- Canada

- /

- Metals and Mining

- /

- TSXV:AIR

Discover 3 TSX Penny Stocks With Market Caps Over CA$10M

Reviewed by Simply Wall St

The Canadian market remained flat over the last week, but it has seen a notable 27% rise over the past year, with earnings expected to grow by 16% annually in the coming years. Penny stocks, though an outdated term, continue to represent intriguing opportunities for investors seeking growth at lower price points. By focusing on those with strong balance sheets and solid fundamentals, these stocks can provide potential upside while mitigating some of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$611.71M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$184.89M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$120.73M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.35 | CA$313.96M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$233.67M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.75 | CA$298.44M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.07 | CA$132.27M | ★★★★☆☆ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Clean Air Metals (TSXV:AIR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Clean Air Metals Inc. is a Canadian exploration company focused on identifying, acquiring, exploring, and developing mineral properties, with a market cap of CA$18.58 million.

Operations: Clean Air Metals Inc. currently does not report any revenue segments as it is focused on exploration and development activities.

Market Cap: CA$18.58M

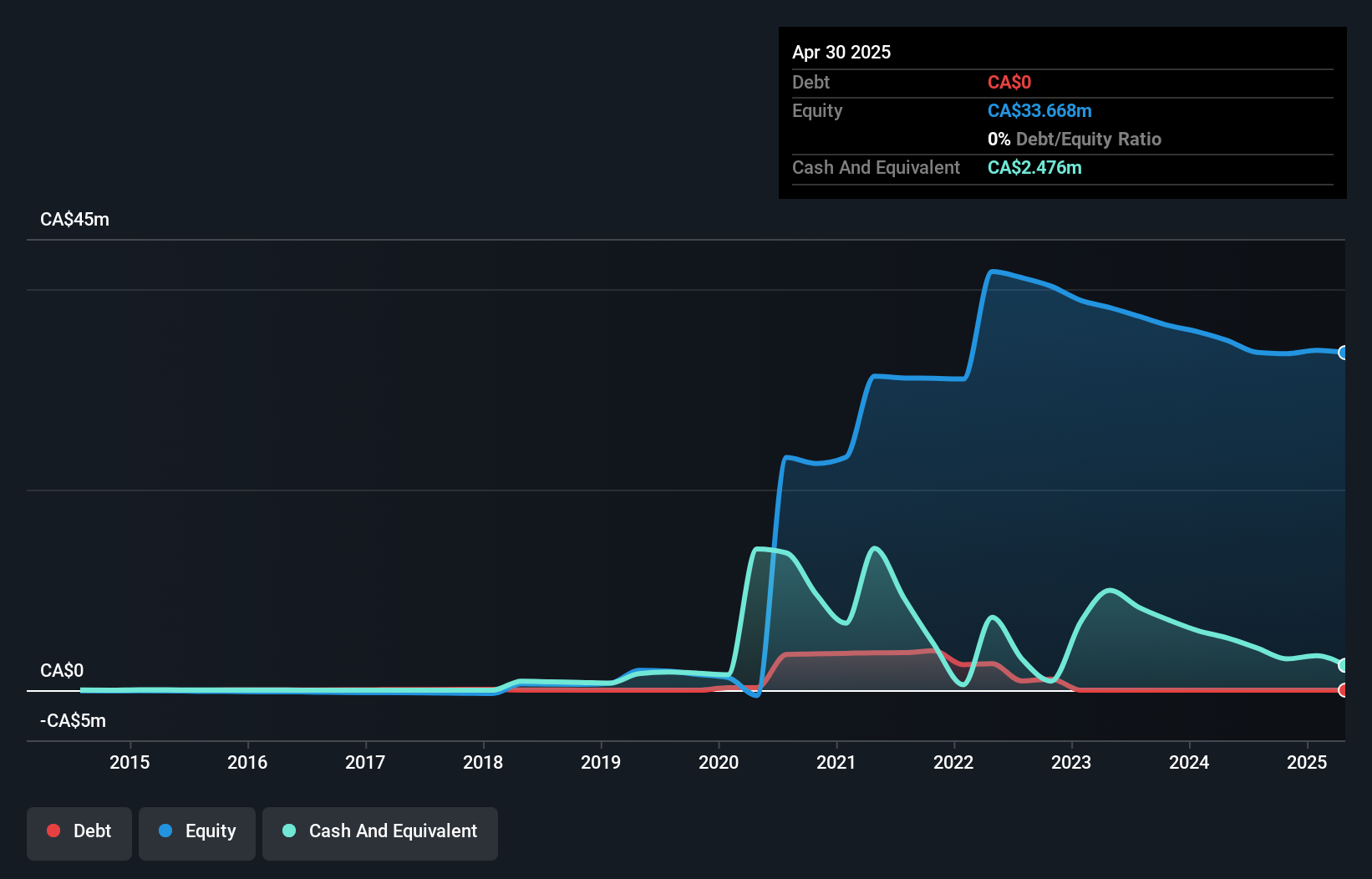

Clean Air Metals Inc., with a market cap of CA$18.58 million, is focused on exploration and development without significant revenue streams, classifying it as pre-revenue. Recent drilling results at its Thunder Bay North project show promising high-grade mineralization, which could enhance resource estimates and support a low-capital mine plan. Despite having no debt, the company faces financial challenges with less than a year's cash runway and increased shareholder dilution over the past year. Management changes point to an evolving strategy but also highlight inexperience within the team, potentially impacting future execution and stability.

- Get an in-depth perspective on Clean Air Metals' performance by reading our balance sheet health report here.

- Gain insights into Clean Air Metals' past trends and performance with our report on the company's historical track record.

Laurion Mineral Exploration (TSXV:LME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Laurion Mineral Exploration Inc. focuses on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$107.13 million.

Operations: Laurion Mineral Exploration Inc. currently does not report any revenue segments.

Market Cap: CA$107.13M

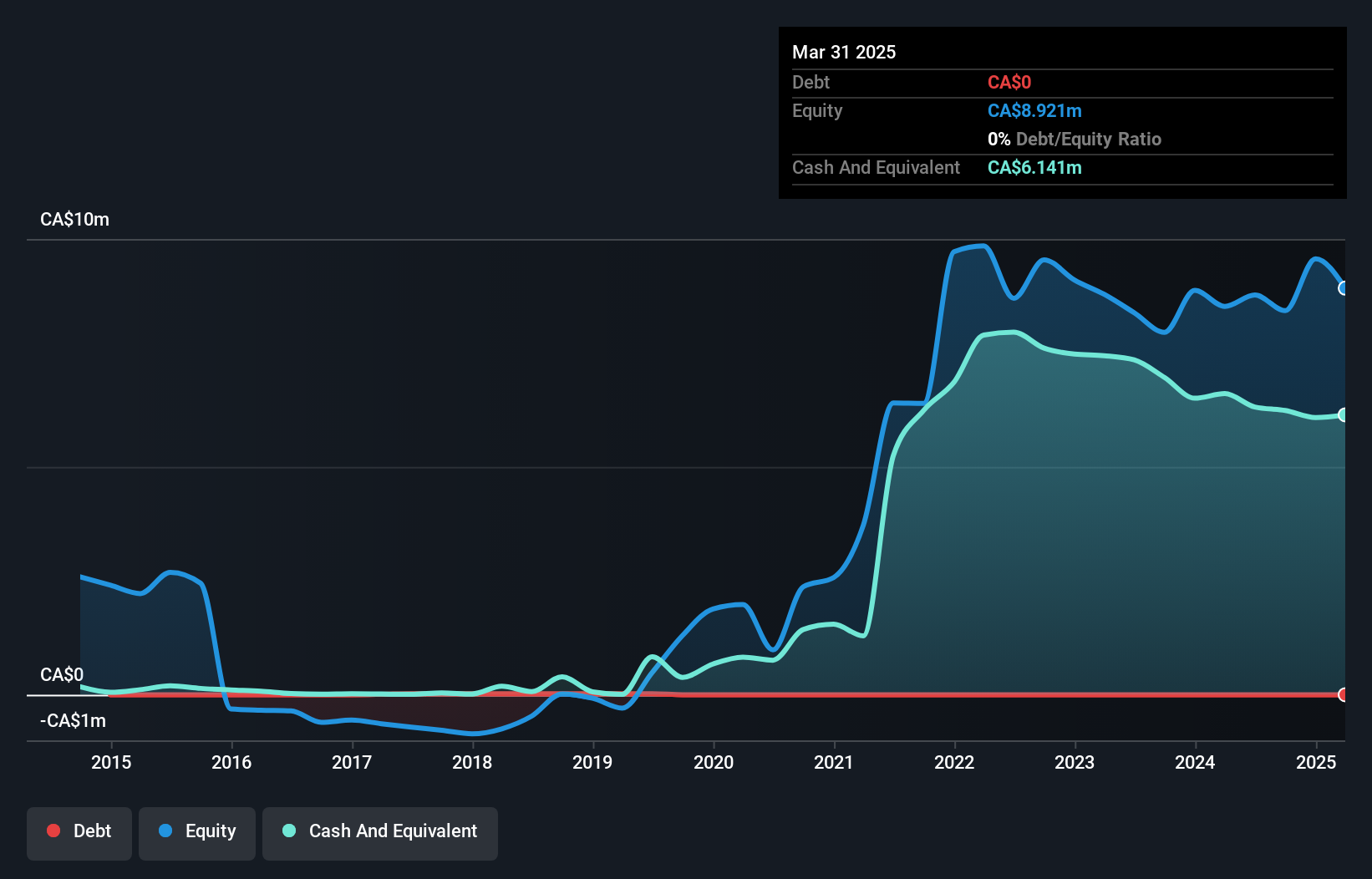

Laurion Mineral Exploration Inc., with a market cap of CA$107.13 million, is pre-revenue and focuses on mineral exploration in Canada. The company recently closed a private placement, raising CA$2.61 million to support its ongoing projects, including the Ishkõday Project's Fall 2024 drilling program aimed at expanding high-grade gold zones. Despite being debt-free and having sufficient short-term assets to cover liabilities, Laurion remains unprofitable with increasing losses over recent years. Shareholder dilution has occurred as shares outstanding grew by 3.8%. The management team’s experience level is unclear, but the board has an average tenure of 5.3 years.

- Unlock comprehensive insights into our analysis of Laurion Mineral Exploration stock in this financial health report.

- Examine Laurion Mineral Exploration's past performance report to understand how it has performed in prior years.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver One Resources Inc., along with its subsidiary, focuses on acquiring, exploring, and developing mineral properties in the United States with a market cap of CA$95.46 million.

Operations: Silver One Resources Inc. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and development of mineral properties in the United States.

Market Cap: CA$95.46M

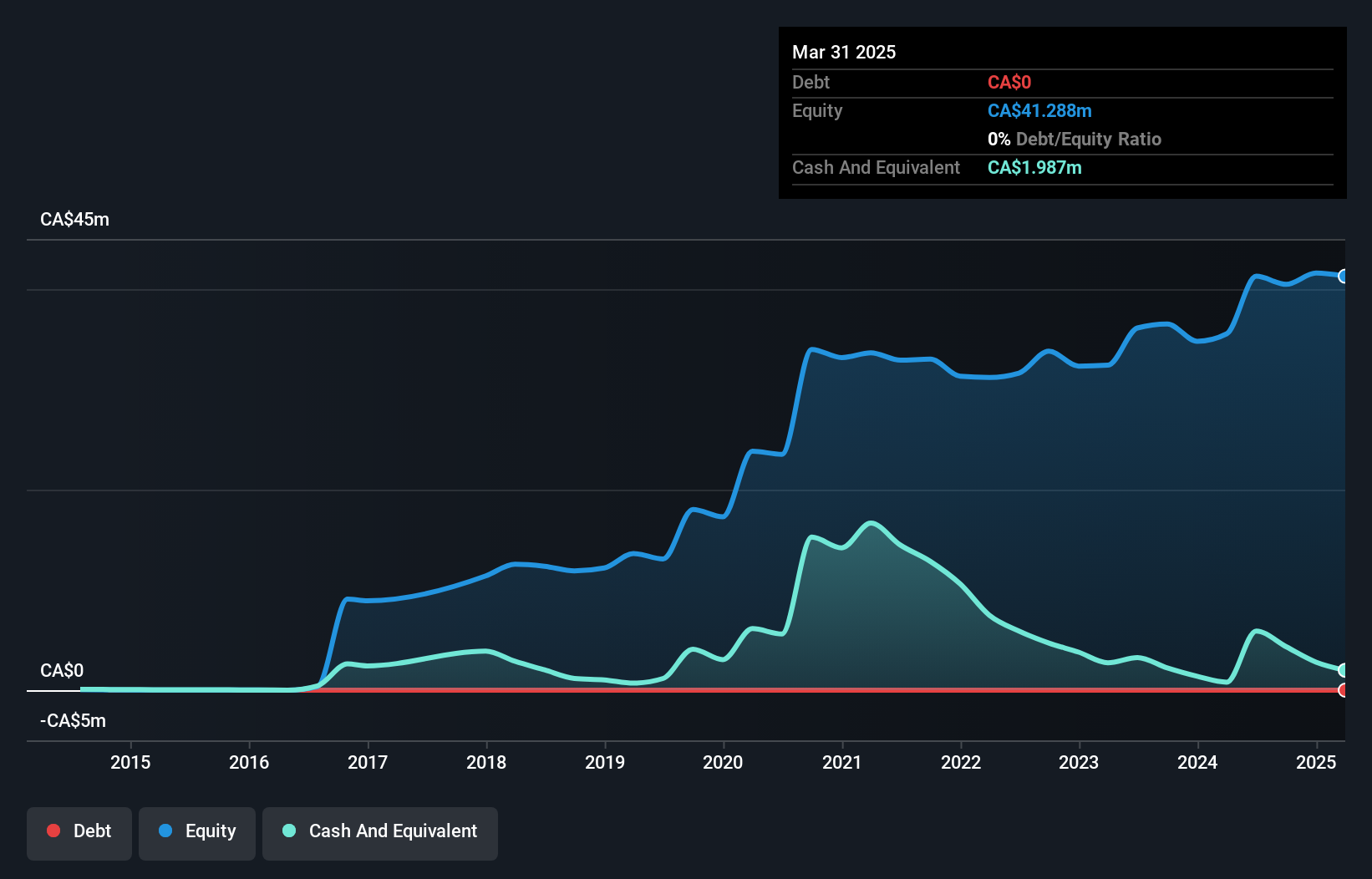

Silver One Resources Inc., with a market cap of CA$95.46 million, remains pre-revenue as it focuses on mineral exploration in the U.S., particularly at its high-grade Phoenix Silver Project in Arizona. The company is debt-free and maintains sufficient short-term assets to cover liabilities, but it has experienced shareholder dilution with shares outstanding increasing by 9.9% over the past year. Despite being unprofitable and having increased losses over five years, Silver One's management team is seasoned, and recent inclusion in the S&P/TSX Venture Composite Index may enhance visibility among investors interested in speculative opportunities within penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Silver One Resources.

- Review our historical performance report to gain insights into Silver One Resources' track record.

Key Takeaways

- Click through to start exploring the rest of the 944 TSX Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AIR

Clean Air Metals

An exploration company, engages in the identification, acquisition, exploration, and development of mineral properties in Canada.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives