- Canada

- /

- Metals and Mining

- /

- TSX:WDO

Wesdome Gold Mines (TSX:WDO) Is Up 5.1% After Strong Q2 Earnings and Updated 2025 Guidance

Reviewed by Simply Wall St

- Wesdome Gold Mines Ltd. recently reported second quarter 2025 results, with sales rising to CA$208.55 million and net income reaching CA$82.7 million, both higher than the previous year.

- The company also updated its 2025 consolidated production guidance, narrowing the range but maintaining a strong overall production outlook.

- We'll explore how Wesdome's robust earnings growth shapes the company's investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Wesdome Gold Mines Investment Narrative Recap

To be a Wesdome Gold Mines shareholder, one must believe in the company’s ability to execute its fill-the-mill strategy and sustain growth at both the Kiena Deep and Eagle River mines. The recent jump in quarterly earnings reinforces confidence in operational performance; however, the narrowed production guidance range does not materially impact the most important short-term catalyst, continued strong output from key mining assets, nor does it significantly alleviate the central risk tied to potential disruptions or underperformance at these core sites.

Among the recent developments, the updated production guidance directly relates to current results and future expectations. By confirming a consolidated production range of 185,000 to 205,000 ounces, slightly reduced yet reaffirming a robust outlook, the company signals stability in its operations, which is especially important for those watching how output trends affect near-term revenue and earnings catalysts.

Yet, investors should be aware that despite these strong results, any unexpected operational hiccup at Kiena Deep or Eagle River could quickly change the outlook...

Read the full narrative on Wesdome Gold Mines (it's free!)

Wesdome Gold Mines is expected to reach CA$1.0 billion in revenue and CA$374.1 million in earnings by 2028. This outlook assumes 16.4% annual revenue growth and a CA$186.9 million increase in earnings from the current CA$187.2 million.

Uncover how Wesdome Gold Mines' forecasts yield a CA$23.19 fair value, a 35% upside to its current price.

Exploring Other Perspectives

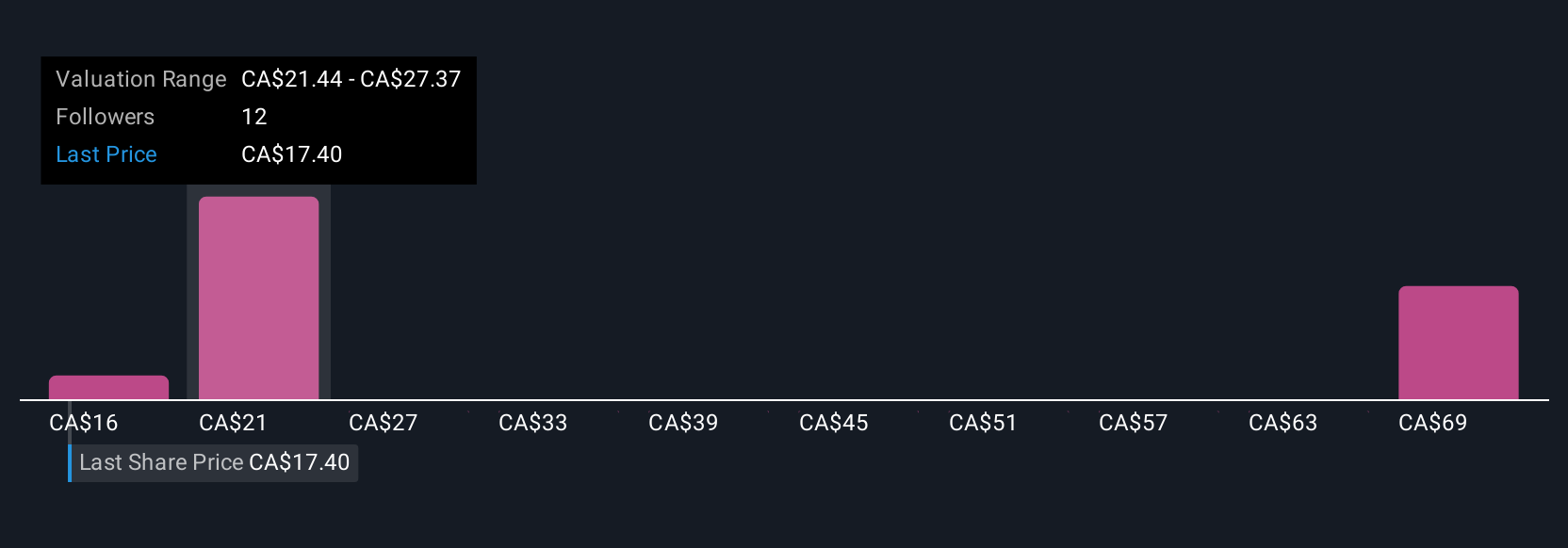

Five members of the Simply Wall St Community estimate Wesdome’s fair value between CA$15.50 and CA$78.14, reflecting a wide spread of opinion. Some expect continued production stability to support performance, while others highlight the importance of monitoring key mine output in case of operational risks.

Explore 5 other fair value estimates on Wesdome Gold Mines - why the stock might be worth over 4x more than the current price!

Build Your Own Wesdome Gold Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesdome Gold Mines research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wesdome Gold Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesdome Gold Mines' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives