- Canada

- /

- Metals and Mining

- /

- TSX:ARG

March 2025's Top TSX Penny Stocks To Watch

Reviewed by Simply Wall St

In 2025, the Canadian stock market has experienced volatility with negative returns, highlighting the importance of diversification in investment portfolios. Despite these challenges, certain sectors have shown resilience and offered positive returns, underscoring opportunities for strategic investments. Penny stocks, often associated with smaller or newer companies, continue to present intriguing growth prospects; when these stocks are supported by strong financials and solid fundamentals, they can offer potential upside in an otherwise uncertain market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| NTG Clarity Networks (TSXV:NCI) | CA$1.87 | CA$77.14M | ✅ 4 ⚠️ 2 View Analysis > |

| NamSys (TSXV:CTZ) | CA$1.12 | CA$29.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Madoro Metals (TSXV:MDM) | CA$0.045 | CA$3.58M | ✅ 2 ⚠️ 5 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.99 | CA$453.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.93 | CA$312.9M | ✅ 2 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.84 | CA$167.51M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.69 | CA$623.15M | ✅ 2 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.18 | CA$78.01M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.485 | CA$13.89M | ✅ 2 ⚠️ 4 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.06 | CA$39.5M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Western Uranium & Vanadium (CNSX:WUC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Western Uranium & Vanadium Corp. is involved in the exploration, development, mining, and production of uranium and vanadium resource properties in the United States with a market cap of CA$63.54 million.

Operations: The company's revenue is derived from its Metals & Mining - Miscellaneous segment, amounting to $0.22 million.

Market Cap: CA$63.54M

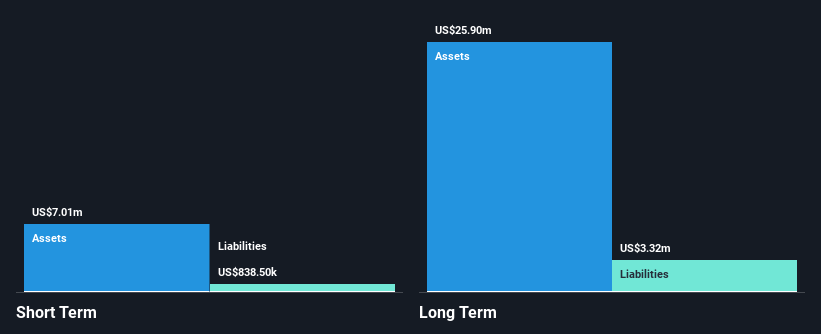

Western Uranium & Vanadium Corp., with a market cap of CA$63.54 million, is pre-revenue, generating only US$220K. The company has no debt and its short-term assets significantly exceed both its short- and long-term liabilities, providing financial stability. Recent strategic acquisitions like the Mustang Mineral Processing Site enhance operational capabilities, positioning it as a key regional processing hub for uranium and vanadium. Despite being unprofitable with volatile share prices, Western's seasoned management team continues to advance projects that could potentially strengthen the supply chain in North America while focusing on sustainable mineral processing initiatives.

- Click here to discover the nuances of Western Uranium & Vanadium with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Western Uranium & Vanadium's future.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., is engaged in the production of copper and molybdenum concentrates in Chile, with a market cap of CA$312.90 million.

Operations: The company generates revenue of $192.77 million from producing copper concentrates through a tolling agreement with DET.

Market Cap: CA$312.9M

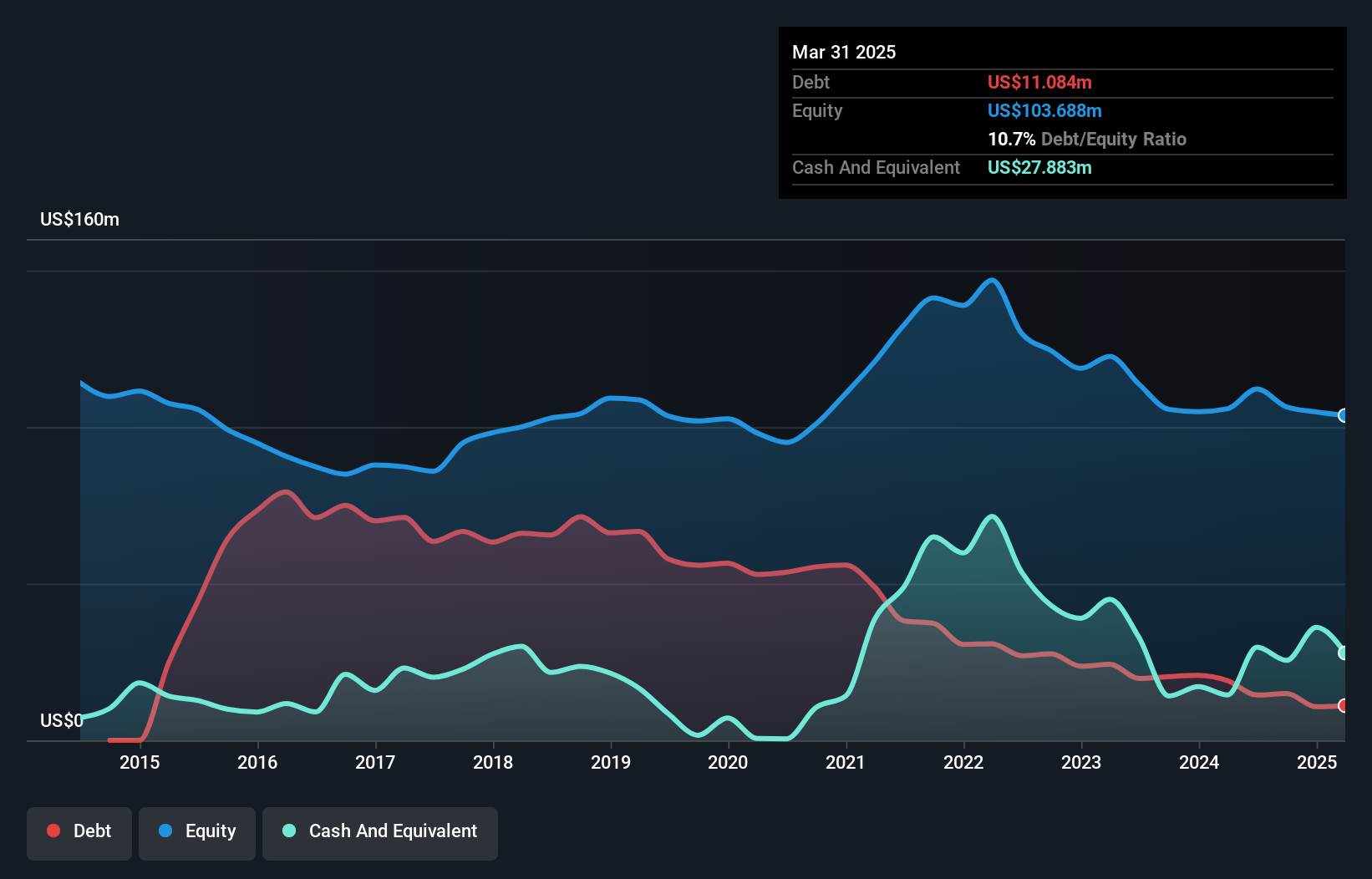

Amerigo Resources Ltd., with a market cap of CA$312.90 million, has shown significant financial improvement. The company reported a net income of US$19.24 million for 2024, up from US$3.38 million the previous year, driven by increased copper and molybdenum production in Chile. Amerigo's earnings growth of 468.9% over the past year is noteworthy compared to its industry peers. The company's debt is well-managed with cash exceeding total debt and interest payments well covered by EBIT (16.4x). Despite an unstable dividend track record, Amerigo continues shareholder returns through dividends and share buybacks while maintaining operational efficiency.

- Navigate through the intricacies of Amerigo Resources with our comprehensive balance sheet health report here.

- Assess Amerigo Resources' future earnings estimates with our detailed growth reports.

Talon Metals (TSX:TLO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Talon Metals Corp. is a mineral exploration company focused on exploring and developing mineral properties in the United States, with a market cap of CA$74.78 million.

Operations: Talon Metals Corp. does not report any revenue segments.

Market Cap: CA$74.78M

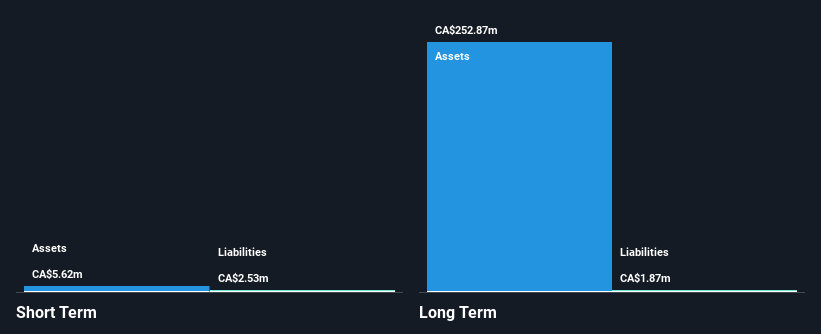

Talon Metals Corp., with a market cap of CA$74.78 million, remains pre-revenue, focusing on exploration activities in the U.S. Recent assays from its Boulderdash discovery in Michigan revealed promising nickel-copper mineralization, suggesting potential for significant resource development. The company is strategically advancing its Tamarack Nickel Copper Project and exploring innovative processing technologies at its North Dakota facility, supported by US$2.47 million in funding from the Defense Logistics Agency. Although Talon has reduced losses over five years by 14.7% annually and maintains more cash than debt, it faces challenges with a short cash runway and declining earnings forecasts.

- Dive into the specifics of Talon Metals here with our thorough balance sheet health report.

- Gain insights into Talon Metals' future direction by reviewing our growth report.

Summing It All Up

- Navigate through the entire inventory of 935 TSX Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., produces copper and molybdenum concentrates in Chile.

Excellent balance sheet and fair value.

Market Insights

Community Narratives