- Canada

- /

- Auto Components

- /

- TSX:MG

3 TSX Dividend Stocks Yielding Up To 9.8%

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape of policy uncertainties and economic resilience, the TSX has managed to reach new all-time highs, reflecting a robust backdrop despite earlier volatility. In this environment, dividend stocks offer investors an attractive opportunity for steady income, particularly when they yield up to 9.8%, making them a compelling choice for those seeking stability amid market fluctuations.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.00% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.86% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.43% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 7.78% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.67% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.33% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.21% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.97% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.75% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.47% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Magna International (TSX:MG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Magna International Inc. is a company that manufactures and supplies vehicle engineering, contract, and automotive space services with a market cap of CA$15.98 billion.

Operations: Magna International Inc.'s revenue is primarily derived from its Body Exteriors & Structures segment at $16.54 billion, followed by Power & Vision at $15.20 billion, Seating Systems at $5.66 billion, and Complete Vehicles at $5.08 billion.

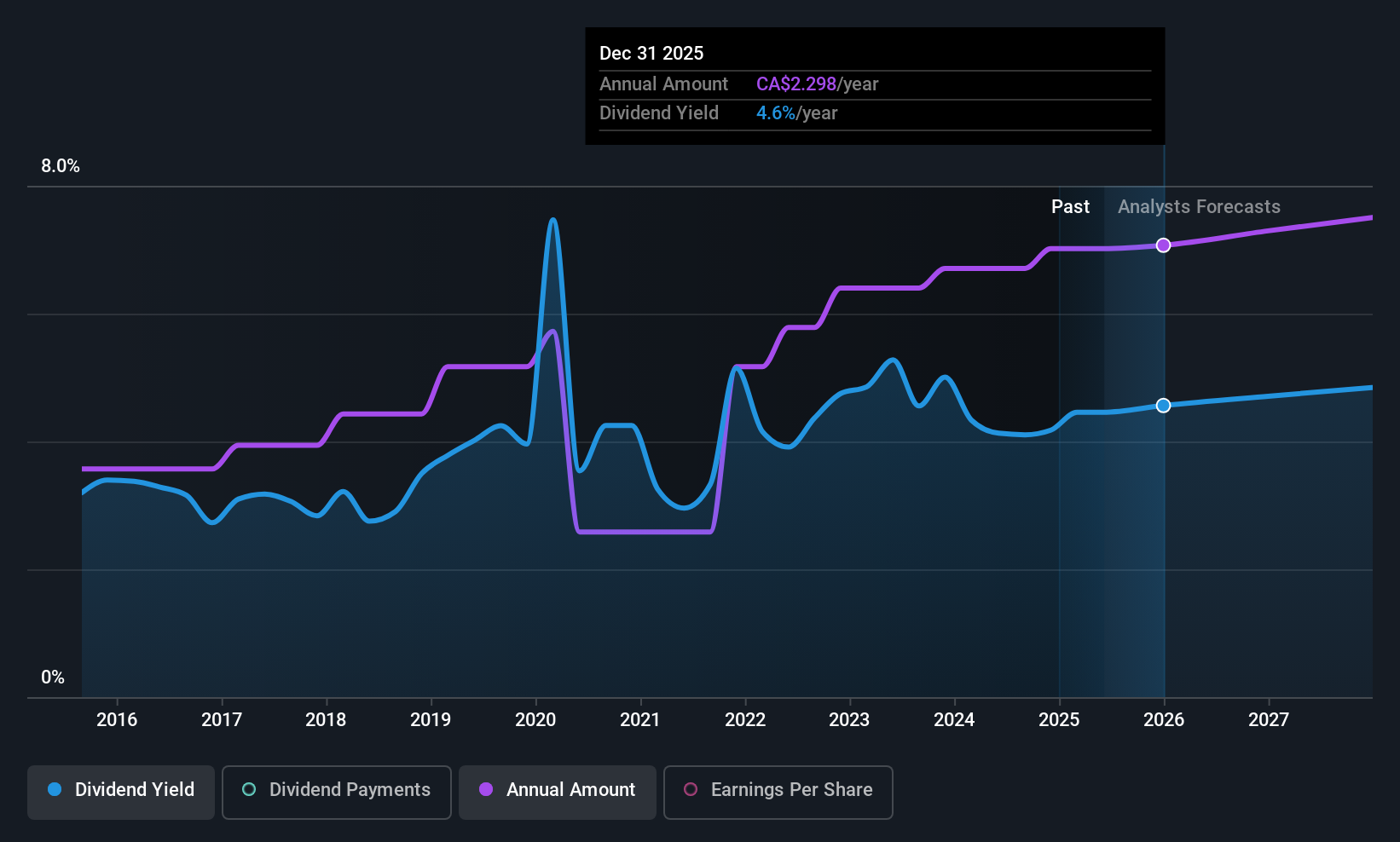

Dividend Yield: 4.7%

Magna International offers a reliable dividend yield of 4.71%, though lower than the top Canadian payers. The dividend is well-supported by earnings and cash flows, with payout ratios of 47.8% and 36.5%, respectively, indicating sustainability. Recent collaborations, like the City Delivery pilot with Bell Media, highlight innovation but don't directly impact dividends. Despite a dip in sales to US$10 billion in Q1 2025, net income rose significantly to US$146 million from US$9 million year-over-year.

- Click here to discover the nuances of Magna International with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Magna International's current price could be quite moderate.

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$63.83 billion.

Operations: Suncor Energy Inc.'s revenue segments include Oil Sands at CA$25.80 billion, Refining and Marketing at CA$31.36 billion, and Exploration and Production at CA$2.17 billion.

Dividend Yield: 4.4%

Suncor Energy's quarterly dividend of C$0.57 per share reflects its commitment to shareholder returns, supported by a 46.1% payout ratio from earnings and a 31.1% cash payout ratio, ensuring coverage and sustainability despite past volatility. First-quarter net income rose to C$1.69 billion, with record upstream production of 853,000 bbls/d enhancing financial stability. The company also completed significant share buybacks worth C$3.77 billion since early 2024, potentially impacting future dividend reliability positively.

- Take a closer look at Suncor Energy's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Suncor Energy shares in the market.

Alphamin Resources (TSXV:AFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alphamin Resources Corp., along with its subsidiaries, is involved in the production and sale of tin concentrate and has a market capitalization of approximately CA$1.11 billion.

Operations: Alphamin Resources Corp. generates revenue primarily through the production and sale of tin from its Bisie Tin Mine, amounting to $539.16 million.

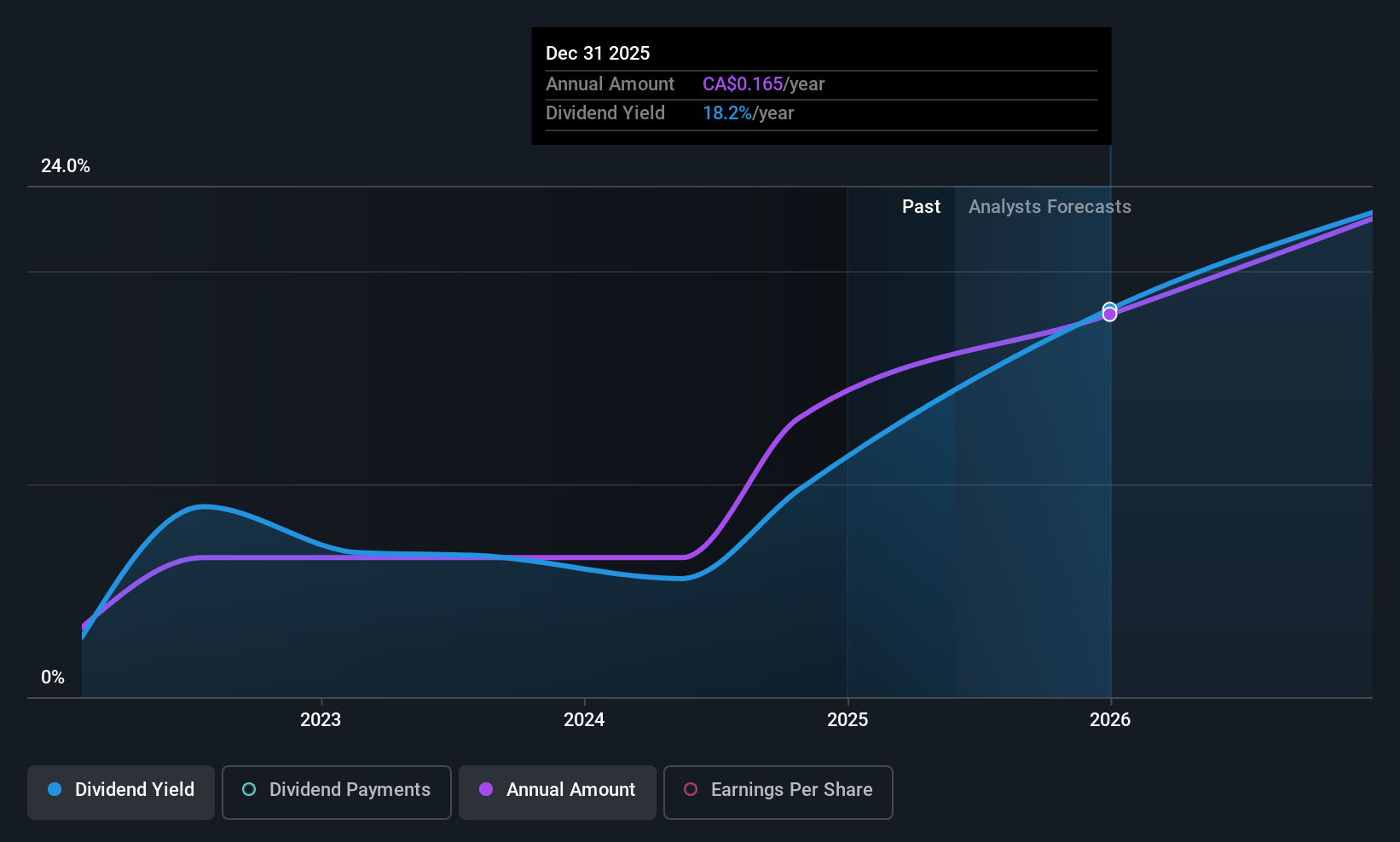

Dividend Yield: 9.8%

Alphamin Resources' dividend yield is among the top 25% in Canada, yet its track record for stability remains questionable due to recent volatility. The company's payout ratios of 77% from earnings and 63.3% from cash flows indicate coverage, though dividends have been inconsistent over three years. Recent operational challenges, including a phased restart post-interruption and leadership changes, may affect future dividend reliability despite strong earnings growth of US$23.64 million in Q1 2025.

- Get an in-depth perspective on Alphamin Resources' performance by reading our dividend report here.

- According our valuation report, there's an indication that Alphamin Resources' share price might be on the cheaper side.

Make It Happen

- Click through to start exploring the rest of the 24 Top TSX Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MG

Magna International

Manufactures and supplies vehicle engineering, contract, and automotive space.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives