- Canada

- /

- Metals and Mining

- /

- TSX:TRX

TRX Gold (TSX:TRX) Is Up 26.1% After Record Q4 Output and Debt Repayment—What's Changed

Reviewed by Sasha Jovanovic

- TRX Gold Corporation recently reported record gold production for Q4 2025, with output rising 37% over the previous quarter and the company fully repaying US$3.0 million of short-term borrowings while improving working capital.

- These achievements coincide with ongoing plant optimizations and expansion at the Buckreef Gold Project in Tanzania, supporting a stronger financial foundation and enhanced production capacity.

- We'll examine how the rapid production growth and plant expansion are shaping TRX Gold's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is TRX Gold's Investment Narrative?

Anyone considering TRX Gold as an investment needs to believe in the company’s ability to execute its growth plans at the Buckreef Gold Project and deliver on its path to sustainable profitability, especially now that it has achieved record quarterly production and a significant debt reduction. The latest results are clearly material, with gold output up 37%, short-term debt repaid, and working capital improved, steps that help address key risks around liquidity and financing that had been highlighted in prior quarters. This operational progress, combined with tangible upgrades to the processing plant, shifts short-term catalysts firmly toward production ramp-up and margin enhancement, potentially setting a new baseline for earnings performance. However, investors should balance optimism with caution, considering short mine operating history and the pace of transition to full-scale expansion, which could introduce new operational or cost risks not previously as prominent.

But what if Buckreef’s scaling challenges disrupt cash flows just as growth gets underway?

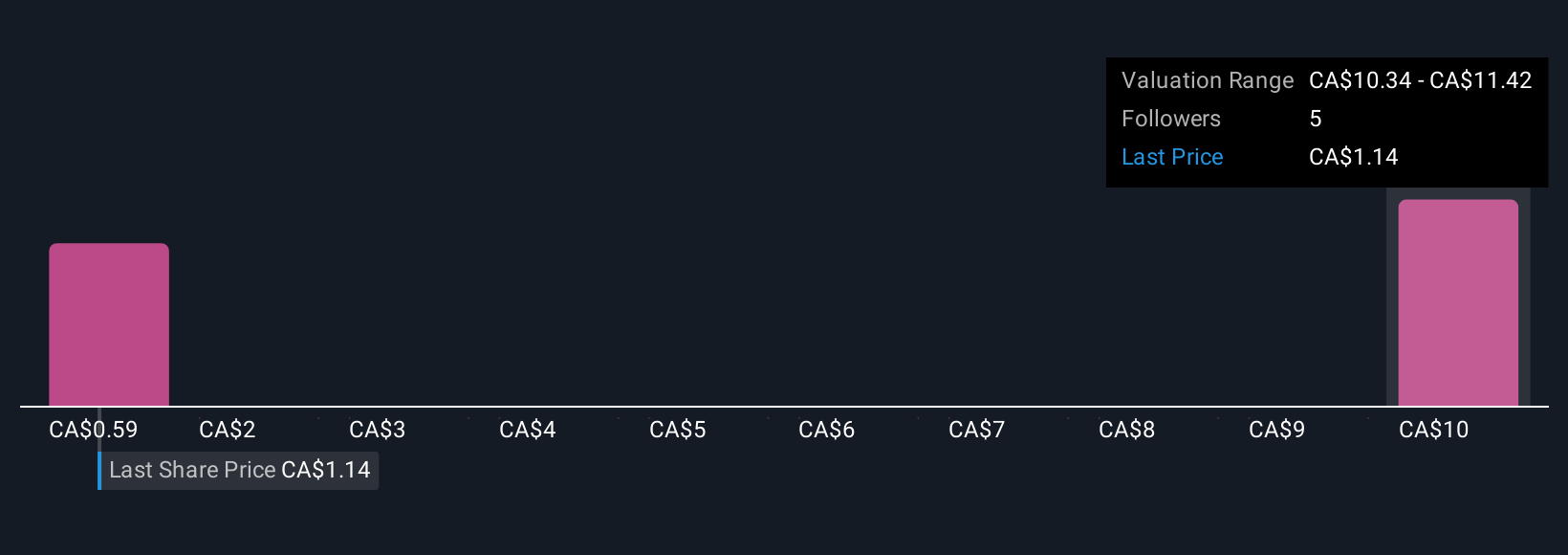

TRX Gold's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on TRX Gold - why the stock might be worth over 10x more than the current price!

Build Your Own TRX Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TRX Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TRX Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TRX Gold's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TRX Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRX

TRX Gold

A junior gold mining company, engages in the exploration, development, and production of mineral property in Tanzania.

Excellent balance sheet and good value.

Market Insights

Community Narratives