A Look at 5N Plus (TSX:VNP) Valuation After Expanded Agreements and Strong Earnings Growth

Reviewed by Kshitija Bhandaru

5N Plus (TSX:VNP) has caught investors’ attention after announcing expanded agreements that are expected to boost future revenue streams. The company is trading below estimated fair value and has also posted strong earnings growth recently.

See our latest analysis for 5N Plus.

5N Plus has delivered an impressive run, with the latest share price climbing 14.3% over the past month and surging more than 123% year-to-date. When you zoom out, momentum really stands out, as shareholders have enjoyed a blockbuster one-year total return of nearly 160% and an astonishing 1,082% over the last three years. This hints that optimism about earnings growth and the potential impact of those new agreements is steadily building.

If the story behind 5N Plus has you thinking bigger, now’s an exciting time to expand your search and discover fast growing stocks with high insider ownership

With shares still trading below estimated fair value despite remarkable gains, the question is whether 5N Plus remains a bargain with more upside ahead or if the market has already priced in its future growth potential.

Most Popular Narrative: 9.9% Undervalued

With 5N Plus closing at CA$17.73 while the most watched fair value estimate sits at CA$19.68, the difference is clear, and it has implications for how the market sees future growth. This sets the stage for the core drivers that analysts believe could sustain the company’s momentum.

The expansion of the long-term supply agreement with First Solar positions 5N Plus as a critical U.S.-based supplier to the leading American solar panel manufacturer. This aligns with accelerating clean energy adoption and North American supply chain security. It is expected to drive sustained and step-wise increases in semiconductor compound volumes (33% in 2025-26, with another 25% lift in 2027-28) and support multi-year revenue and earnings growth, with minimal additional capital investment required.

Want to know the secret assumptions behind this bullish price gap? The narrative hinges on dramatic supply ramp-ups and profit expansion. What’s the forecasted growth engine that analysts bet on for their higher fair value? Dig deeper to unearth the numbers powering this price target.

Result: Fair Value of $19.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes or overreliance on major clients could quickly challenge the current bullish outlook and introduce new uncertainties for 5N Plus.

Find out about the key risks to this 5N Plus narrative.

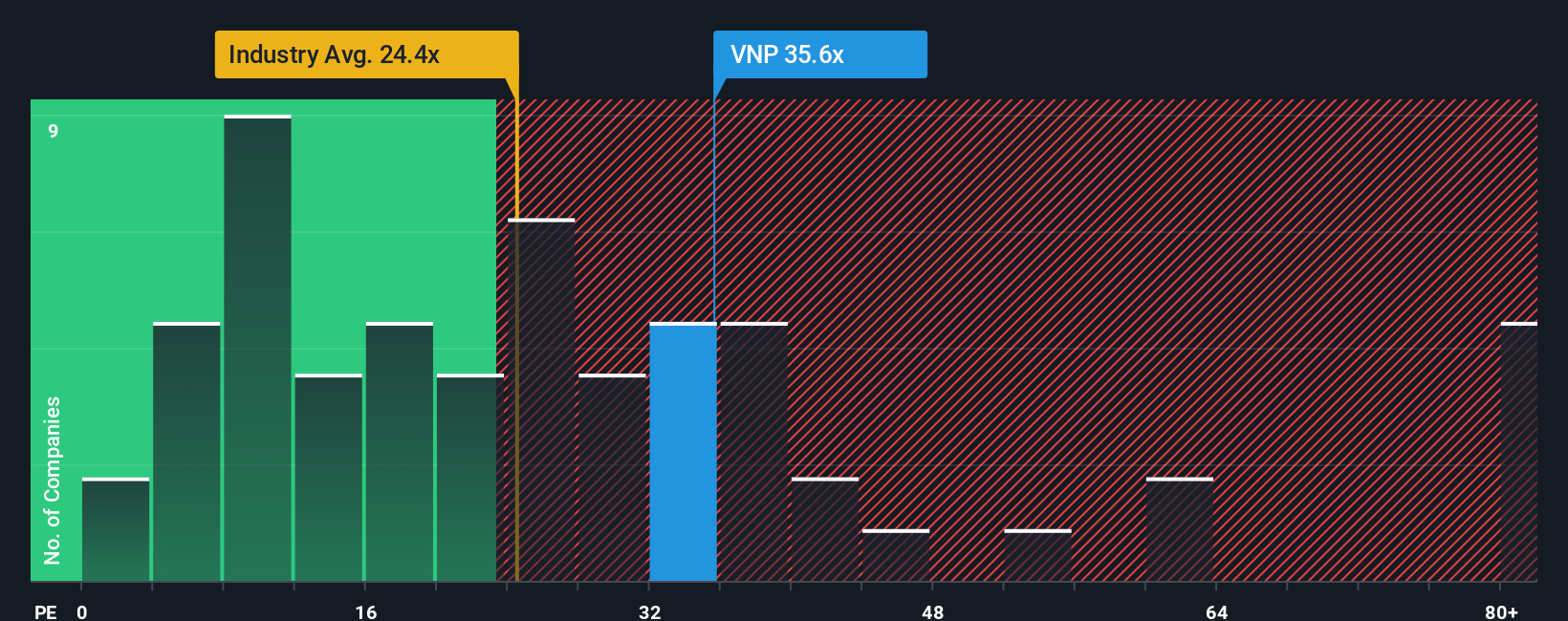

Another View: Are Valuation Ratios Flashing Red?

While the fair value model suggests 5N Plus looks undervalued, the company's price-to-earnings ratio tells a different story. At 35.2x, it is much higher than both the North American Chemicals industry average of 25.2x and its peers' average of 14.5x. It also stands above the fair ratio of 18.3x, suggesting that market optimism might have run too far. Could this premium signal increased risk if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 5N Plus Narrative

Keep in mind, you can examine the numbers firsthand and build your own perspective on 5N Plus in just a few minutes. Do it your way

A great starting point for your 5N Plus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Uncover fresh investment angles beyond 5N Plus with the Simply Wall Street Screener. These handpicked ideas could set your portfolio apart.

- Unlock strong yield potential by reviewing these 19 dividend stocks with yields > 3% that consistently offer attractive income streams backed by solid financials.

- Tap into tomorrow’s breakthroughs by tracking these 25 AI penny stocks at the forefront of artificial intelligence and next-gen innovation.

- Position yourself ahead of market trends with these 894 undervalued stocks based on cash flows revealing stocks with healthy fundamentals trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VNP

5N Plus

Produces and sells specialty semiconductors and performance materials in the Americas, Europe, Asia, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives