- Canada

- /

- Communications

- /

- TSX:HAI

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The Canadian market, while facing challenges such as trade uncertainties and emerging credit concerns, remains resilient with positive corporate earnings growth and potential interest rate cuts on the horizon. In this context, penny stocks—typically smaller or newer companies—continue to capture investor interest due to their affordability and growth potential. By focusing on those with strong balance sheets and solid fundamentals, these stocks can offer a unique opportunity for investors seeking promising returns without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.61 | CA$65.98M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.385 | CA$3.22M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.31 | CA$871.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.77 | CA$447.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.39 | CA$172.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.06 | CA$195.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cardiol Therapeutics (TSX:CRDL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cardiol Therapeutics Inc. is a clinical-stage life sciences company specializing in developing anti-fibrotic and anti-inflammatory therapies for heart diseases, with a market cap of CA$125.59 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage life sciences company.

Market Cap: CA$125.59M

Cardiol Therapeutics, a clinical-stage life sciences company, remains pre-revenue with no significant revenue streams reported. Despite its unprofitability and negative return on equity, the company is debt-free and has a cash runway of 11 months after recent capital raises totaling CA$11.4 million through private placements. The promising results from its ARCHER Phase II trial for CardiolRx in acute myocarditis highlight potential therapeutic advancements, though profitability isn't forecasted within three years. The management team is seasoned with an average tenure of 4.8 years, providing stability as they navigate clinical developments and financial challenges.

- Take a closer look at Cardiol Therapeutics' potential here in our financial health report.

- Assess Cardiol Therapeutics' future earnings estimates with our detailed growth reports.

Haivision Systems (TSX:HAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Haivision Systems Inc. offers mission-critical, real-time video networking and visual collaboration solutions across Canada, the United States, and internationally, with a market cap of CA$136.39 million.

Operations: The company generates CA$127.61 million in revenue from providing comprehensive video streaming solutions.

Market Cap: CA$136.39M

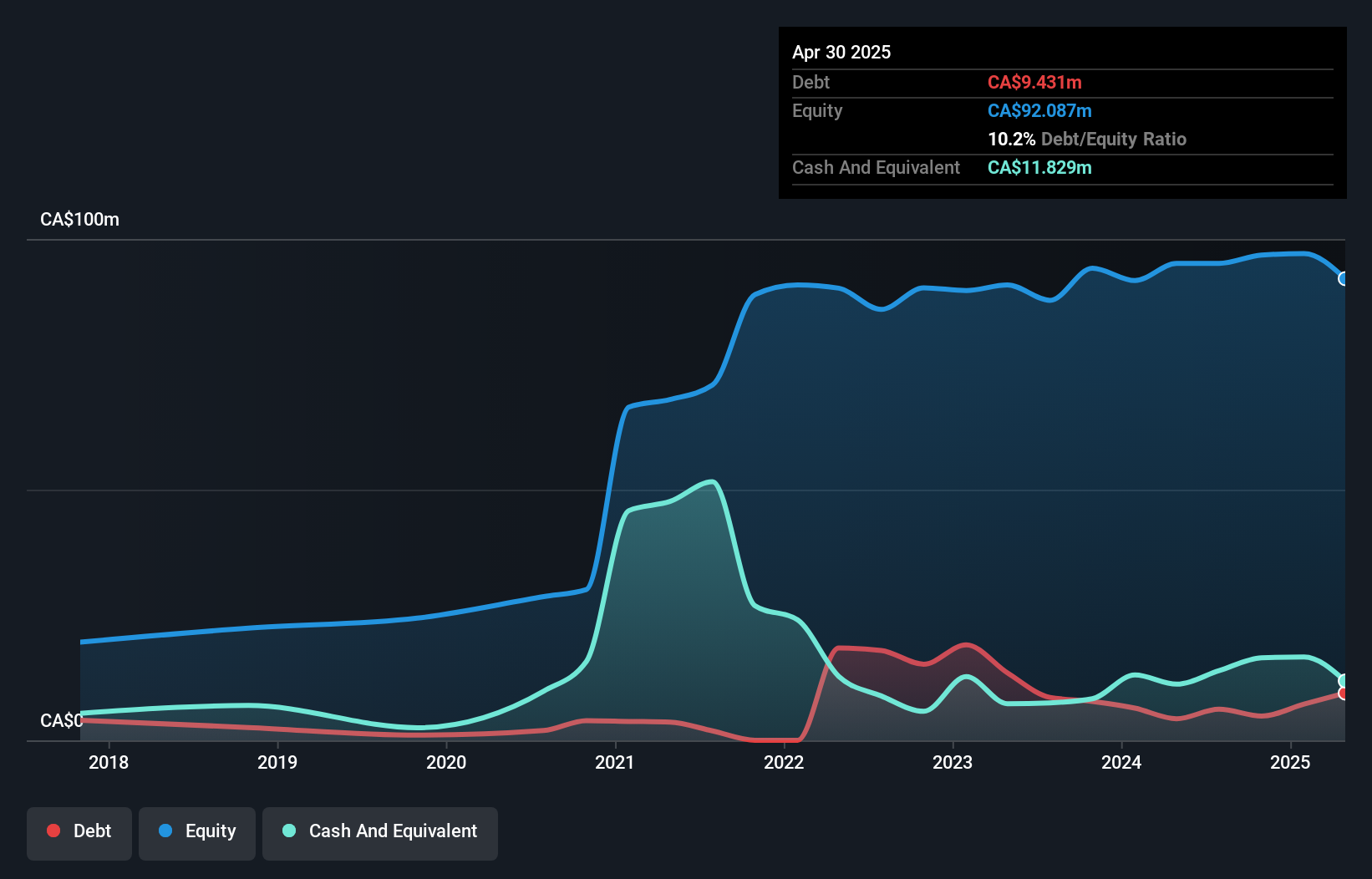

Haivision Systems Inc., with a market cap of CA$136.39 million, has shown resilience despite being unprofitable. The company reported third-quarter sales of CA$35.02 million, reflecting growth from the previous year, though net income declined to CA$0.179 million. It maintains a strong cash position with short-term assets exceeding liabilities and sufficient cash runway for over three years due to positive free cash flow trends. While its return on equity is negative at -1.34%, analysts project significant earnings growth of 120.84% annually, suggesting potential upside in its valuation relative to peers and industry standards.

- Jump into the full analysis health report here for a deeper understanding of Haivision Systems.

- Evaluate Haivision Systems' prospects by accessing our earnings growth report.

Yorbeau Resources (TSX:YRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yorbeau Resources Inc. is involved in the acquisition, development, and exploration of mineral properties in Canada with a market cap of CA$27.70 million.

Operations: The company generates its revenue primarily from mining exploration, totaling CA$0.05 million.

Market Cap: CA$27.7M

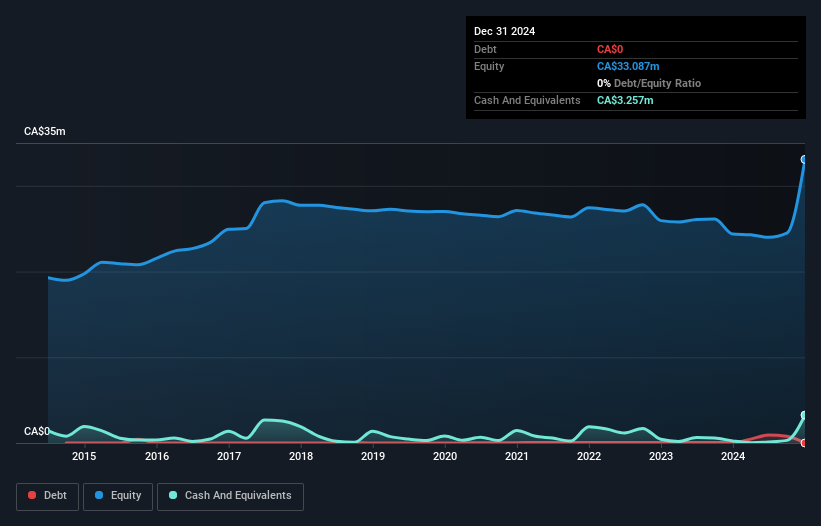

Yorbeau Resources Inc., with a market cap of CA$27.70 million, has transitioned to profitability, reporting net income of CA$0.30 million for the first half of 2025. Despite generating minimal revenue from mining exploration (CA$0.05 million), it has no debt and strong asset coverage for liabilities, indicating financial stability uncommon in its sector. The company's price-to-earnings ratio is notably low at 3.2x compared to the Canadian market average, suggesting potential undervaluation. However, its share price remains highly volatile and earnings are bolstered by high non-cash components, which may affect perceived quality of profits.

- Navigate through the intricacies of Yorbeau Resources with our comprehensive balance sheet health report here.

- Understand Yorbeau Resources' track record by examining our performance history report.

Next Steps

- Access the full spectrum of 413 TSX Penny Stocks by clicking on this link.

- Curious About Other Options? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haivision Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HAI

Haivision Systems

Provides mission-critical, real-time video networking, and visual collaboration solutions in Canada, the United States, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives