- Canada

- /

- Metals and Mining

- /

- TSX:TECK.B

Teck Resources (TSX:TECK.B): Is the Market Fairly Pricing Its Copper-Focused Growth Story?

Reviewed by Simply Wall St

Teck Resources (TSX:TECK.B) has quietly drifted higher over the past 3 months, gaining close to 30%, even though daily moves look modest. That kind of steady climb usually reflects shifting expectations beneath the surface.

See our latest analysis for Teck Resources.

Over the past year Teck’s 90 day share price return of almost 30% stands in contrast to a slightly negative 1 year total shareholder return. This suggests momentum has only recently started to build as investors reassess its growth and risk profile around copper focused expansion plans and commodity price expectations.

If Teck’s recent move has you thinking about what else could be setting up for a rerating, it might be worth exploring fast growing stocks with high insider ownership as your next hunting ground.

With Teck trading just below analyst targets but at a steep discount to some intrinsic value estimates, the key question now is whether the market is overlooking copper driven upside or already baking future growth into the price.

Most Popular Narrative: 3.1% Undervalued

With Teck Resources last closing at CA$60.43 against a narrative fair value of about CA$62.39, the story leans toward modest upside built on copper heavy assumptions, not speculative hype.

The sanctioned Highland Valley Copper Mine Life Extension project and ongoing optimization/debottlenecking at QB are set to double Teck's copper production by decade's end, enabling the company to capitalize on the accelerating demand for copper from global electrification and energy transition, which should materially increase revenue and long-term earnings growth.

Want to see the math behind this copper bet? The narrative leans on ambitious volume gains, wider margins, and a surprisingly punchy future earnings multiple. Curious which assumptions really move that fair value line?

Result: Fair Value of $62.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent project delays, rising capital costs, and weaker copper prices could quickly compress margins and undermine the upbeat, copper-driven valuation story.

Find out about the key risks to this Teck Resources narrative.

Another Lens On Value

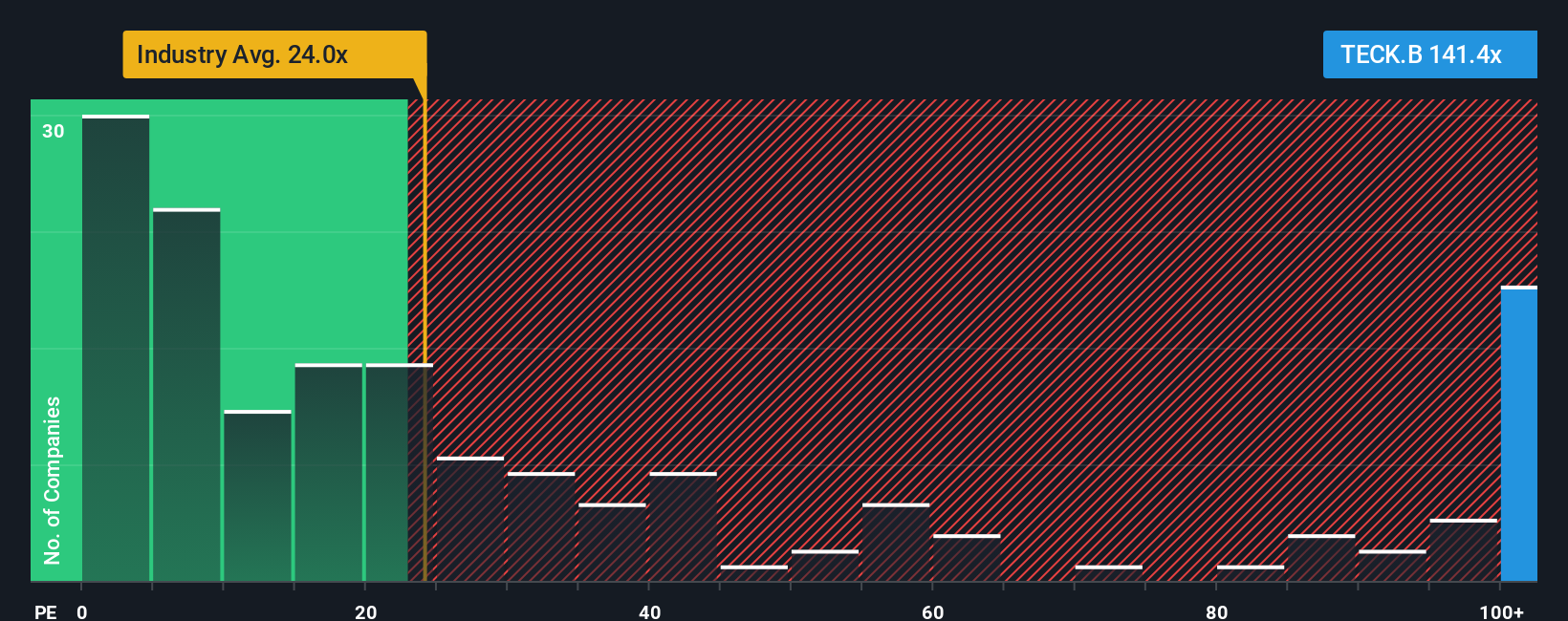

On simple earnings multiples, Teck looks far less forgiving. The stock trades on about 23.8 times earnings versus an industry average near 20.6 times and a fair ratio closer to 17.4. If sentiment cools, could that valuation gap close from the downside rather than the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teck Resources Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized narrative in a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Teck Resources.

Ready for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall St Screener to uncover fresh, data backed ideas before the crowd moves and potential gains diminish.

- Explore potential income opportunities by zeroing in on these 14 dividend stocks with yields > 3% that may strengthen your portfolio with cash returns.

- Look for structural growth trends by scanning these 30 healthcare AI stocks transforming how medicine, diagnostics, and patient care are delivered.

- Follow disruptive innovation by tracking these 81 cryptocurrency and blockchain stocks shaping the landscape of payments, digital assets, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teck Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TECK.B

Teck Resources

Engages in research, exploration, development, processing, smelting, refining, and reclamation of mineral properties in Asia, the Americas, and Europe.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026