- Canada

- /

- Metals and Mining

- /

- TSX:USA

A Look at Americas Gold and Silver (TSX:USA) Valuation Following Major Galena Complex Hoisting Upgrades

Reviewed by Simply Wall St

If you are following Americas Gold and Silver (TSX:USA), you have probably taken notice of a recent event that could shift the outlook for the stock. The company just announced it finished the first phase of upgrades to the No. 3 Shaft at its Galena Complex in Idaho, completing the work ahead of schedule and effectively doubling the hoisting capacity from 40 to 80 tons per hour. In addition, the upgrades included a new hoist motor, a backup system, and improved weight-measuring systems, all aimed at making the mine safer and more efficient. For investors, this is not just operational housekeeping but a meaningful step that could have real implications for the company’s bottom line in the months ahead.

Looking at the bigger picture, Americas Gold and Silver’s share price has experienced strong momentum over the past year, with recent upgrades and metallurgical results underpinning fresh optimism in the mining operation’s future. The company’s shares are up about 3% in the past year and have surged close to 180% since January, which suggests that the market is responding positively to this productivity push. While setbacks in years past have dampened long-term returns, it appears that momentum is turning in the company’s favor as these operational wins start to add up.

With that kind of movement, the big question now is whether Americas Gold and Silver remains an undervalued play on future growth or if the market has already factored these improvements into the price.

Most Popular Narrative: 68% Undervalued

The prevailing narrative sees Americas Gold and Silver as deeply undervalued, with the potential for significant upside under a strong precious metals cycle. According to Agricola, the company stands to benefit not only from higher commodity prices, but also from operational improvements and production growth at its key projects.

“EC120 project: Expected to add approximately 2 to 3 million ounces of silver annually by 2026, based on feasibility studies for similar projects.”

Total Cosalá silver production by 2027: approximately 3 to 4 million ounces per year.”

Imagine a future where production surges and margins expand. What could that mean for a mining stock trading at a hefty discount? The secret sauce in this narrative is a bold forecast for remarkable revenue and cash flow growth as production ramps up. Want to know how high the upside could reach if the assumptions play out? The numbers driving this valuation might surprise even experienced investors.

Result: Fair Value of $12.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, production delays or a reversal in silver and gold prices could quickly shift sentiment. This serves as a reminder to investors that assumptions can change fast.

Find out about the key risks to this Americas Gold and Silver narrative.Another View: How Do Valuation Comparisons Stack Up?

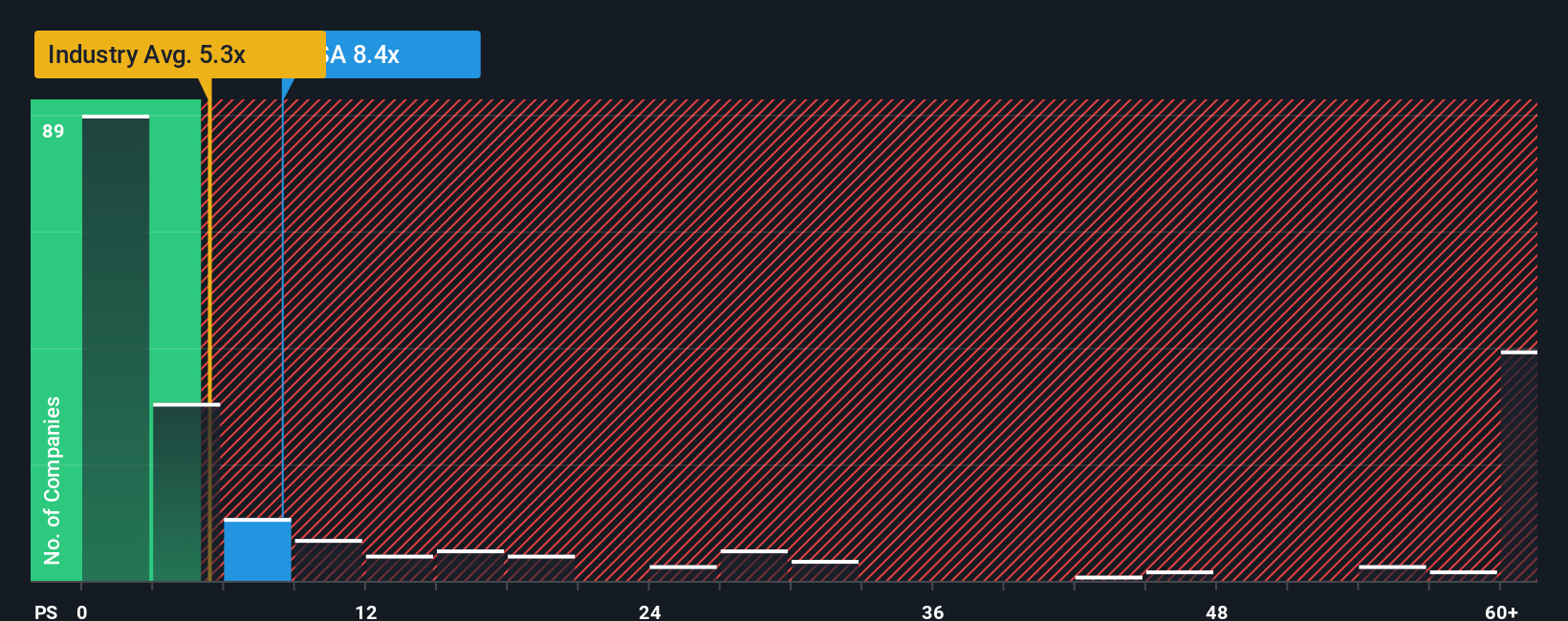

Switching gears, our model that compares sales multiples to the broader industry paints a much less optimistic picture. This approach suggests the stock may actually be more expensive than it first appears. Which view will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Americas Gold and Silver to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Americas Gold and Silver Narrative

If you see things differently, or want to dig into the numbers on your own terms, you can craft a custom narrative in just a few minutes. Do it your way.

A great starting point for your Americas Gold and Silver research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the moment and give your portfolio fresh energy by targeting untapped growth, income, and innovation opportunities. These hand-selected themes offer a shot at strong returns that others may miss out on.

- Access the power of generous yields and stable income with dividend stocks with yields > 3%. This is ideal for building wealth and cushioning against market volatility.

- Ride the wave of artificial intelligence innovation by checking out AI penny stocks. Uncover tomorrow’s leaders transforming industries with disruptive AI tech.

- Capitalize on bargain opportunities by targeting stocks flagged as promising value plays with undervalued stocks based on cash flows. Don’t let great deals pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

High growth potential and fair value.

Market Insights

Community Narratives