Mining

- /

- TSXV:ATY

Why Investors Shouldn't Be Surprised By Atico Mining Corporation's (CVE:ATY) 28% Share Price Plunge

Atico Mining Corporation (CVE:ATY) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 20% share price drop.

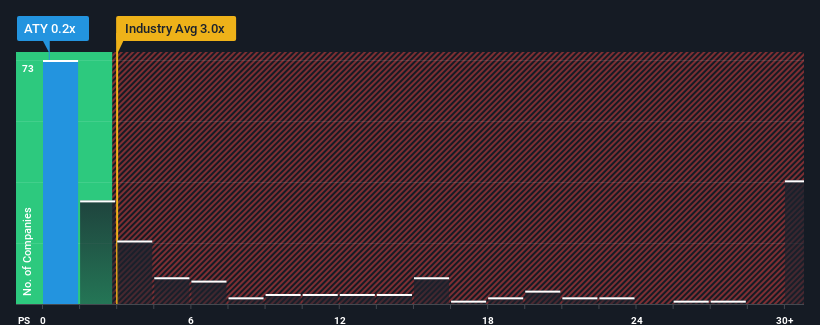

Since its price has dipped substantially, Atico Mining may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 3x and even P/S higher than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Atico Mining

What Does Atico Mining's P/S Mean For Shareholders?

Atico Mining's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Atico Mining's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Atico Mining?

Atico Mining's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.2%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 12% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 7.3% over the next year. With the industry predicted to deliver 20% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Atico Mining is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Having almost fallen off a cliff, Atico Mining's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Atico Mining's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Atico Mining (1 is significant!) that you should be aware of.

If you're unsure about the strength of Atico Mining's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ATY

Atico Mining

Engages in the acquisition, exploration, and development of copper and gold projects in Latin America.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives