Winpak (TSX:WPK): Assessing Valuation Following Earnings Decline and Share Buyback Completion

Reviewed by Simply Wall St

Winpak (TSX:WPK) just shared its latest quarterly earnings, revealing modest drops in both sales and net income compared to a year ago. In addition, the company wrapped up a sizable share buyback program.

See our latest analysis for Winpak.

After a challenging quarter, Winpak’s short-term share price has demonstrated resilience, posting a 4.7% return over the last 90 days even as its 1-year total shareholder return remains down by 7.9%. Momentum has picked up slightly following the recently completed share buyback. However, long-term investors have still outperformed broader materials averages over the past three and five years.

If recent buybacks have you considering new strategies, why not broaden your scope and discover fast growing stocks with high insider ownership

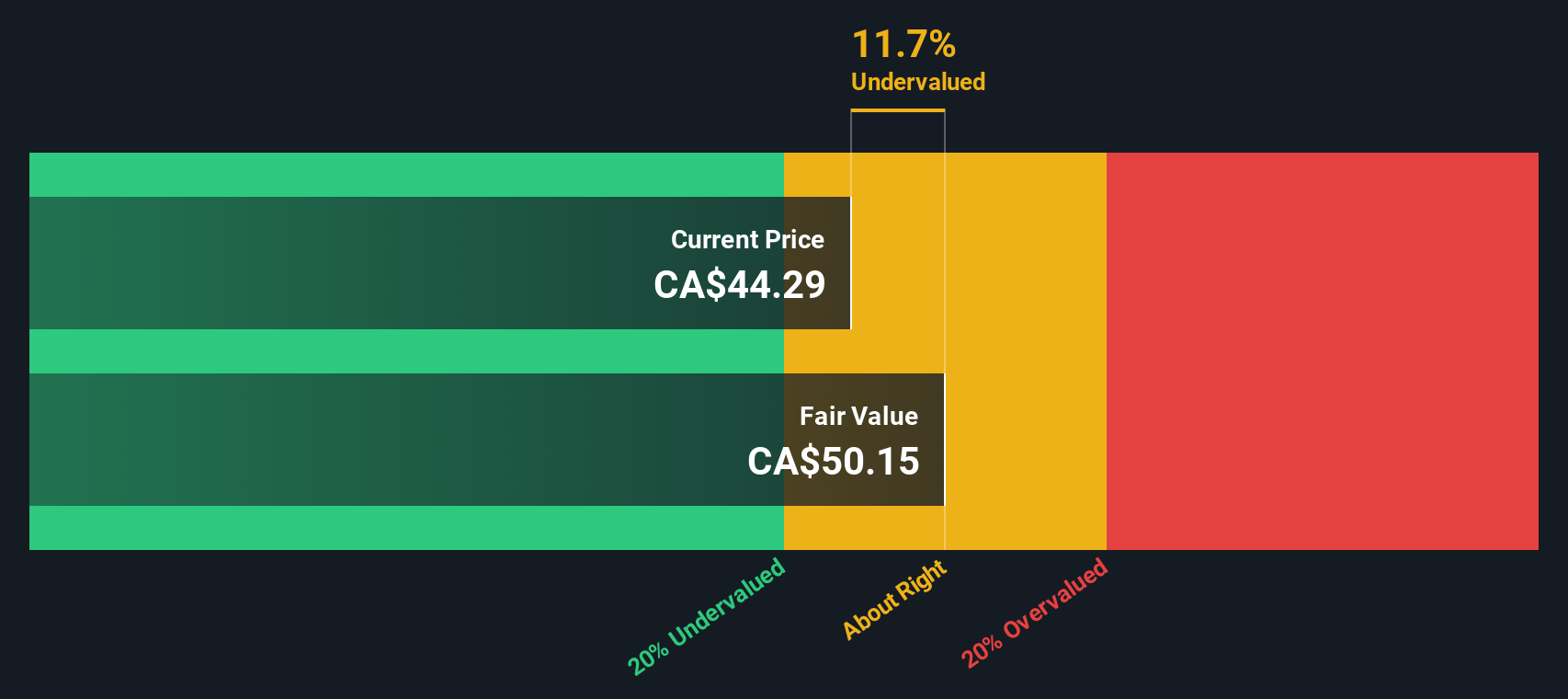

With earnings slipping, share buybacks completed, and the stock still trading at a notable discount to analyst targets, the crucial question is whether Winpak is undervalued or if the market already reflects its growth prospects.

Price-to-Earnings of 13.5x: Is it justified?

Winpak's shares are trading at a price-to-earnings (P/E) ratio of 13.5x, which is below the peer average and industry benchmarks, with a last close of CA$43.02.

The P/E ratio shows how much investors are willing to pay today for a dollar of the company’s future earnings. In packaging, where margins and steady profits matter, this metric is crucial for gauging value and market sentiment.

With Winpak’s 13.5x multiple below the global packaging industry average of 16x and a fair P/E ratio estimation of 15.2x, the market appears to be undervaluing its consistent earnings and profit track record. If Winpak continues to deliver solid results, the multiple could trend closer to what our regression model suggests as fair value.

Explore the SWS fair ratio for Winpak

Result: Price-to-Earnings of 13.5x (UNDERVALUED)

However, slowing revenue and net income growth rates could weigh on sentiment if margins face pressure or if industry demand falters in coming quarters.

Find out about the key risks to this Winpak narrative.

Another View: What Does the SWS DCF Model Say?

Looking at Winpak from another angle, our SWS DCF model suggests an even greater discount, indicating the shares trade well below fair value estimates. This raises the question: are investors overlooking the company’s long-term cash flow potential, or is there an underlying risk being priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Winpak for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Winpak Narrative

If you see things differently or want to dive deeper into Winpak’s data, you can quickly build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Winpak.

Looking for more investment ideas?

If you’re serious about staying ahead, now’s the time to look beyond a single stock. The right opportunities can set you up for smarter investing and long-term gains. Don’t let them pass you by.

- Catch early movers with huge upside by scanning these 3588 penny stocks with strong financials for stocks demonstrating strong financials and growth potential.

- Power up your portfolio with income plays by tapping into these 22 dividend stocks with yields > 3% that consistently deliver high yields above 3%.

- Unlock potential breakthroughs in innovation when you check out these 28 quantum computing stocks, where the future of computing is being shaped by visionary companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Winpak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPK

Winpak

Manufactures and distributes packaging materials and related packaging machines in the United States, Canada, and Mexico.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion