Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSXV:ARTG

TSX Growth Companies With High Insider Ownership Highlighted In 3 Stocks

Reviewed by Simply Wall St

The Canadian market has shown robust performance, with a 1.2% increase over the last week and an impressive 11% rise over the past 12 months, alongside forecasts predicting annual earnings growth of 15%. In this context, stocks with high insider ownership can be particularly appealing, as they often indicate that those who know the company best are confident in its future prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

| goeasy (TSX:GSY) | 21.5% | 15.8% |

| Payfare (TSX:PAY) | 15% | 46.7% |

| Propel Holdings (TSX:PRL) | 40% | 36.4% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

| Aritzia (TSX:ATZ) | 19.1% | 51.2% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

| Ivanhoe Mines (TSX:IVN) | 13% | 66.3% |

| Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

| Artemis Gold (TSXV:ARTG) | 32.1% | 48.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, along with its subsidiaries, is engaged in the exploration and production of mineral deposits in Africa, with a market capitalization of approximately CA$747.16 million.

Operations: The company generates revenue from three primary mines: Agbaou Mine at CA$141.39 million, Bonikro Mine at CA$192.71 million, and Sadiola Mine at CA$342.34 million.

Insider Ownership: 22.5%

Revenue Growth Forecast: 15.2% p.a.

Allied Gold, a Canadian miner with substantial insider ownership, has shown promising growth indicators despite some operational challenges. Recently added to the S&P/TSX Global Mining Index, the company reported a significant reduction in net loss and reaffirmed strong production guidance for 2024-2026. Allied Gold's strategic exploration activities aim to expand its mineral resources substantially, aligning with its aggressive production targets. Analysts predict a robust return on equity and a considerable potential upside in stock price, reflecting confidence in its value relative to peers.

- Unlock comprehensive insights into our analysis of Allied Gold stock in this growth report.

- Our valuation report unveils the possibility Allied Gold's shares may be trading at a discount.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$21.87 billion.

Operations: The company primarily focuses on the extraction and processing of minerals and precious metals in Africa.

Insider Ownership: 13%

Revenue Growth Forecast: 83.1% p.a.

Ivanhoe Mines, a growth-oriented company with significant insider ownership, recently achieved early completion of its Phase 3 concentrator at the Kamoa-Kakula Copper Complex, boosting production forecasts. Despite a recent net loss in Q1 2024, the company is poised for substantial revenue growth (83.1% per year) and earnings expansion (66.29% per year). Insider transactions have been minimal over the past three months, reflecting cautious optimism among insiders about the firm's trajectory amidst strategic expansions and operational advancements.

- Click here to discover the nuances of Ivanhoe Mines with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Ivanhoe Mines' current price could be inflated.

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.04 billion.

Operations: The company's revenue segments are not specified as it primarily focuses on the development stage of gold properties.

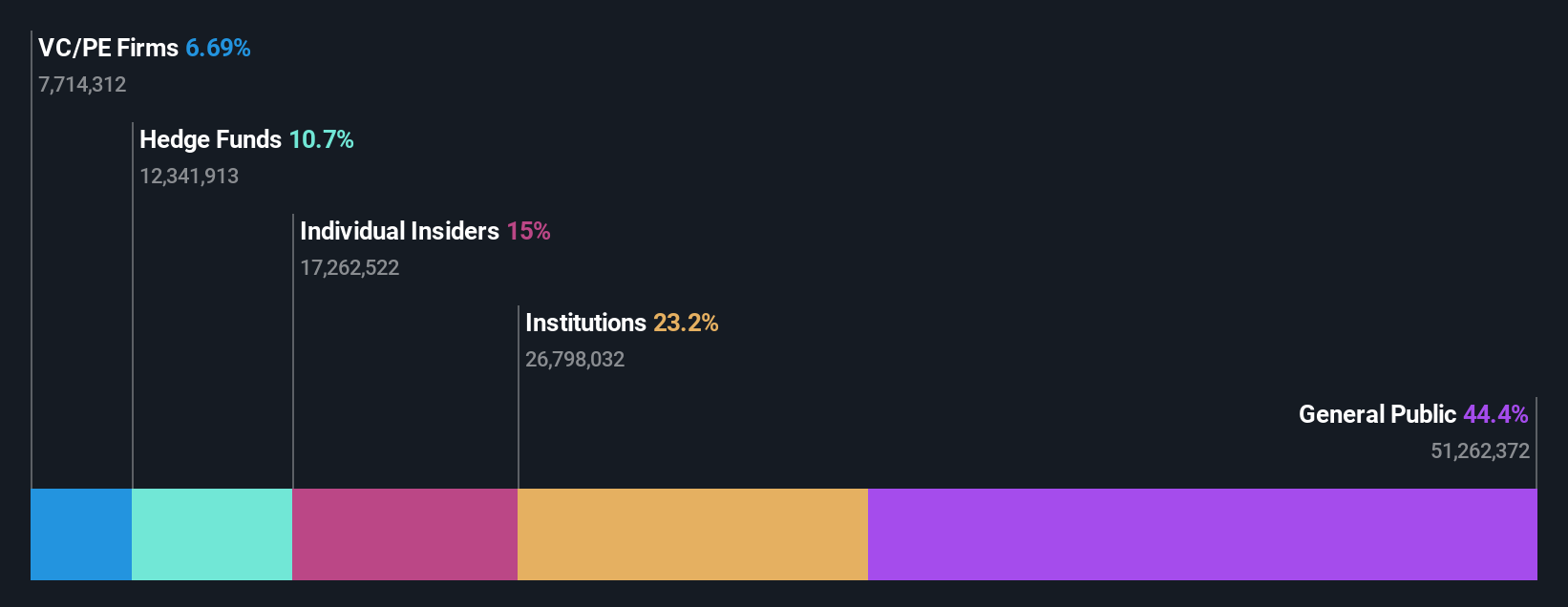

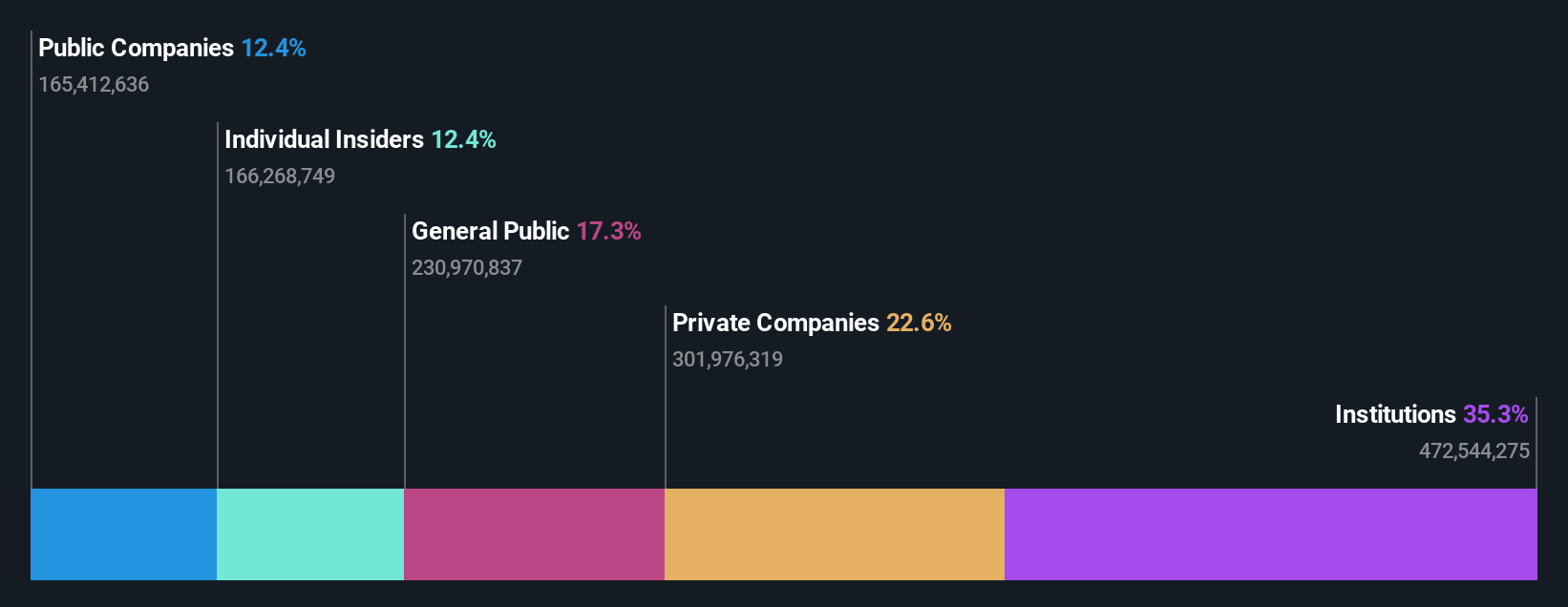

Insider Ownership: 32.1%

Revenue Growth Forecast: 52.5% p.a.

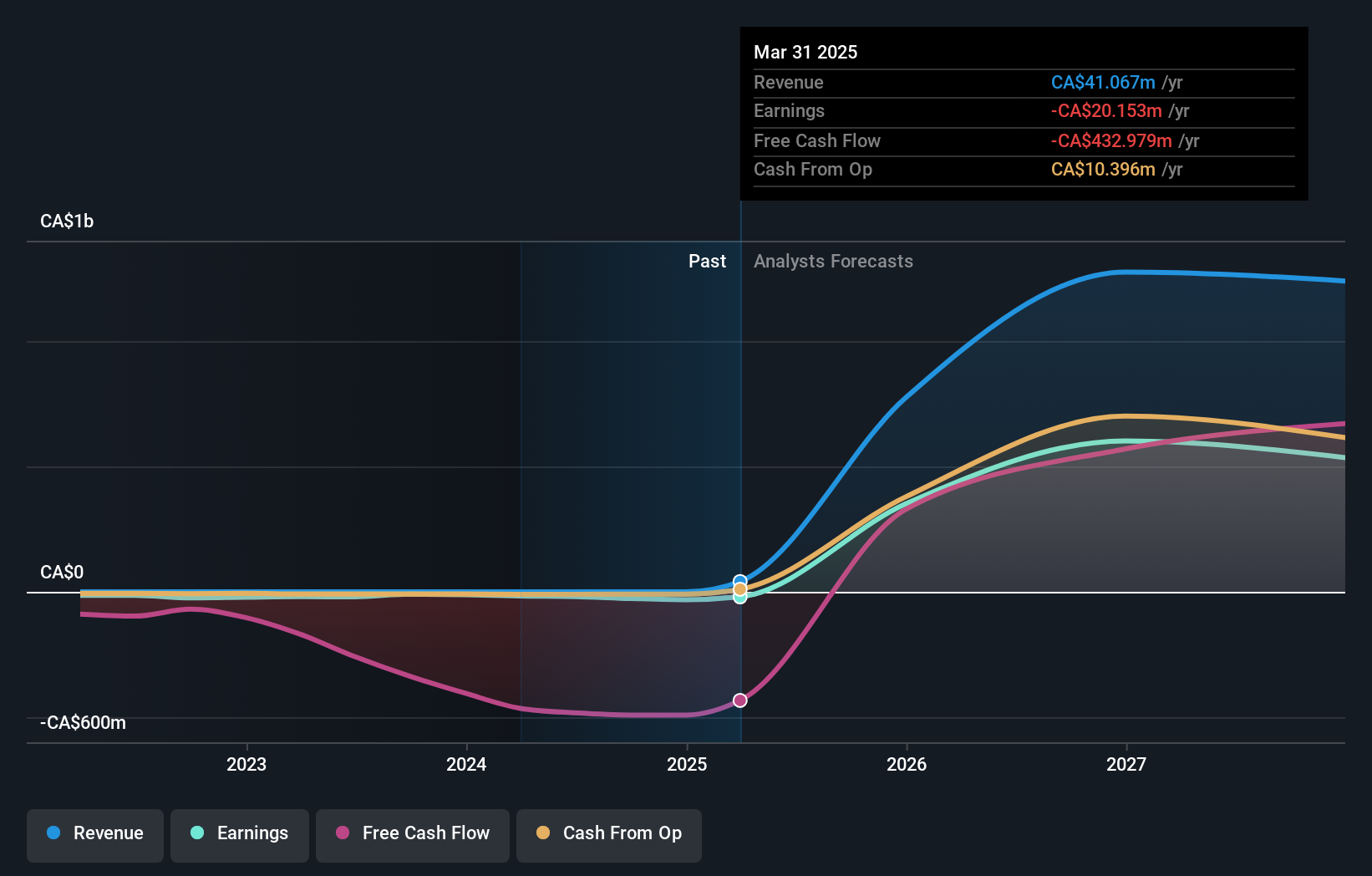

Artemis Gold, with high insider ownership, is progressing on its Blackwater Mine project in British Columbia, staying within budget and on schedule for its first gold pour in late 2024. Despite a significant increase in net loss to CAD 6.65 million in Q1 2024 from CAD 1.81 million the previous year, insider buying activity has been positive over the last three months. The company's revenue growth is forecasted to significantly outpace the Canadian market average, although profitability is only expected to materialize within three years amid ongoing substantial capital expenditures and shareholder dilution during the past year.

- Click here and access our complete growth analysis report to understand the dynamics of Artemis Gold.

- Our comprehensive valuation report raises the possibility that Artemis Gold is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 29 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Artemis Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ARTG

Artemis Gold

A gold development company, focuses on the identification, acquisition, and development of gold properties.

High growth potential and slightly overvalued.