- Canada

- /

- Consumer Finance

- /

- TSX:GSY

October 2024's Top TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has risen by 1.4%, contributing to an impressive 24% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this thriving environment, growth companies with high insider ownership can be particularly appealing as they often signal strong alignment between management and shareholders' interests, potentially enhancing long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| VersaBank (TSX:VBNK) | 13.3% | 30.4% |

| Aritzia (TSX:ATZ) | 18.9% | 59.7% |

| Allied Gold (TSX:AAUC) | 18.3% | 73% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 69.5% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Let's uncover some gems from our specialized screener.

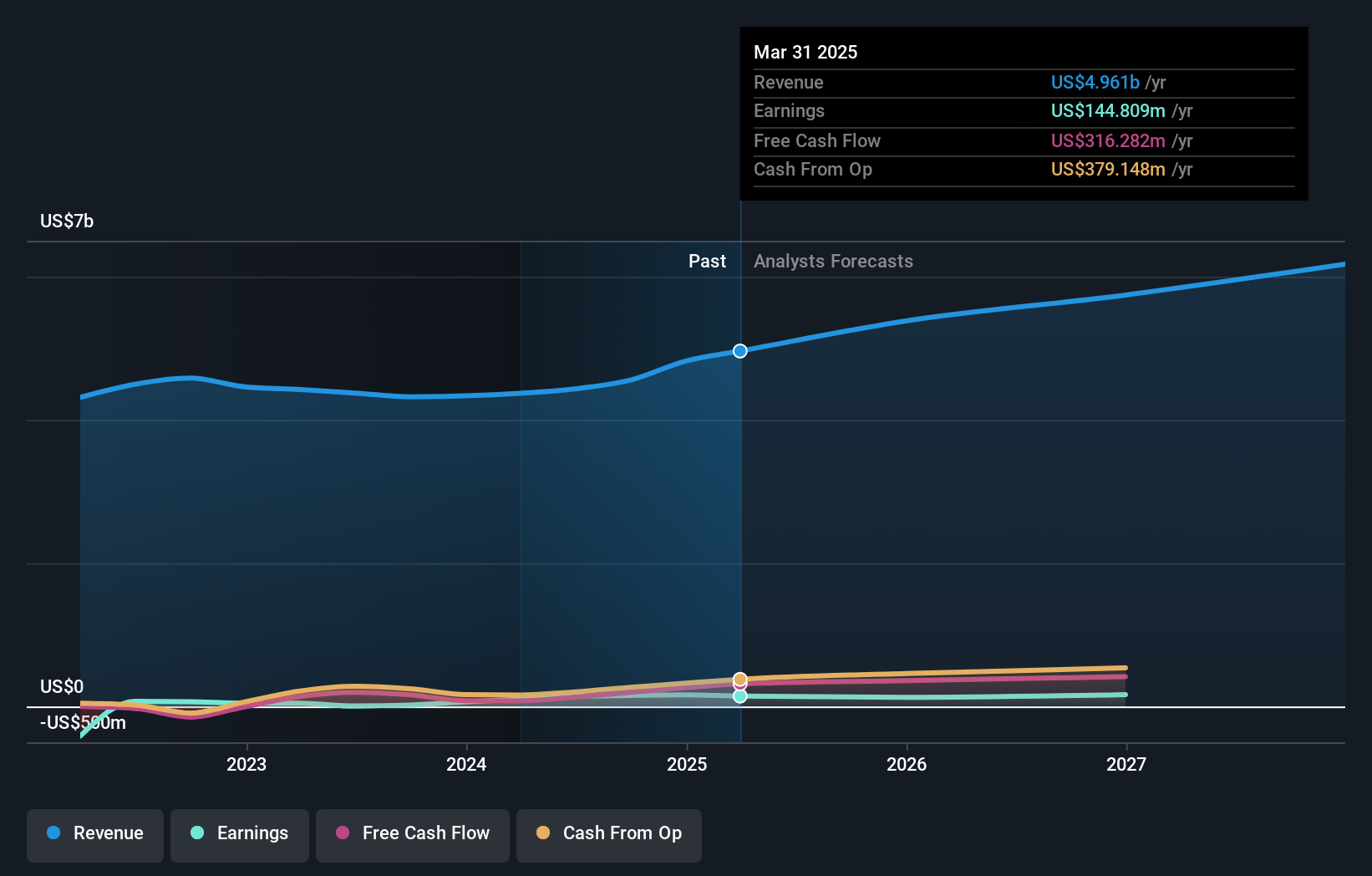

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. offers commercial real estate and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of CA$10.38 billion.

Operations: The company's revenue is primarily derived from its operations in the Americas ($2.59 billion), followed by Europe, the Middle East & Africa (EMEA) ($734.93 million), Asia Pacific ($614.55 million), and its Investment Management segment ($496.42 million).

Insider Ownership: 14.1%

Revenue Growth Forecast: 11% p.a.

Colliers International Group demonstrates strong growth potential, with earnings forecasted to grow significantly at 20.8% annually, outpacing the Canadian market. Recent financial results show a notable turnaround with net income of US$36.72 million in Q2 2024 compared to a loss the previous year. However, insider activity has been mixed, with substantial selling over the past three months and no significant buying recently. Revenue is expected to grow between 8-13%, reflecting recent acquisitions.

- Dive into the specifics of Colliers International Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Colliers International Group's current price could be inflated.

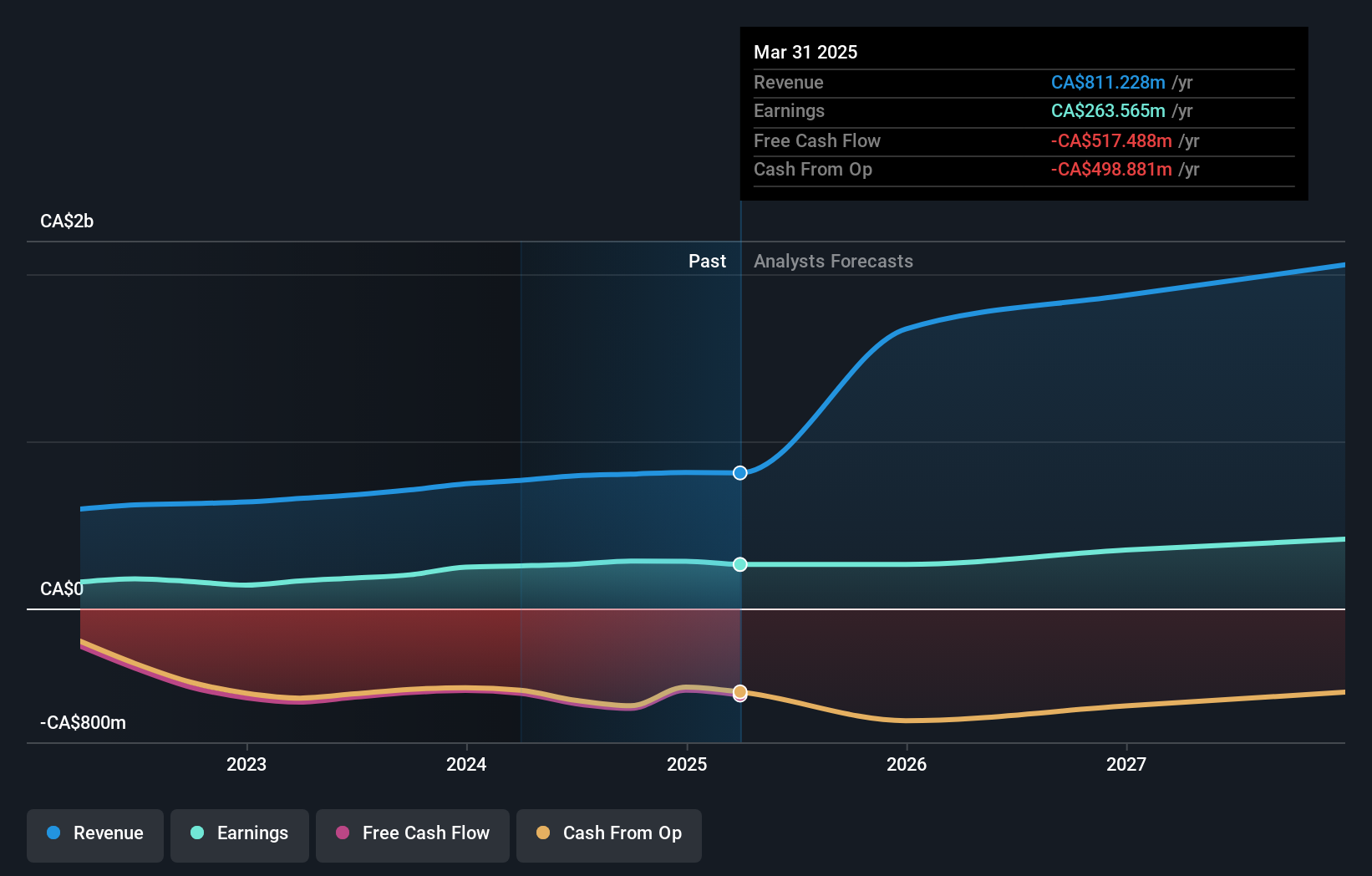

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its brands easyhome, easyfinancial, and LendCare, with a market cap of CA$3.14 billion.

Operations: The company's revenue is primarily generated from its Easyfinancial segment, contributing CA$1.24 billion, and its Easyhome segment, which adds CA$154.10 million.

Insider Ownership: 21.2%

Revenue Growth Forecast: 31.6% p.a.

goeasy shows promising growth prospects, with earnings forecasted to grow at 17.1% annually and revenue expected to increase by 31.6% per year, surpassing Canadian market averages. The company trades at a significant discount to its estimated fair value, although insider activity has been mixed recently with more buying than selling. Recent board appointments bring valuable expertise in business transformation, potentially supporting goeasy's growth trajectory despite its current debt challenges.

- Delve into the full analysis future growth report here for a deeper understanding of goeasy.

- Insights from our recent valuation report point to the potential undervaluation of goeasy shares in the market.

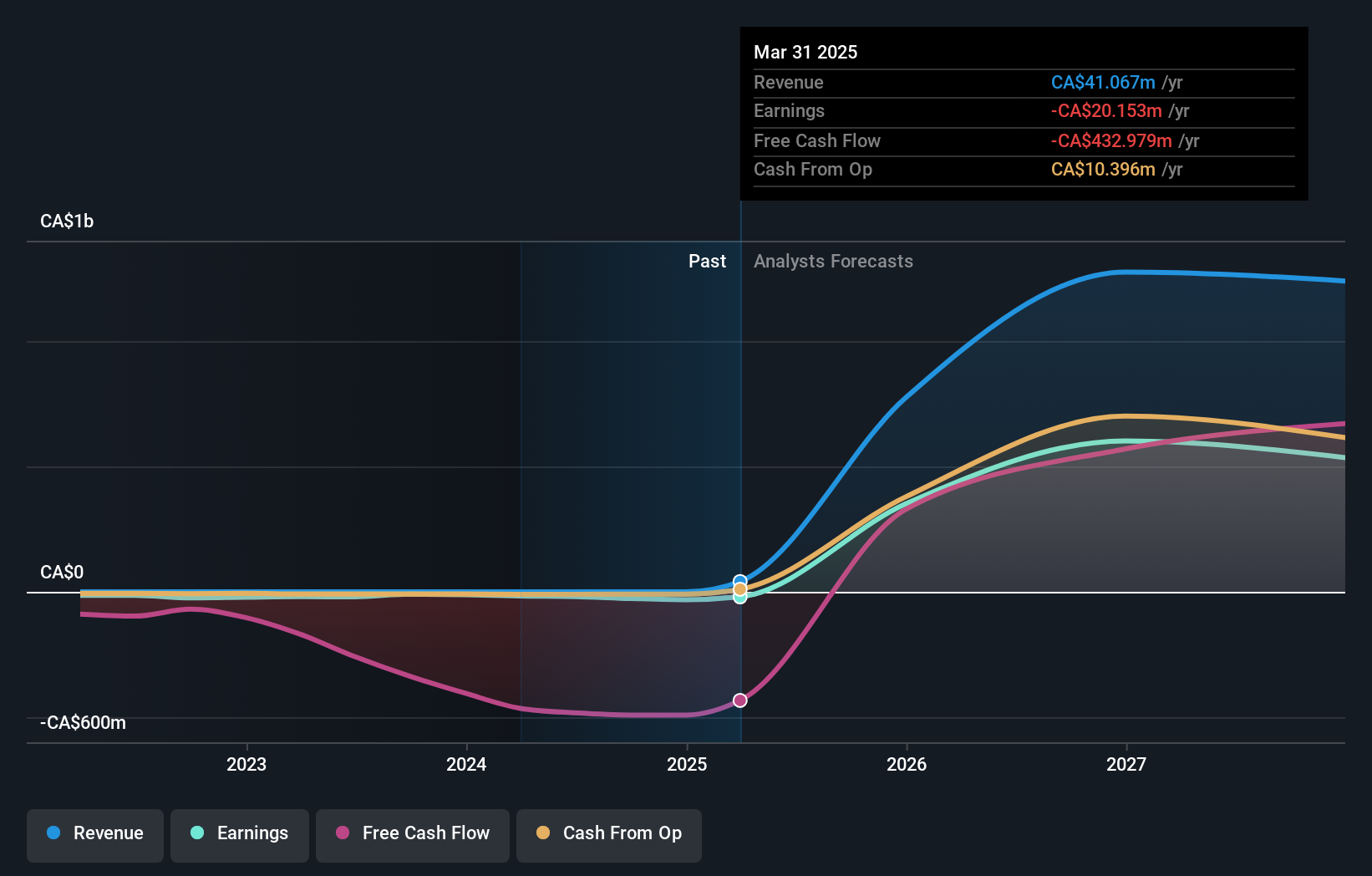

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company that specializes in identifying, acquiring, and developing gold properties, with a market cap of CA$3.22 billion.

Operations: The company's revenue segments are currently not specified in monetary terms.

Insider Ownership: 29.9%

Revenue Growth Forecast: 45.9% p.a.

Artemis Gold is advancing its Blackwater Mine project, now over 95% complete, with first gold pour expected late Q4 2024. Despite recent wildfire disruptions and increased construction costs, the project remains fully funded. Artemis trades significantly below estimated fair value and anticipates high revenue growth of 45.9% annually, outpacing the Canadian market. Although current earnings are negative, profitability is expected within three years, supported by accelerated commissioning efforts at Blackwater.

- Unlock comprehensive insights into our analysis of Artemis Gold stock in this growth report.

- In light of our recent valuation report, it seems possible that Artemis Gold is trading behind its estimated value.

Key Takeaways

- Navigate through the entire inventory of 35 Fast Growing TSX Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Very undervalued with reasonable growth potential and pays a dividend.