- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

Did Record Q2 Revenue and Maintained Guidance Just Shift Triple Flag’s (TSX:TFPM) Investment Narrative?

Reviewed by Simply Wall St

- Triple Flag Precious Metals Corp. recently announced record second quarter 2025 revenue of US$94.1 million from 28,682 gold equivalent ounces sold and reaffirmed its 2025 annual sales guidance of 105,000 to 115,000 GEOs.

- Repeated achievement of record quarterly revenues while confirming full-year production targets highlights both strong operational performance and transparency for stakeholders.

- With record sales and guidance maintained, we’ll assess how this operational consistency impacts Triple Flag’s broader investment narrative.

Triple Flag Precious Metals Investment Narrative Recap

Owning Triple Flag Precious Metals means believing in the long-term value of royalty and streaming models in precious metals, underpinned by consistent gold and silver exposure and a portfolio designed for stable cash flow. The recent record revenue and maintained annual guidance suggest steady operational execution, but these results do not materially alter the main near-term catalyst, progress around key acquisitions, nor the biggest risk, which remains the eventual depletion of high-grade ore at flagship assets like Northparkes.

Among recent company announcements, plans to acquire Orogen Resources stand out, as this move could meaningfully expand Triple Flag’s royalty interests and future revenue stream. With integration and completion of this deal being pivotal, monitoring execution on acquisitions remains closely tied to near-term growth opportunities for shareholders.

However, despite operational consistency, investors should be aware that if ore grades or production at core assets unexpectedly change...

Read the full narrative on Triple Flag Precious Metals (it's free!)

Triple Flag Precious Metals' outlook forecasts $372.2 million in revenue and $301.4 million in earnings by 2028. Achieving this would require annual revenue growth of 8.2% and an increase in earnings of $296.4 million from the current $5.0 million.

Exploring Other Perspectives

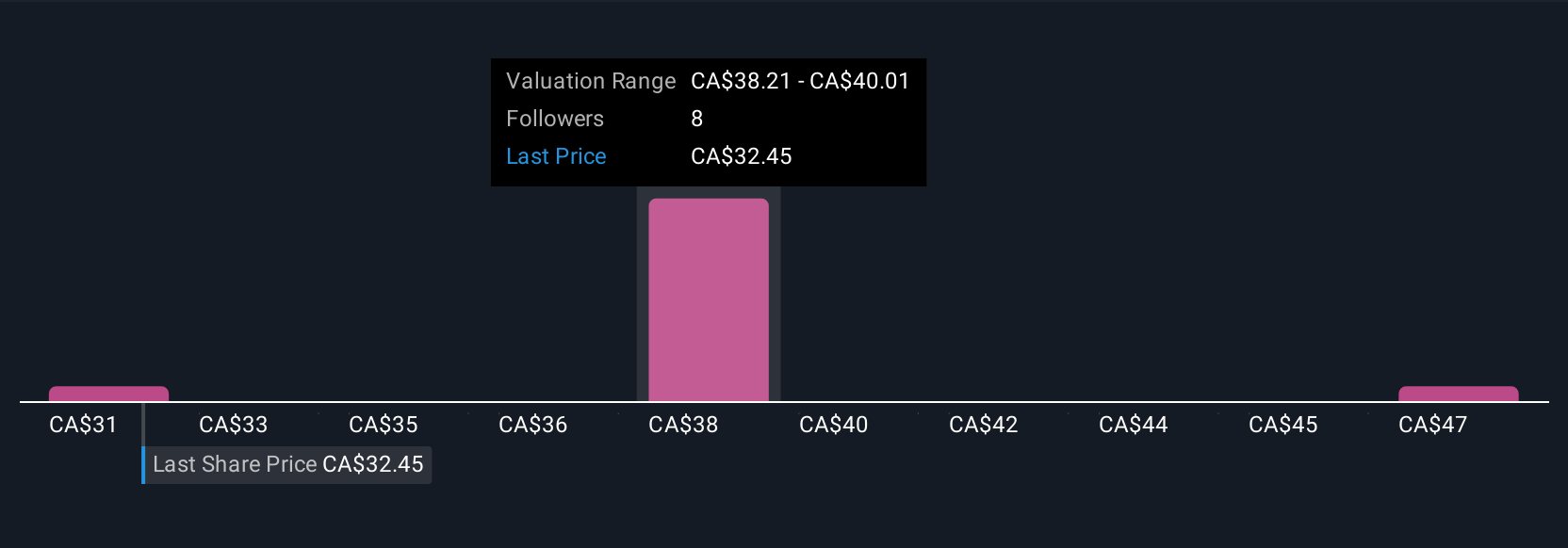

Three fair value estimates from the Simply Wall St Community range from CA$31.00 to CA$46.08 per share. While community opinions differ, the potential impact of acquisitions on future revenue makes it important to consider additional viewpoints before making any decisions.

Build Your Own Triple Flag Precious Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Triple Flag Precious Metals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Triple Flag Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Triple Flag Precious Metals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFPM

Triple Flag Precious Metals

A precious metals streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties, and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives