- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

A Look at Triple Flag Precious Metals (TSX:TFPM) Valuation Following Record Q3 Revenue and Reaffirmed Outlook

Reviewed by Kshitija Bhandaru

Triple Flag Precious Metals (TSX:TFPM) just announced record third-quarter revenue of USD 93.5 million, with strong gold equivalent ounce sales. The company also reaffirmed its annual guidance, which signals steady progress toward its 2025 sales targets.

See our latest analysis for Triple Flag Precious Metals.

Triple Flag’s record-setting quarterly results and reaffirmed guidance have caught the market’s attention. This has fueled a 101% year-to-date share price return and a 97% total shareholder return over the past year. With momentum clearly building and operational performance exceeding expectations, the latest moves are being seen as a sign of growing confidence among investors.

If you’re curious about other companies showing strong trajectories, it’s a smart moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares soaring after recent strong results, investors now face a crucial question: is Triple Flag still flying beneath the radar, or is the market already factoring in all of its growth potential?

Most Popular Narrative: 0.7% Undervalued

Triple Flag Precious Metals trades only slightly below what the widely followed narrative views as fair value, with a last close of CA$44.25 and a calculated fair value of CA$44.55. There is little gap between market price and the story that underpins this consensus, so it pays to examine what’s driving analyst conviction at this stage.

Ongoing robust global demand for gold and silver, alongside record-high commodity prices, has increased per-share operating cash flow by over 50% year-over-year, supporting margin sustainability and presenting upside to future earnings if macro tailwinds continue.

Is the valuation propped up by bullish growth forecasts or lean, durable profit margins? Just one crucial assumption holds the key to understanding why this price target is so stubbornly close to the market. Ready to uncover the narrative’s secret growth lever? Click to see which quantitative force is shaping this almost perfectly aligned fair value call.

Result: Fair Value of $44.55 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing production declines at key assets and potential operator disputes could quickly challenge Triple Flag’s upbeat growth narrative if these issues are not offset by new deals.

Find out about the key risks to this Triple Flag Precious Metals narrative.

Another View: Price Ratios Signal a Premium

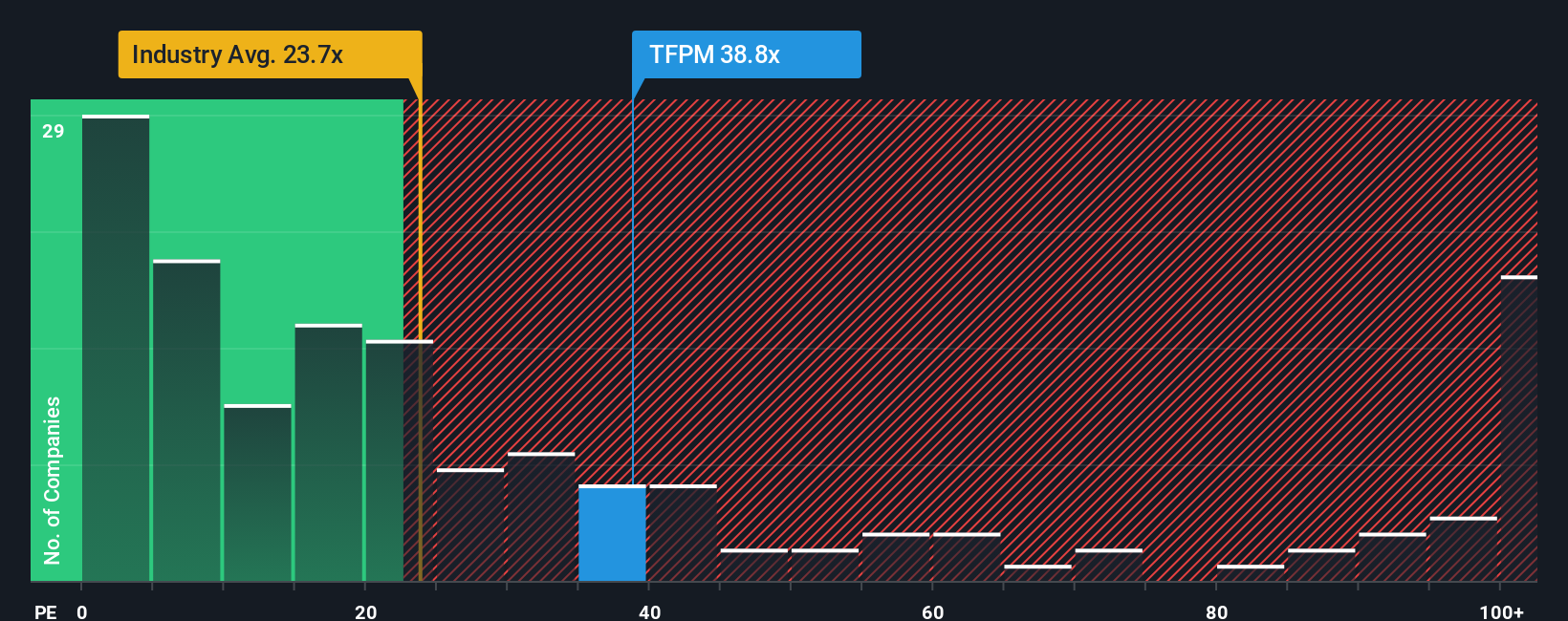

Looking beyond fair value models, Triple Flag trades at a price-to-earnings ratio of 37.8, which is much higher than both the Canadian Metals and Mining industry average of 24 and its peer average of 19.4. Its ratio is also well above the fair ratio of 18.6. This premium could mean investors are pricing in more growth, or simply that the bar for continued outperformance is getting higher. Could such a lofty multiple increase downside risk if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triple Flag Precious Metals Narrative

If you see a different angle in the numbers or want to reach your own conclusions, it takes just a few minutes to craft your personal narrative. Do it your way

A great starting point for your Triple Flag Precious Metals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let great ideas pass you by. Use the Simply Wall Street Screener to find innovative and high-potential stocks you might be overlooking right now.

- Unlock additional yield potential by checking out these 18 dividend stocks with yields > 3%, which have solid track records of paying dividends above 3%.

- Spot the next market disruptors by targeting these 24 AI penny stocks, companies operating at the frontier of artificial intelligence breakthroughs.

- Take advantage of undervaluation by reviewing these 877 undervalued stocks based on cash flows, which stand out for value based on cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFPM

Triple Flag Precious Metals

A precious metals streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties, and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.