- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

Revenues Not Telling The Story For Triple Flag Precious Metals Corp. (TSE:TFPM)

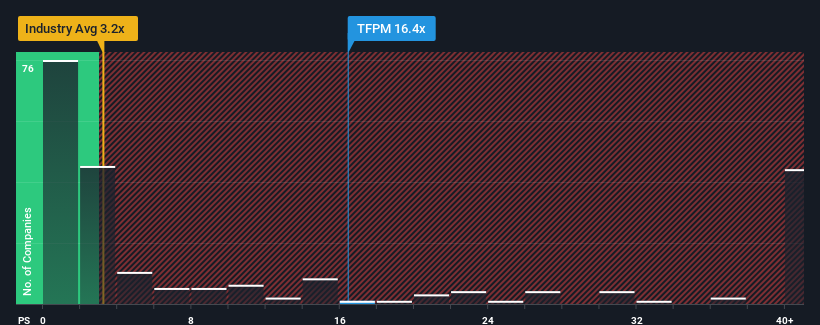

When you see that almost half of the companies in the Metals and Mining industry in Canada have price-to-sales ratios (or "P/S") below 3.4x, Triple Flag Precious Metals Corp. (TSE:TFPM) looks to be giving off strong sell signals with its 16.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in Triple Flag Precious Metals. Read for free now.See our latest analysis for Triple Flag Precious Metals

How Triple Flag Precious Metals Has Been Performing

With revenue growth that's superior to most other companies of late, Triple Flag Precious Metals has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Triple Flag Precious Metals will help you uncover what's on the horizon.How Is Triple Flag Precious Metals' Revenue Growth Trending?

In order to justify its P/S ratio, Triple Flag Precious Metals would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 79% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 8.0% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 51% per annum, which is noticeably more attractive.

With this information, we find it concerning that Triple Flag Precious Metals is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Triple Flag Precious Metals, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Triple Flag Precious Metals that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TFPM

Triple Flag Precious Metals

A precious metals streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties, and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026