Stock Analysis

- Canada

- /

- Electrical

- /

- TSX:HPS.A

Exploring Three Undervalued Small Caps With Insider Action In The Region

Reviewed by Simply Wall St

As global markets exhibit mixed signals with modest gains in U.S. stocks and a cautious economic outlook, small-cap stocks present a unique landscape for potential value discovery. In the context of these broader market dynamics, identifying undervalued small caps with insider action can offer intriguing opportunities for investors looking to tap into potentially overlooked segments of the market.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ramaco Resources | 11.4x | 0.9x | 27.12% | ★★★★★★ |

| Norcros | 7.8x | 0.5x | 41.37% | ★★★★★☆ |

| PCB Bancorp | 8.5x | 2.3x | 46.93% | ★★★★★☆ |

| AtriCure | NA | 2.7x | 42.50% | ★★★★★☆ |

| Hanover Bancorp | 8.5x | 1.9x | 49.11% | ★★★★☆☆ |

| NSI | NA | 4.5x | 47.74% | ★★★★☆☆ |

| Robert Walters | 20.6x | 0.3x | 35.56% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -151.77% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -155.91% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

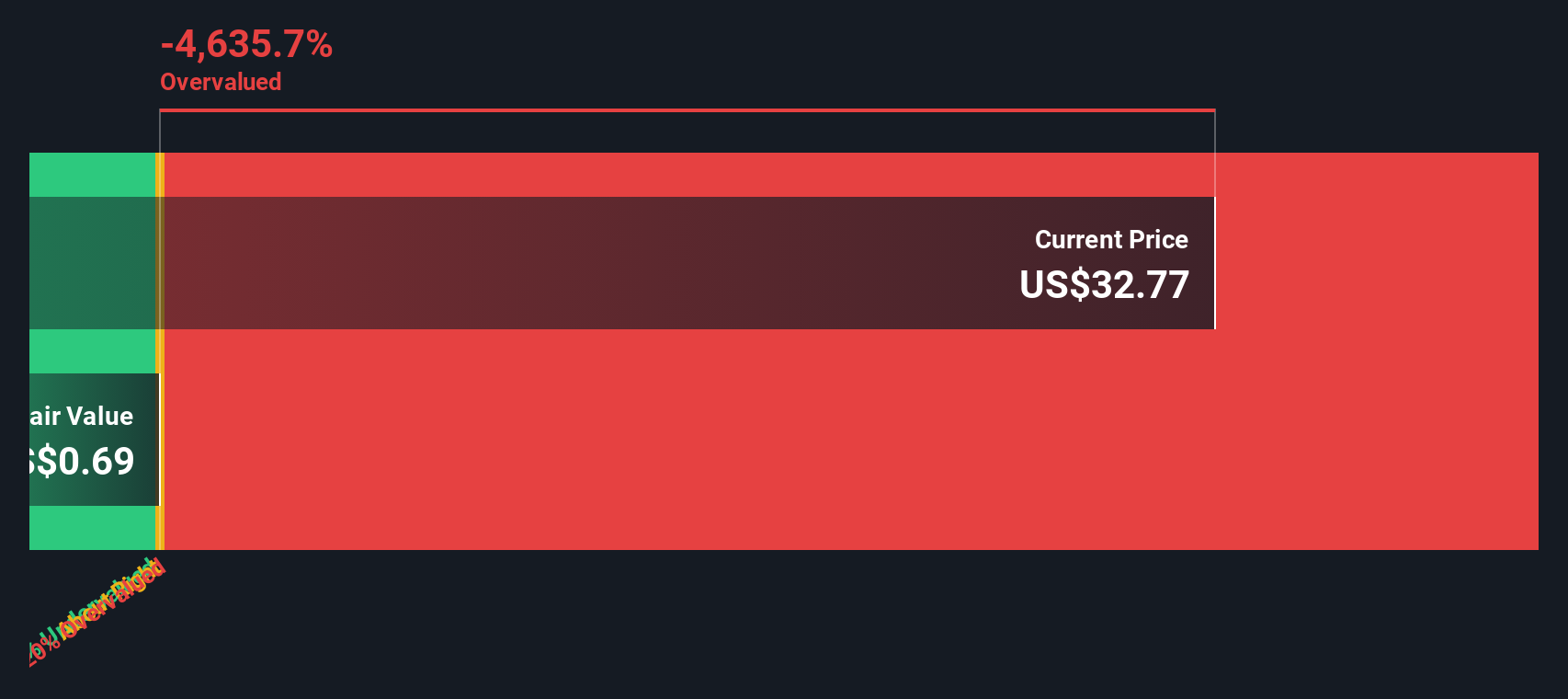

AtriCure (NasdaqGM:ATRC)

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure is a medical device company specializing in surgical and medical equipment, with a market capitalization of approximately $2.47 billion.

Operations: The business generates revenue from its surgical and medical equipment segment, with the most recent figures showing a revenue of $414.60 million. The gross profit margin has shown an upward trend, reaching 75.26% in the latest period, reflecting efficient cost management relative to production costs which stood at $102.57 million.

PE: -29.9x

AtriCure, recently presenting at multiple healthcare conferences, announced a projected revenue increase to US$459 million for 2024, signaling robust growth. Despite current unprofitability and shareholder dilution over the past year, their innovative cryoSPHERE+ device is set to enhance surgical outcomes by reducing operative times—a factor likely to boost adoption rates. This blend of technological advancement and financial growth metrics reflects a potentially overlooked opportunity within the market.

- Take a closer look at AtriCure's potential here in our valuation report.

Explore historical data to track AtriCure's performance over time in our Past section.

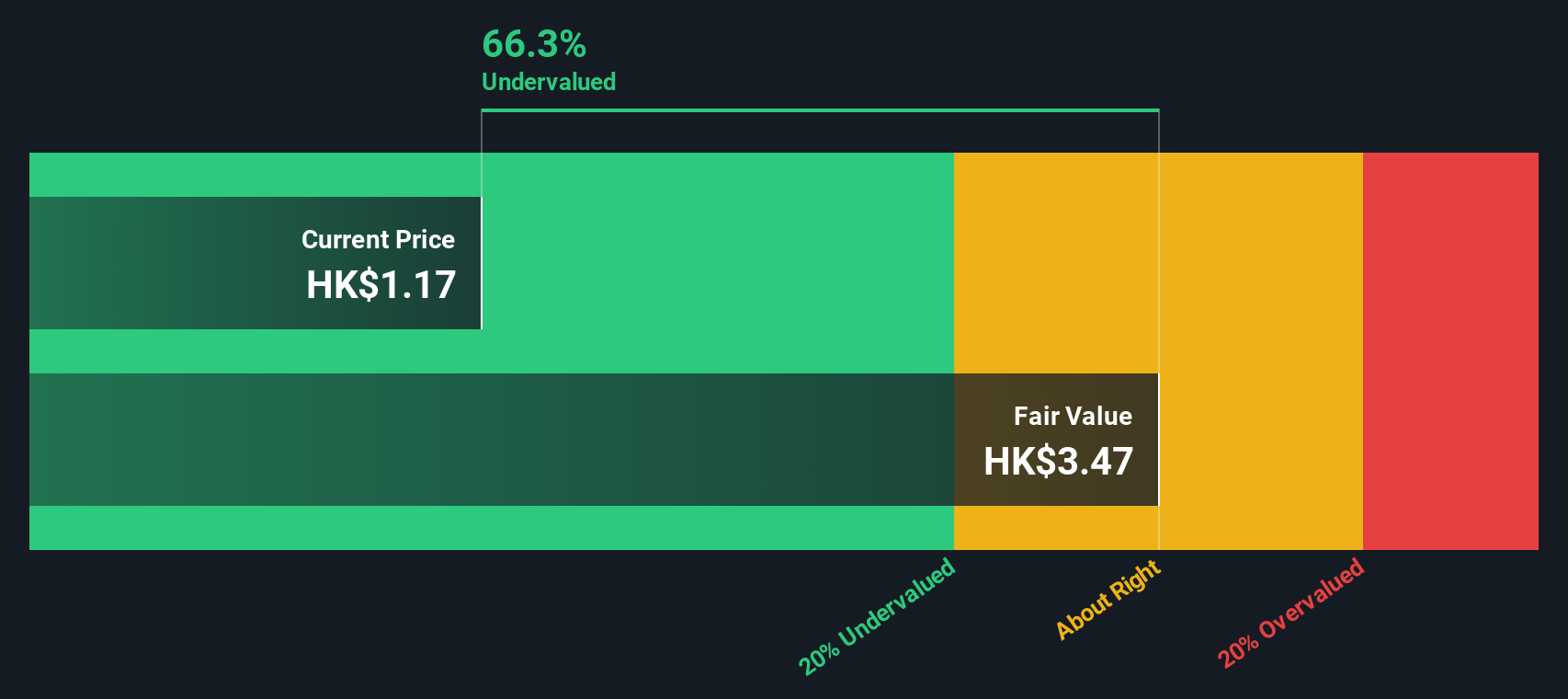

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company involved in various business sectors with a market capitalization of approximately CN¥1.27 billion.

Operations: The company generates revenue through the sale of goods and services, evidenced by an increase in gross profit from CN¥7.65 million in June 2013 to CN¥2.80 billion by December 2023, reflecting a significant expansion in operations. Over the same period, gross profit margin saw a notable rise from 9.66% to approximately 59.07%.

PE: 4.1x

Kinetic Development Group, a lesser-known entity in the market, recently demonstrated insider confidence as they approved significant changes to their corporate governance and declared both regular and special dividends—HKD 0.05 and HKD 0.03 per share respectively. These moves, particularly the insider purchases made in early May 2024, suggest a robust belief in the company's prospects among those closest to its operations. Despite relying solely on external borrowing—a higher risk funding strategy—the firm's ability to maintain dividend payments points to a potentially overlooked financial resilience. This blend of qualitative governance adjustments alongside quantitative financial commitments paints Kinetic as an intriguing option for those seeking exposure to promising yet underappreciated assets.

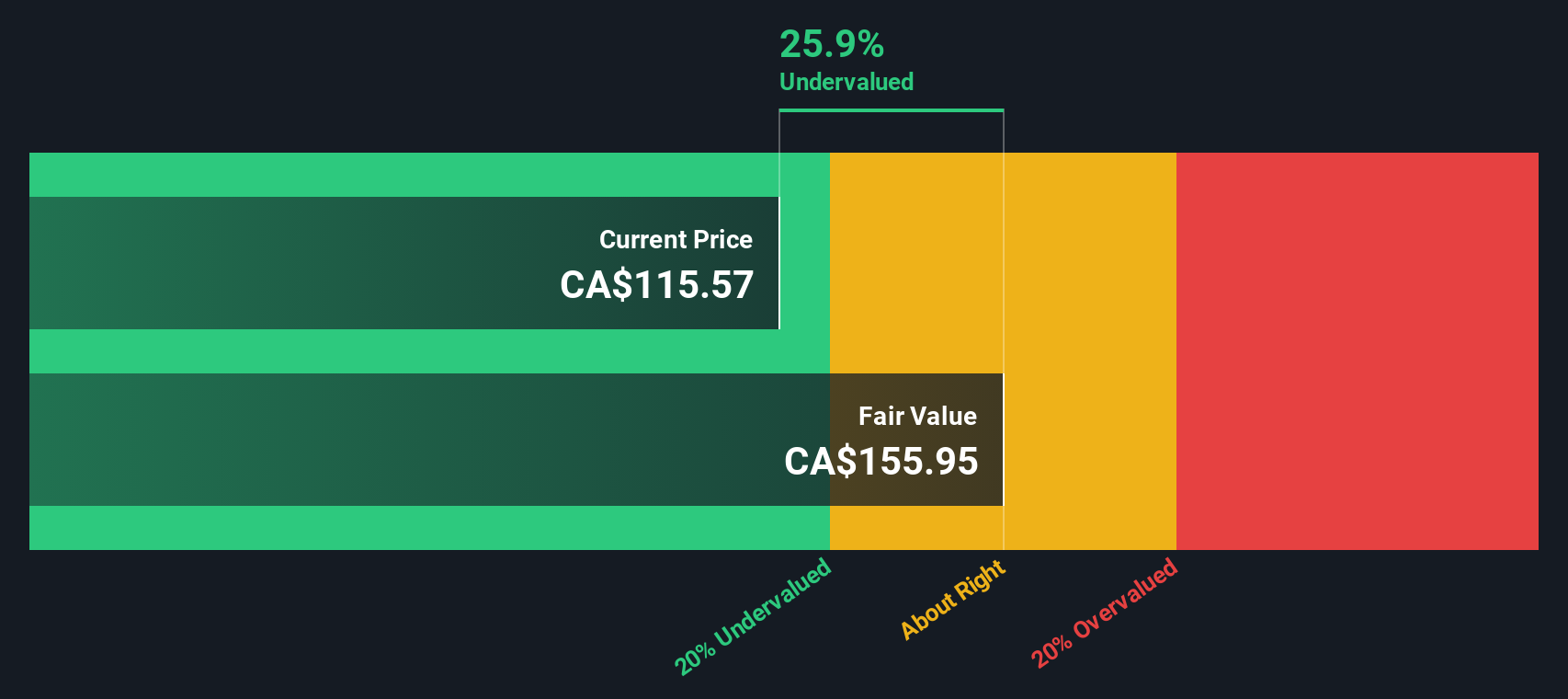

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammond Power Solutions specializes in the manufacture and sale of transformers, with a market capitalization of approximately CA$729.61 million.

Operations: The business generates CA$729.61 million from the manufacture and sale of transformers, with a gross profit margin recently reported at 32.49%. Notably, the net income for the latest period stood at CA$55.63 million.

PE: 23.1x

Hammond Power Solutions, with its substantial year-over-year revenue increase from CAD 558.46 million to CAD 710.06 million, demonstrates strong financial growth. Despite a recent dip in quarterly net income to CAD 7.95 million from last year's CAD 15.73 million, the company's robust annual performance and an earnings forecast growth of 18.59% per year suggest resilience and potential for recovery. Insider confidence is evident as they recently purchased shares, underscoring their belief in the company’s prospects amidst preparations for future opportunities indicated by their new Shelf Registration filing for Class A Subordinate Voting Shares.

Turning Ideas Into Actions

- Get an in-depth perspective on all 232 Undervalued Small Caps With Insider Buying by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Hammond Power Solutions is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet and fair value.