- Canada

- /

- Metals and Mining

- /

- TSX:WM

Top TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market is showing strong momentum as it heads into 2025, supported by resilient consumer spending, rising corporate profits, and the beginning of a rate-cutting cycle. While optimism is high, investors are advised to remain cautious of potential curveballs and consider diversifying their portfolios. Penny stocks, often representing smaller or newer companies, continue to offer intriguing opportunities for those looking beyond the big names; they can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.54 | CA$165.86M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$288.49M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$119.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.52 | CA$330.8M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.18 | CA$215.73M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.79 | CA$1.04B | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 960 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Green Impact Partners (TSXV:GIP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Green Impact Partners Inc., with a market cap of CA$73.31 million, offers water, waste, and solids treatment and recycling services across North America.

Operations: The company generates revenue of CA$157.99 million from its water and solids recycling and energy product optimization segment.

Market Cap: CA$73.31M

Green Impact Partners Inc., with a market cap of CA$73.31 million, shows potential in the penny stock segment through its substantial revenue generation of CA$157.99 million from water and solids recycling services. Despite this, the company is currently unprofitable and not expected to reach profitability within the next three years. Its net debt to equity ratio stands at a satisfactory 16.9%, although short-term assets exceed liabilities, long-term liabilities remain uncovered by short-term assets. Recent earnings reports indicate increased losses compared to previous periods, highlighting ongoing financial challenges despite stable weekly volatility over the past year.

- Click to explore a detailed breakdown of our findings in Green Impact Partners' financial health report.

- Evaluate Green Impact Partners' prospects by accessing our earnings growth report.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company with a market cap of CA$251.81 million.

Operations: No revenue segments are reported for this mineral exploration company.

Market Cap: CA$251.81M

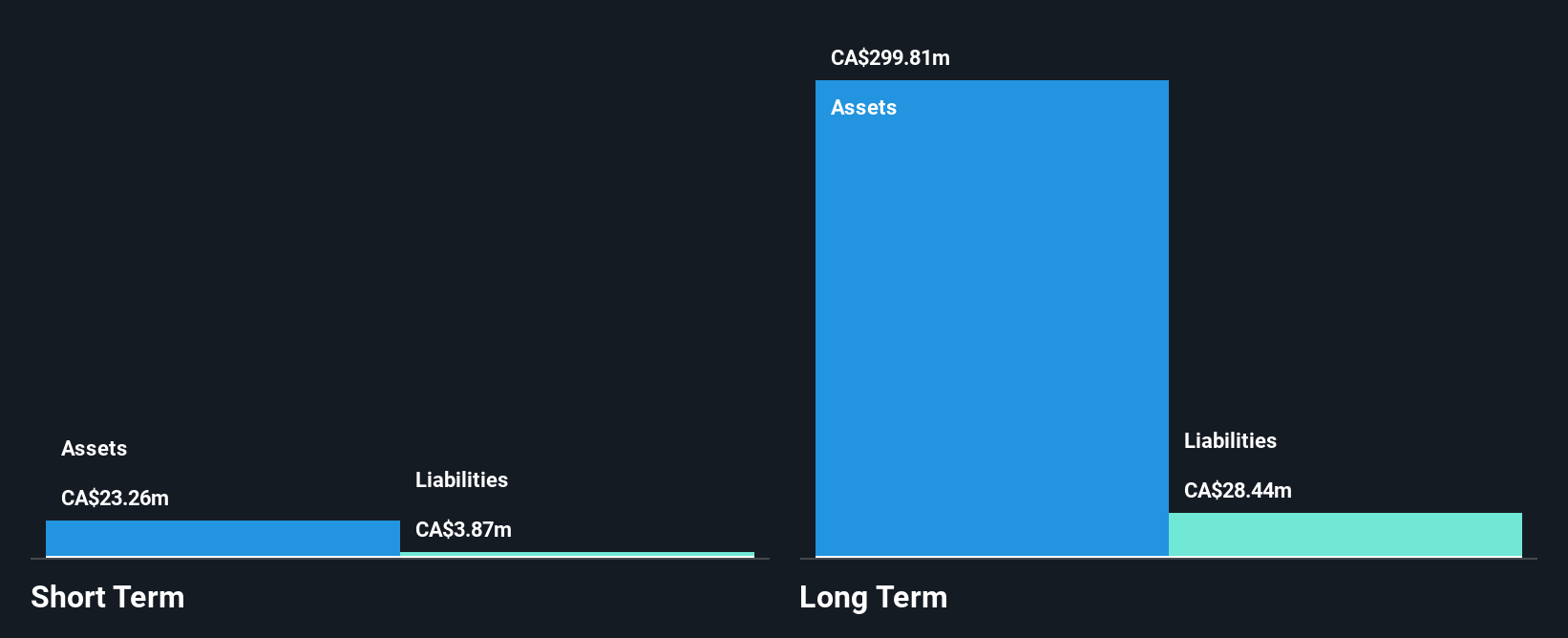

Regulus Resources Inc., with a market cap of CA$251.81 million, operates as a pre-revenue mineral exploration company, focusing on strategic asset acquisitions like the recent agreement to acquire the remaining 30% interest in Colquirrumi claims. Despite being unprofitable and having experienced increased losses over five years, Regulus benefits from a seasoned management team and board with extensive tenure. The company is debt-free and maintains sufficient cash runway for over three years based on current free cash flow levels. While short-term assets significantly exceed liabilities, earnings have not shown growth compared to industry standards.

- Click here and access our complete financial health analysis report to understand the dynamics of Regulus Resources.

- Gain insights into Regulus Resources' past trends and performance with our report on the company's historical track record.

Wallbridge Mining (TSX:WM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wallbridge Mining Company Limited focuses on the acquisition, exploration, discovery, development, and production of gold properties with a market cap of CA$65.28 million.

Operations: Wallbridge Mining Company Limited does not have any reported revenue segments.

Market Cap: CA$65.28M

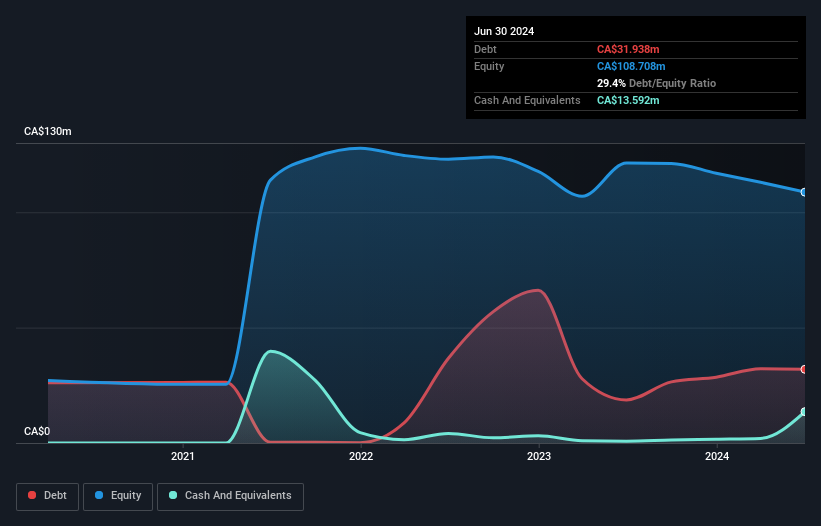

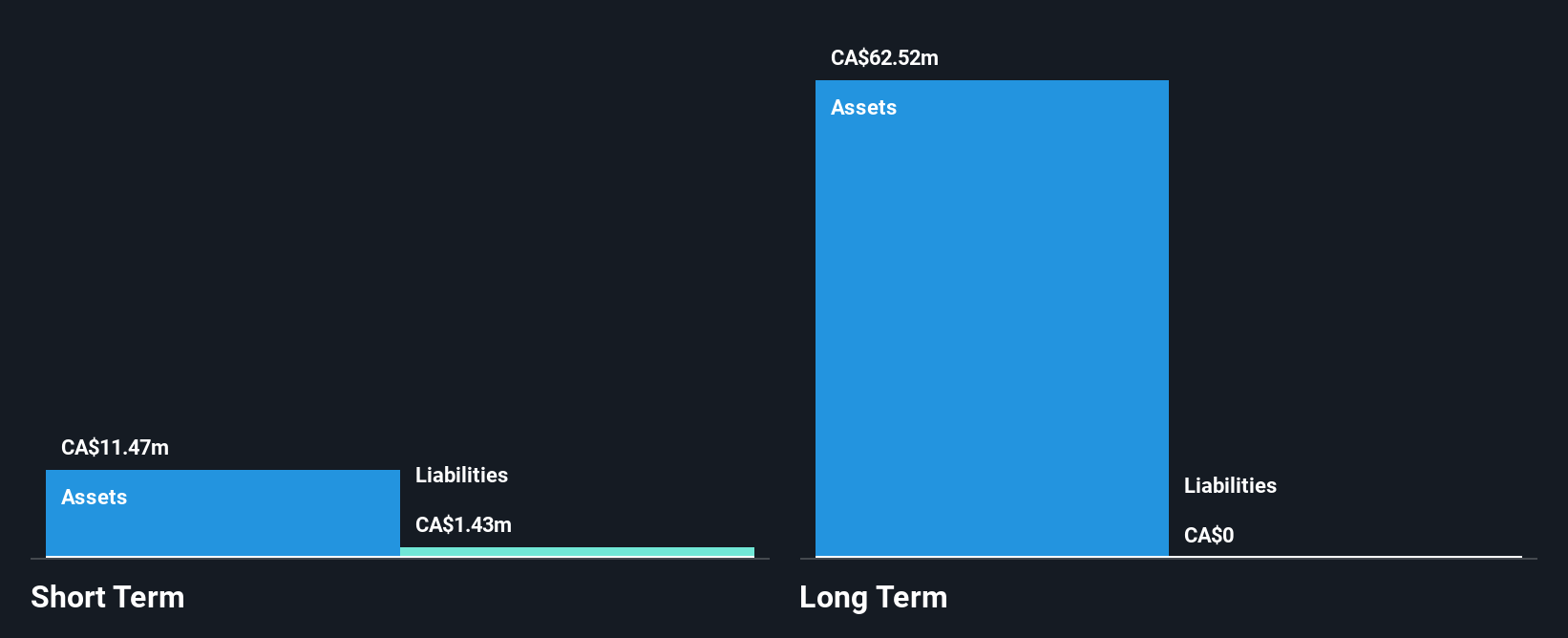

Wallbridge Mining Company Limited, with a market cap of CA$65.28 million, is a pre-revenue entity focusing on gold exploration and development. The company recently announced significant high-grade gold intercepts from its Martiniere project, which could indicate potential resource expansion. Despite being debt-free, Wallbridge faces challenges with short-term assets not covering long-term liabilities and has experienced shareholder dilution over the past year. Recent private placements raised CA$6.23 million to support ongoing exploration efforts. The management team is relatively new, while the board has more experience with an average tenure of 3.9 years.

- Navigate through the intricacies of Wallbridge Mining with our comprehensive balance sheet health report here.

- Assess Wallbridge Mining's previous results with our detailed historical performance reports.

Seize The Opportunity

- Navigate through the entire inventory of 960 TSX Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wallbridge Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WM

Wallbridge Mining

Engages in the acquisition, exploration, discovery, development, and production of gold properties.

Excellent balance sheet moderate.