- Canada

- /

- Metals and Mining

- /

- TSX:WM

3 Canadian Penny Stocks On TSX With Market Caps Under CA$80M

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating through a landscape shaped by recent U.S. policy changes, with the TSX index showing resilience amidst potential economic shifts. In this context, penny stocks—often representing smaller or newer companies—continue to capture investor interest due to their affordability and growth potential. While the term may seem outdated, these stocks can still offer compelling opportunities when selected for their financial strength and stability.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$189.37M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.34 | CA$933.34M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.50 | CA$406.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$222.46M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$123.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.495 | CA$14.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.03 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 937 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

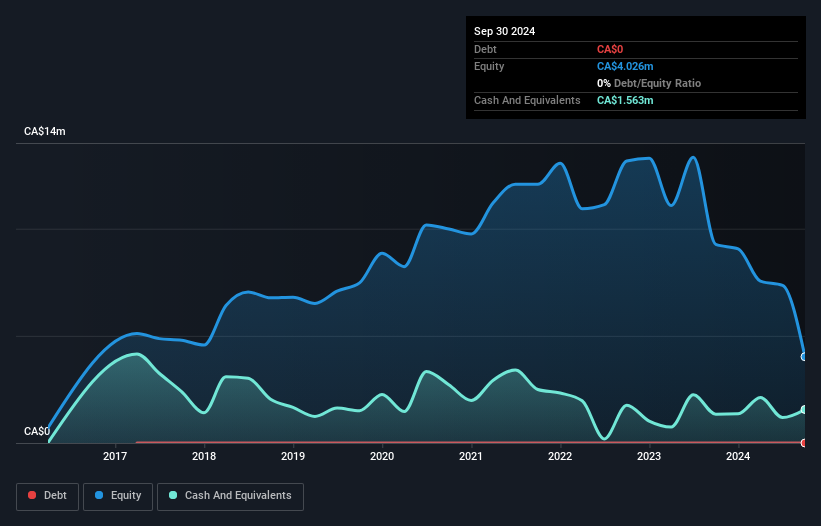

Scottie Resources (TSXV:SCOT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scottie Resources Corp. is involved in the identification, acquisition, exploration, and development of mineral properties in British Columbia, Canada, with a market cap of CA$42.47 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$42.47M

Scottie Resources, with a market cap of CA$42.47 million, is pre-revenue and currently unprofitable. Despite this, the company remains debt-free and has a cash runway extending over three years due to positive free cash flow. Recent drilling results from the Scottie Gold Mine Project have revealed high-grade gold intercepts in several zones, highlighting potential resource expansion opportunities. However, its share price has been highly volatile recently and earnings have declined annually by 26.4% over five years. The management team is experienced with an average tenure of 6.2 years, offering stability amid exploration activities.

- Click to explore a detailed breakdown of our findings in Scottie Resources' financial health report.

- Gain insights into Scottie Resources' past trends and performance with our report on the company's historical track record.

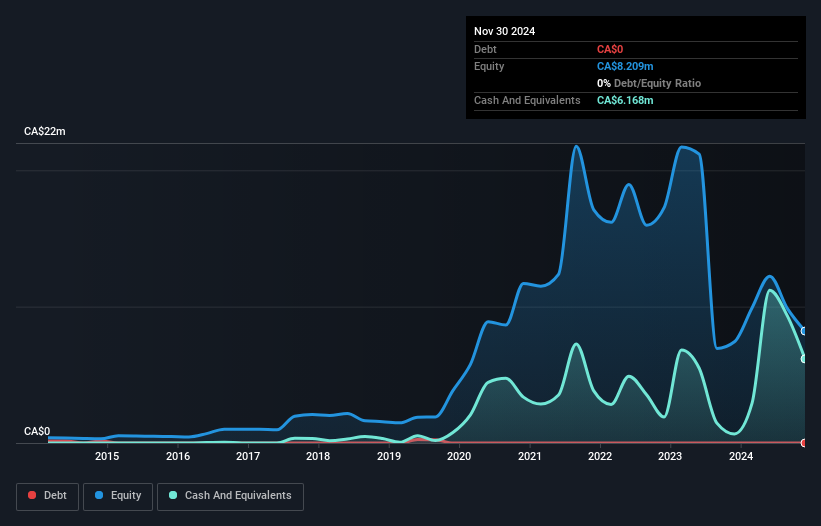

VR Resources (TSXV:VRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VR Resources Ltd. is a junior exploration company focused on acquiring, evaluating, and exploring mineral properties in the United States and Canada, with a market cap of CA$6.25 million.

Operations: VR Resources Ltd. does not report any revenue segments as it is primarily engaged in the exploration and evaluation of mineral properties in North America.

Market Cap: CA$6.25M

VR Resources Ltd., with a market cap of CA$6.25 million, is pre-revenue and focused on mineral exploration in North America. The company is debt-free, but its cash runway is limited to around eight months based on current free cash flow estimates, although recent capital raises may extend this period. Recent drilling at the Silverback copper-gold project in Ontario has identified promising geological features such as shearing and sulfides, indicating potential for significant mineralization. However, VR Resources' share price has been highly volatile recently, and it remains unprofitable with declining earnings over the past five years.

- Navigate through the intricacies of VR Resources with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into VR Resources' track record.

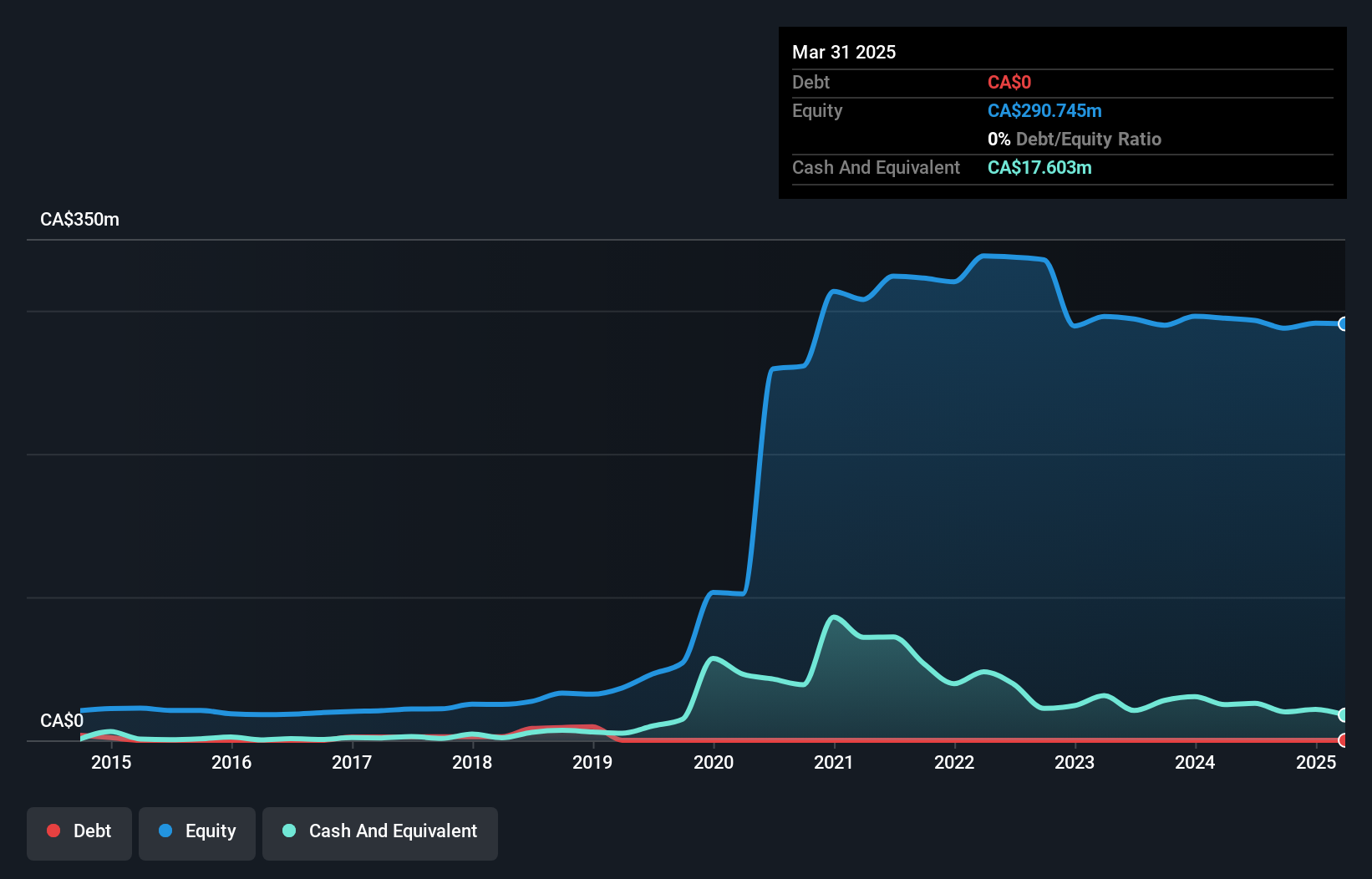

Wallbridge Mining (TSX:WM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wallbridge Mining Company Limited is involved in the acquisition, exploration, discovery, development, and production of gold properties with a market cap of CA$71.28 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$71.28M

Wallbridge Mining Company Limited, with a market cap of CA$71.28 million, remains pre-revenue and focuses on advancing its gold projects in Quebec. The company has a volatile share price but maintains sufficient short-term assets to cover its liabilities. Recent capital raises have bolstered its cash runway to nine months, supporting ongoing exploration and technical studies at the Fenelon and Martiniere projects. Wallbridge is conducting an updated Preliminary Economic Assessment for Fenelon, which aims to optimize production costs and resource estimates. Despite high potential gold recoveries from metallurgical testing at Martiniere, Wallbridge remains unprofitable with increasing losses over five years.

- Jump into the full analysis health report here for a deeper understanding of Wallbridge Mining.

- Explore historical data to track Wallbridge Mining's performance over time in our past results report.

Seize The Opportunity

- Explore the 937 names from our TSX Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wallbridge Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WM

Wallbridge Mining

Engages in the acquisition, exploration, discovery, development, and production of gold properties.

Excellent balance sheet slight.

Market Insights

Community Narratives