- Canada

- /

- Metals and Mining

- /

- TSX:WDO

Optimistic Investors Push Wesdome Gold Mines Ltd. (TSE:WDO) Shares Up 33% But Growth Is Lacking

Despite an already strong run, Wesdome Gold Mines Ltd. (TSE:WDO) shares have been powering on, with a gain of 33% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 91% in the last year.

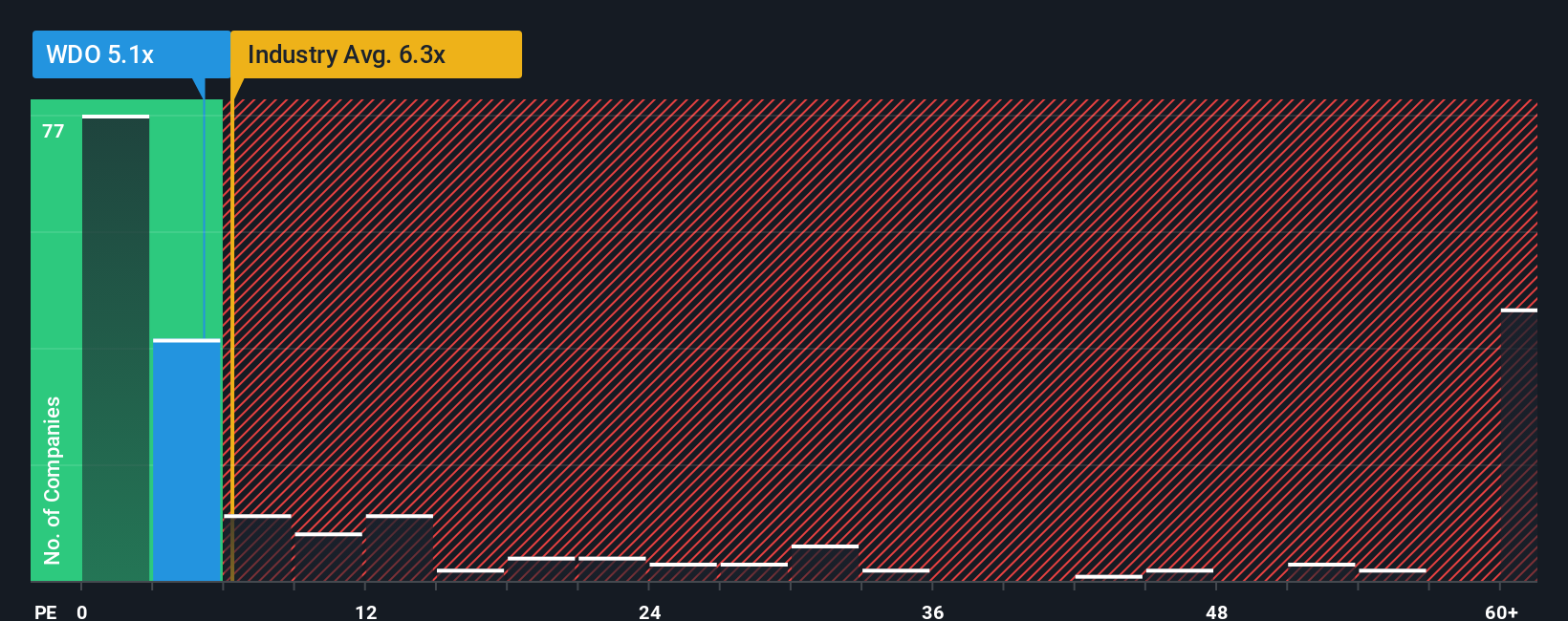

Even after such a large jump in price, there still wouldn't be many who think Wesdome Gold Mines' price-to-sales (or "P/S") ratio of 5.1x is worth a mention when the median P/S in Canada's Metals and Mining industry is similar at about 6.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Wesdome Gold Mines

What Does Wesdome Gold Mines' Recent Performance Look Like?

Wesdome Gold Mines certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wesdome Gold Mines.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Wesdome Gold Mines would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 81% last year. Pleasingly, revenue has also lifted 158% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 11% per year during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 38% per annum growth forecast for the broader industry.

With this information, we find it interesting that Wesdome Gold Mines is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Wesdome Gold Mines' P/S?

Its shares have lifted substantially and now Wesdome Gold Mines' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Wesdome Gold Mines' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Wesdome Gold Mines with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives