- Canada

- /

- Commercial Services

- /

- TSX:BYD

TSX Stocks Estimated To Be Undervalued By Up To 35.8%

Reviewed by Simply Wall St

As the Canadian economy experiences improvements in labor productivity and a healthy rise in hourly compensation, investors are finding new opportunities within the TSX where certain stocks appear to be undervalued. In this environment, identifying stocks that are trading below their intrinsic value can offer potential for growth as corporate earnings continue to show resilience despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| West Fraser Timber (TSX:WFG) | CA$103.47 | CA$172.13 | 39.9% |

| Vitalhub (TSX:VHI) | CA$12.73 | CA$22.01 | 42.2% |

| Versamet Royalties (TSXV:VMET) | CA$1.38 | CA$2.46 | 43.9% |

| Magellan Aerospace (TSX:MAL) | CA$15.68 | CA$28.56 | 45.1% |

| K92 Mining (TSX:KNT) | CA$14.76 | CA$28.06 | 47.4% |

| Ivanhoe Mines (TSX:IVN) | CA$11.46 | CA$19.97 | 42.6% |

| Groupe Dynamite (TSX:GRGD) | CA$39.43 | CA$70.93 | 44.4% |

| goeasy (TSX:GSY) | CA$207.29 | CA$382.19 | 45.8% |

| Endeavour Mining (TSX:EDV) | CA$45.45 | CA$71.99 | 36.9% |

| Blackline Safety (TSX:BLN) | CA$6.24 | CA$10.13 | 38.4% |

Let's explore several standout options from the results in the screener.

Boyd Group Services (TSX:BYD)

Overview: Boyd Group Services Inc. operates non-franchised collision repair centers across North America and has a market cap of CA$4.59 billion.

Operations: The company generates revenue from its automotive collision repair and related services, totaling $3.06 billion.

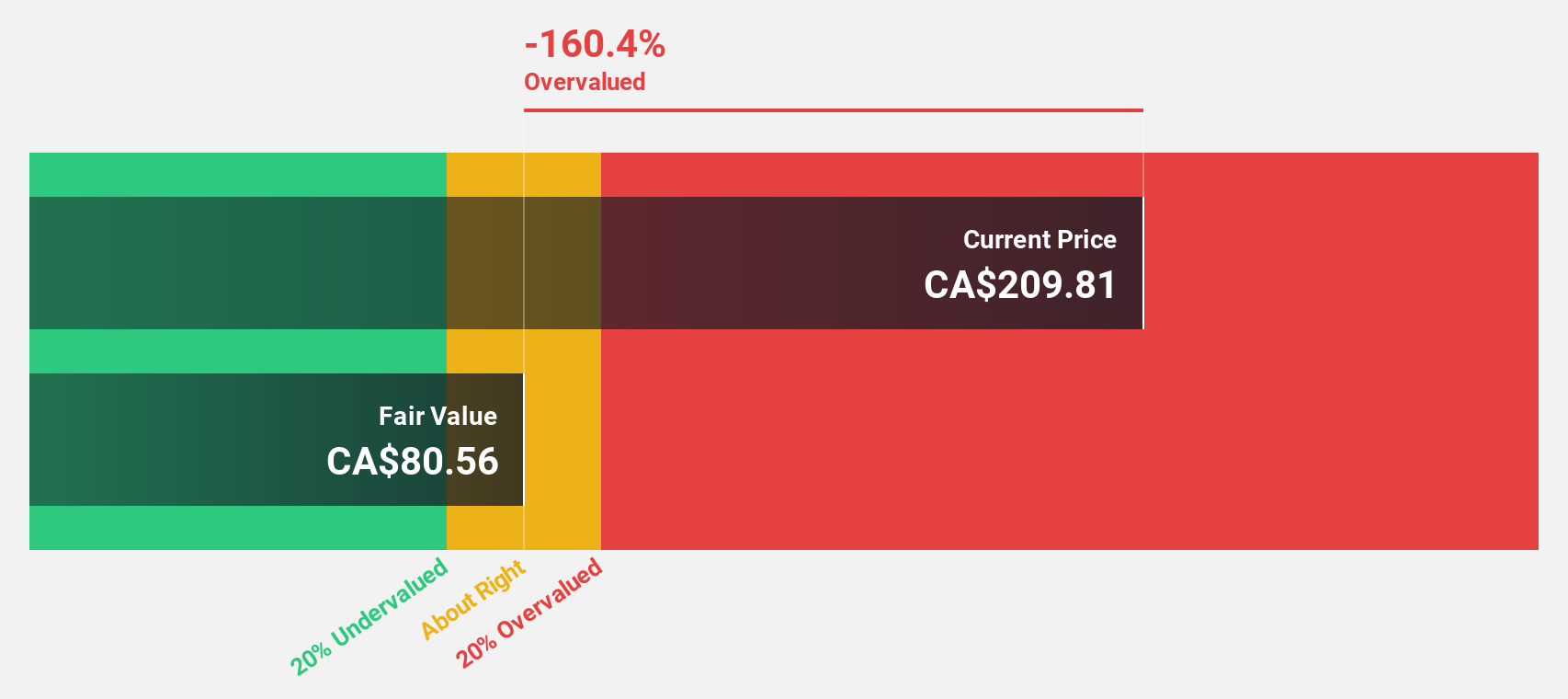

Estimated Discount To Fair Value: 35.8%

Boyd Group Services is trading at CA$211.76, significantly below its estimated fair value of CA$329.75, making it undervalued based on discounted cash flow analysis. Despite recent declines in net income and profit margins, the company’s earnings are forecast to grow substantially by 125.8% annually, outpacing the Canadian market's growth rate of 11%. However, interest payments are not well covered by earnings, indicating financial challenges amidst expected high revenue growth of 9.3% per year.

- Our earnings growth report unveils the potential for significant increases in Boyd Group Services' future results.

- Take a closer look at Boyd Group Services' balance sheet health here in our report.

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation operates in aerospace and aviation services and equipment, as well as manufacturing businesses globally, with a market cap of CA$3.87 billion.

Operations: The company's revenue is derived from two main segments: Aerospace & Aviation, contributing CA$1.69 billion, and Manufacturing, generating CA$1.10 billion.

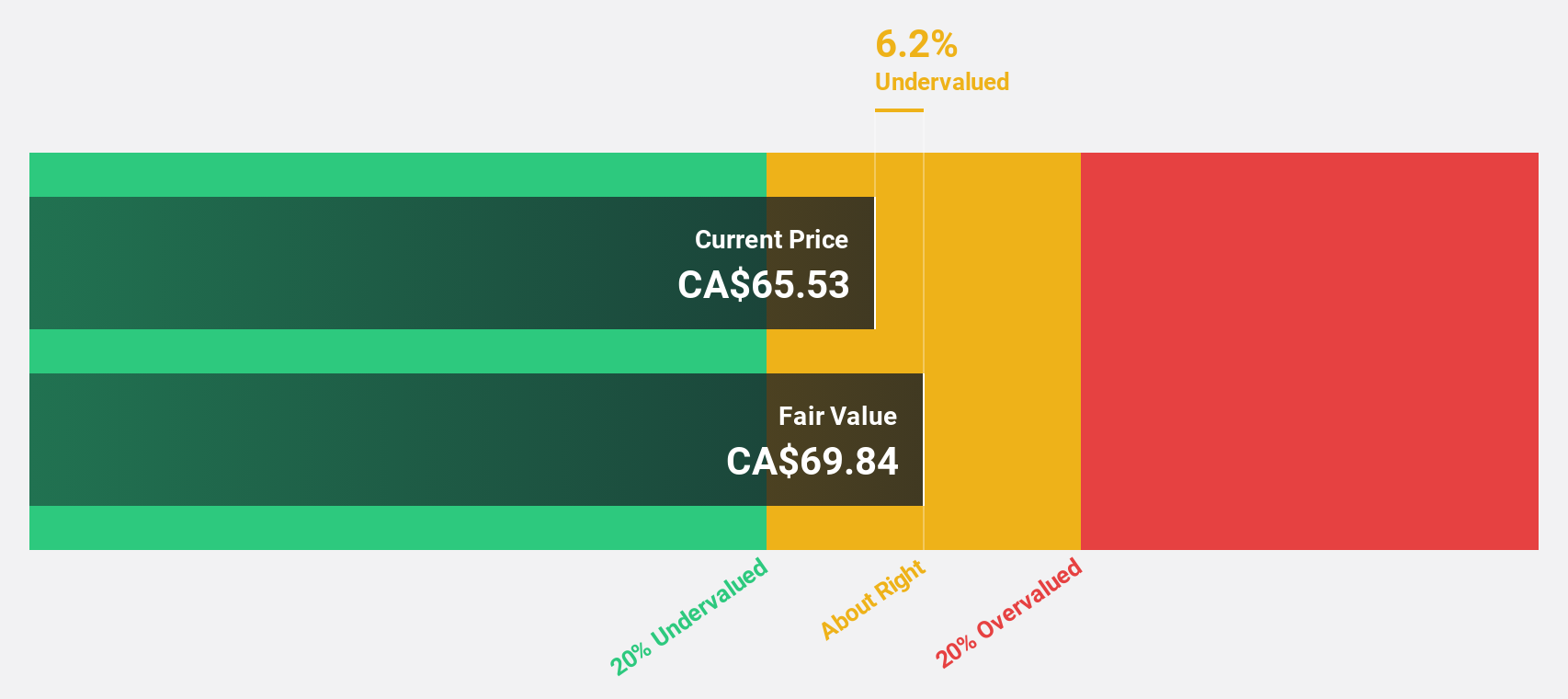

Estimated Discount To Fair Value: 30.2%

Exchange Income Corporation, trading at CA$73.62, is undervalued with an estimated fair value of CA$105.43 based on discounted cash flow analysis. Recent earnings reports show revenue growth to CA$719.93 million in Q2 2025 from CA$660.58 million a year ago, and net income rose to CA$40.01 million from CA$32.65 million. Despite strong earnings growth forecasts of 31% annually, the dividend yield of 3.59% isn't well covered by earnings or free cash flows, and interest payments remain challenging to cover with current earnings levels.

- Our expertly prepared growth report on Exchange Income implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Exchange Income with our comprehensive financial health report here.

Artemis Gold (TSXV:ARTG)

Overview: Artemis Gold Inc. is engaged in the identification, acquisition, and development of gold properties with a market cap of CA$6.50 billion.

Operations: Revenue Segments (in millions of CA$): null

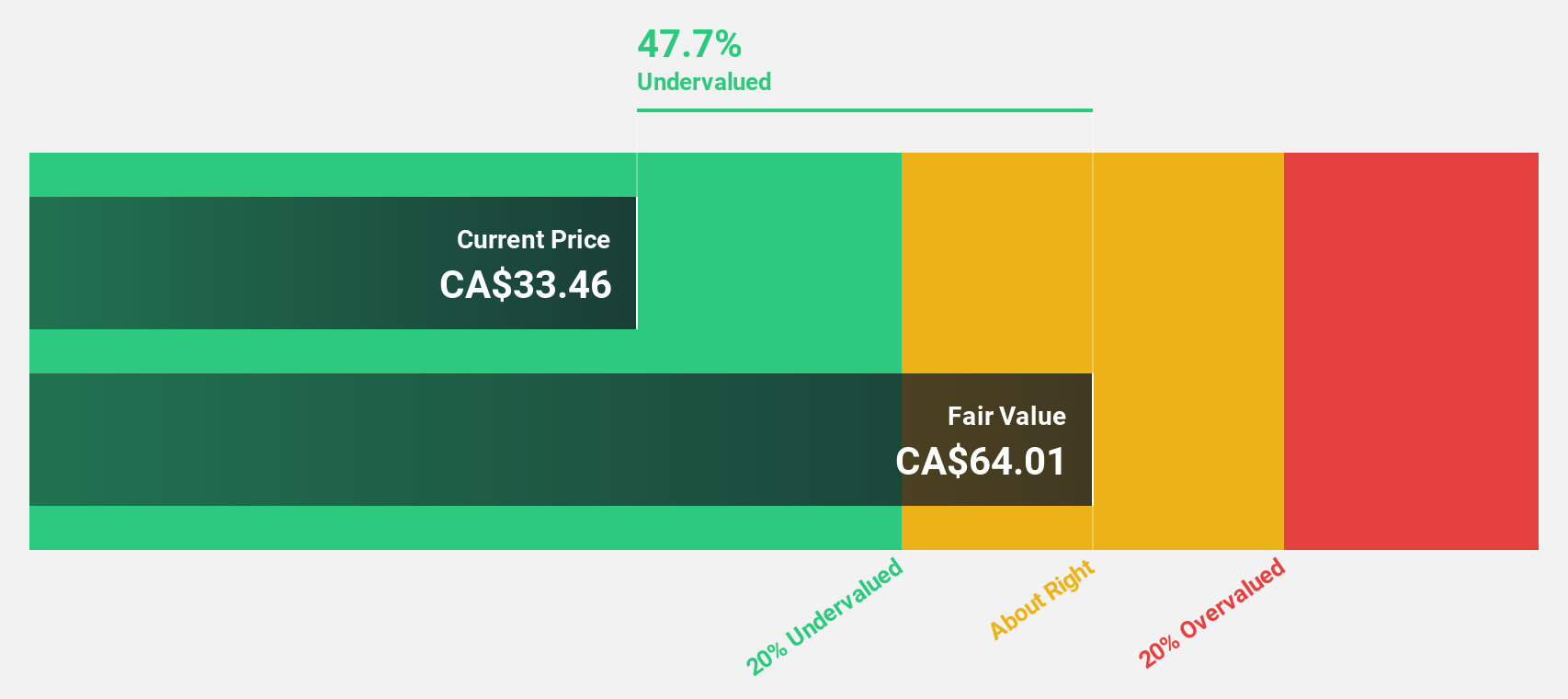

Estimated Discount To Fair Value: 18.6%

Artemis Gold, trading at CA$28.18, is slightly undervalued with a fair value estimate of CA$34.62 based on cash flow analysis. Recent earnings reveal a significant turnaround with Q2 2025 net income of CAD 100.19 million from a loss last year, reflecting improved cash flows. Despite high debt levels due to recent financing activities, projected revenue and earnings growth remain robust at 31.5% and 44.6% annually, respectively, outpacing the Canadian market significantly.

- The analysis detailed in our Artemis Gold growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Artemis Gold stock in this financial health report.

Key Takeaways

- Gain an insight into the universe of 23 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boyd Group Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BYD

Boyd Group Services

Operates non-franchised collision repair centers in North America.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives