- Canada

- /

- Metals and Mining

- /

- TSX:TRX

TRX Gold (TSX:TRX) Profitability Turnaround Tests Bullish Valuation Gap Narrative in FY 2025

Reviewed by Simply Wall St

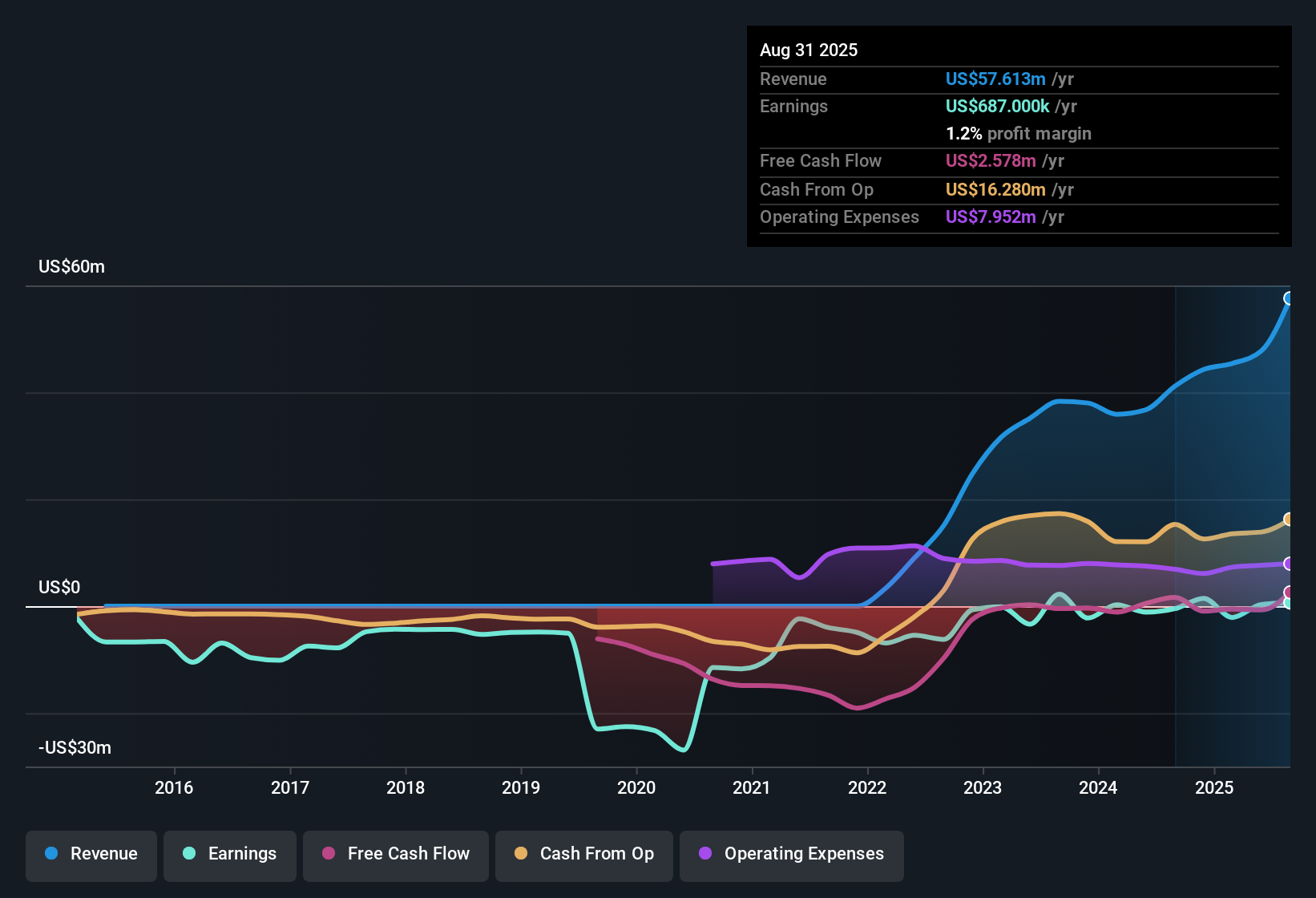

TRX Gold (TSX:TRX) just wrapped up FY 2025 with fourth quarter revenue of about $23.5 million and net income of roughly $2.4 million, capping a year in which the business moved into the black on a trailing twelve month basis. The company has seen revenue step up from around $41.2 million on a trailing basis in late 2024 to about $57.6 million by Q4 2025, while net income over the same window has shifted from a small loss of about $0.5 million to a profit of roughly $0.7 million, pointing to a business that is starting to get more operating leverage through its margin structure.

See our full analysis for TRX Gold.With the headline numbers on the table, the next step is to see how this swing into profitability lines up with the narratives investors have been telling about TRX Gold, and where the latest margins story might force a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

57.5% earnings growth backs profitability shift

- Over the last five years, TRX’s profit has grown about 57.5% per year and on a trailing basis it has moved from a net loss of roughly 0.5 million USD in late 2024 to a profit of about 0.7 million USD by Q4 2025.

- What stands out for the bullish view is that this move into the black is paired with a high earnings quality flag, which heavily supports the idea of a more durable turnaround rather than a one off:

- The latest trailing twelve month revenue of around 57.6 million USD versus about 41.2 million USD in late 2024 shows the business scaling while staying profitable.

- Consistently positive net income in FY 2025 Q1 and Q4, at roughly 1.0 million USD and 2.4 million USD respectively, contrasts with earlier losses and reinforces the bullish case that the operation can now generate real cash style profits.

After a year where profits only just turned positive, some investors will want to see if this 57.5% growth pace can realistically continue or if it was helped by an unusually strong ramp up period for the mine.

📊 Read the full TRX Gold Consensus Narrative.Revenue climbs to 57.6 million USD on a trailing basis

- On a trailing twelve month view, total revenue has risen from about 41.2 million USD in 2024 Q4 to roughly 57.6 million USD by 2025 Q4, alongside an improvement in trailing net income from a loss of approximately 0.5 million USD to a profit of around 0.7 million USD.

- Supporters of the bullish angle argue that scaling production should translate into operating leverage, and the numbers give that claim some substance while also showing where it is still being tested:

- Within FY 2025, quarterly revenue ranged from about 9.1 million USD in Q2 to 23.5 million USD in Q4, yet profitability flipped from a loss of roughly 2.5 million USD in Q2 to a profit of about 2.4 million USD in Q4, which suggests costs were better absorbed at higher output levels.

- However, the swing from a small profit of about 1.0 million USD in Q1 2025 to a loss of roughly 0.2 million USD in Q3, despite similar revenue in those quarters, shows that even with growing sales the path to steady margins may still be uneven.

For a beginner investor, the key is that bigger sales are starting to show up in actual profits, but the quarter to quarter bumps remind you that mining operations can still be volatile while they optimize costs.

Share price 90.3% below 10.53 CAD DCF fair value

- With the stock at about 1.02 CAD and a DCF fair value estimate of roughly 10.53 CAD, TRX is trading around 90.3% below that model value, even as its price to sales ratio of 3.6 times sits above peer averages of 1.9 times but beneath the broader Canadian metals and mining industry at 6.2 times.

- Skeptics highlight that paying 3.6 times sales for a small producer is not cheap against peers, and the recent results both challenge and partly support that cautious stance:

- On one hand, the move from a trailing net loss of roughly 1.1 million USD in 2024 Q3 to a trailing profit of about 0.7 million USD by 2025 Q4 helps justify some premium to peers that are not yet profitable.

- On the other hand, the fact that trailing profit is still under 1 million USD while revenue approaches 60 million USD shows margins are thin, which is exactly what bears point to when they question whether the large DCF discount will actually close.

If you are comparing TRX to other miners, the trade off is paying a higher multiple than some peers today in exchange for a business that has only just turned profitable but is still priced far below its DCF fair value estimate.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TRX Gold's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite moving into profitability, TRX Gold still runs on very thin margins with uneven quarterly results, which raises questions about the durability of its earnings.

If that inconsistency leaves you uneasy, use our CTA_SCREENER_STABLE_GROWTH to quickly focus on companies already delivering steadier revenue and earnings momentum across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TRX Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRX

TRX Gold

Engages in the exploration, development, and production of mineral property in Tanzania.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026