- Canada

- /

- Metals and Mining

- /

- TSX:WPM

Should You Be Adding Wheaton Precious Metals (TSE:WPM) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Wheaton Precious Metals (TSE:WPM). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Wheaton Precious Metals

Wheaton Precious Metals's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Wheaton Precious Metals's EPS went from US$0.19 to US$1.13 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

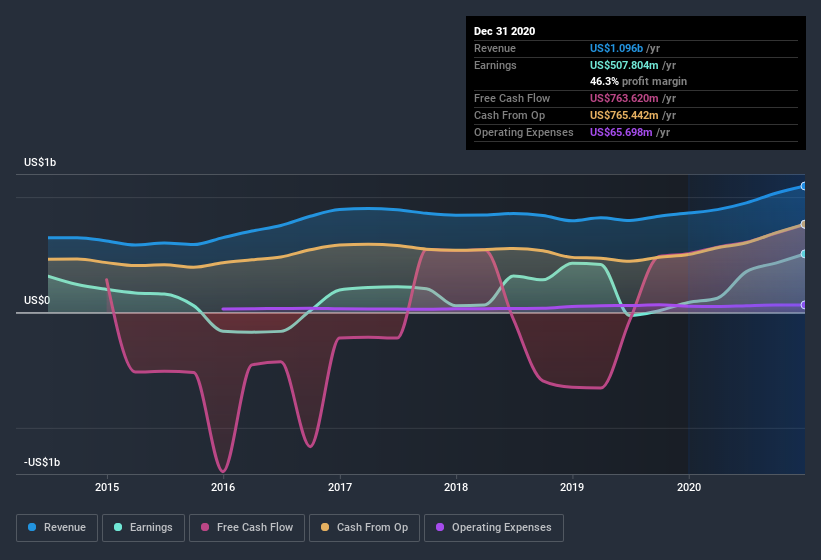

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Wheaton Precious Metals is growing revenues, and EBIT margins improved by 32.9 percentage points to 47%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Wheaton Precious Metals's forecast profits?

Are Wheaton Precious Metals Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While we did see insider selling of Wheaton Precious Metals stock in the last year, one single insider spent plenty more buying. Specifically the Non Independent Director, Glenn Ives, spent US$443k, paying about US$55.31 per share. That certainly pricks my ears up.

On top of the insider buying, it's good to see that Wheaton Precious Metals insiders have a valuable investment in the business. Indeed, they hold US$32m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Randy V. Smallwood, is paid less than the median for similar sized companies. For companies with market capitalizations over US$8.0b, like Wheaton Precious Metals, the median CEO pay is around US$7.2m.

The Wheaton Precious Metals CEO received US$4.6m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Wheaton Precious Metals To Your Watchlist?

Wheaton Precious Metals's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Wheaton Precious Metals deserves timely attention. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Wheaton Precious Metals is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But Wheaton Precious Metals isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Wheaton Precious Metals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wheaton Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:WPM

Wheaton Precious Metals

Sells precious metals in North America, Europe, Africa, and South America.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives