- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

The Bull Case For Triple Flag Precious Metals (TSX:TFPM) Could Change Following Record Q3 Revenue and Guidance Reaffirmation - Learn Why

Reviewed by Sasha Jovanovic

- Triple Flag Precious Metals Corp. recently announced record third-quarter 2025 revenue of US$93.5 million from sales of 27,037 gold equivalent ounces and reaffirmed its annual sales guidance, maintaining expectations of 105,000 to 115,000 ounces for the year.

- This performance highlights continued operational momentum and provides investors with clarity on future output, suggesting effective execution on management’s growth objectives despite sector challenges.

- We’ll explore how Triple Flag’s record quarterly revenue and confirmed guidance might strengthen its investment narrative and future revenue outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Triple Flag Precious Metals Investment Narrative Recap

For shareholders of Triple Flag Precious Metals, conviction rests on the belief that stable precious metals demand and well-executed royalty and streaming investments can offset anticipated production declines at core assets. The company’s record third-quarter revenue and reaffirmed annual guidance have limited material impact on the primary short-term catalyst, timely ramp-up of new revenue streams, and the biggest current risk, which is the drop-off in production at aging assets like Northparkes and Cerro Lindo. Among the latest announcements, the reaffirmation of full-year 2025 sales guidance stands out as most relevant. This confirmation, supported by the strong third-quarter results, suggests management’s confidence in offsetting asset declines with new project ramp-ups. However, ongoing operator-specific disruptions, such as recent payment issues with Steppe Gold, continue to represent an unpredictable risk to revenue consistency. Yet, even with firm near-term performance, there remains the concern that if key operators fail to deliver on promised output...

Read the full narrative on Triple Flag Precious Metals (it's free!)

Triple Flag Precious Metals' narrative projects $395.4 million revenue and $311.4 million earnings by 2028. This requires 6.8% yearly revenue growth and an earnings increase of $139.2 million from $172.2 million.

Uncover how Triple Flag Precious Metals' forecasts yield a CA$44.55 fair value, a 6% upside to its current price.

Exploring Other Perspectives

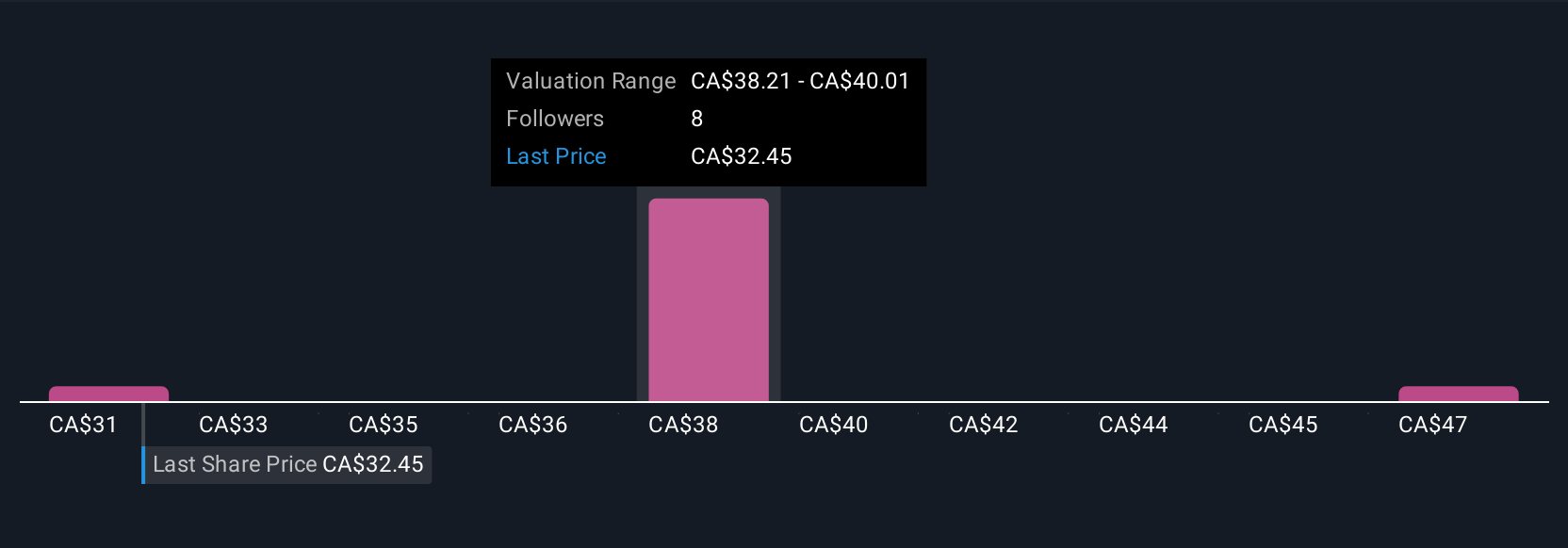

Three Simply Wall St Community members provided fair value estimates for Triple Flag ranging from US$31.00 to US$44.55 per share. Contrasting these views, new revenue streams expected in 2025 remain a focus for potential earnings support, but risks tied to declines at core assets remind you to review several perspectives before making investment decisions.

Explore 3 other fair value estimates on Triple Flag Precious Metals - why the stock might be worth as much as 6% more than the current price!

Build Your Own Triple Flag Precious Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Triple Flag Precious Metals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Triple Flag Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Triple Flag Precious Metals' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFPM

Triple Flag Precious Metals

A precious metals streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties, and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.