- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Uncovering Evertz Technologies And 2 Other Hidden Canadian Gems With Strong Fundamentals

Reviewed by Simply Wall St

As the Canadian market navigates through a period of heightened volatility, influenced by global trade tensions and economic uncertainties, investors are keenly observing how these factors might impact small-cap stocks. Despite the challenges, there remain opportunities for discerning investors to uncover stocks with strong fundamentals that can weather market fluctuations. In this article, we explore three such Canadian gems, including Evertz Technologies, which stand out due to their solid financial health and potential resilience in today's dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Total Energy Services | 19.43% | 15.31% | 54.86% | ★★★★★★ |

| TWC Enterprises | 4.89% | 13.46% | 20.23% | ★★★★★★ |

| Genesis Land Development | 46.48% | 30.46% | 55.37% | ★★★★★☆ |

| Itafos | 28.17% | 11.62% | 53.49% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Pizza Pizza Royalty | 15.76% | 4.94% | 5.38% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Senvest Capital | 81.59% | -11.73% | -12.63% | ★★★★☆☆ |

| Dundee | 3.91% | -36.42% | 49.66% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$734.35 million.

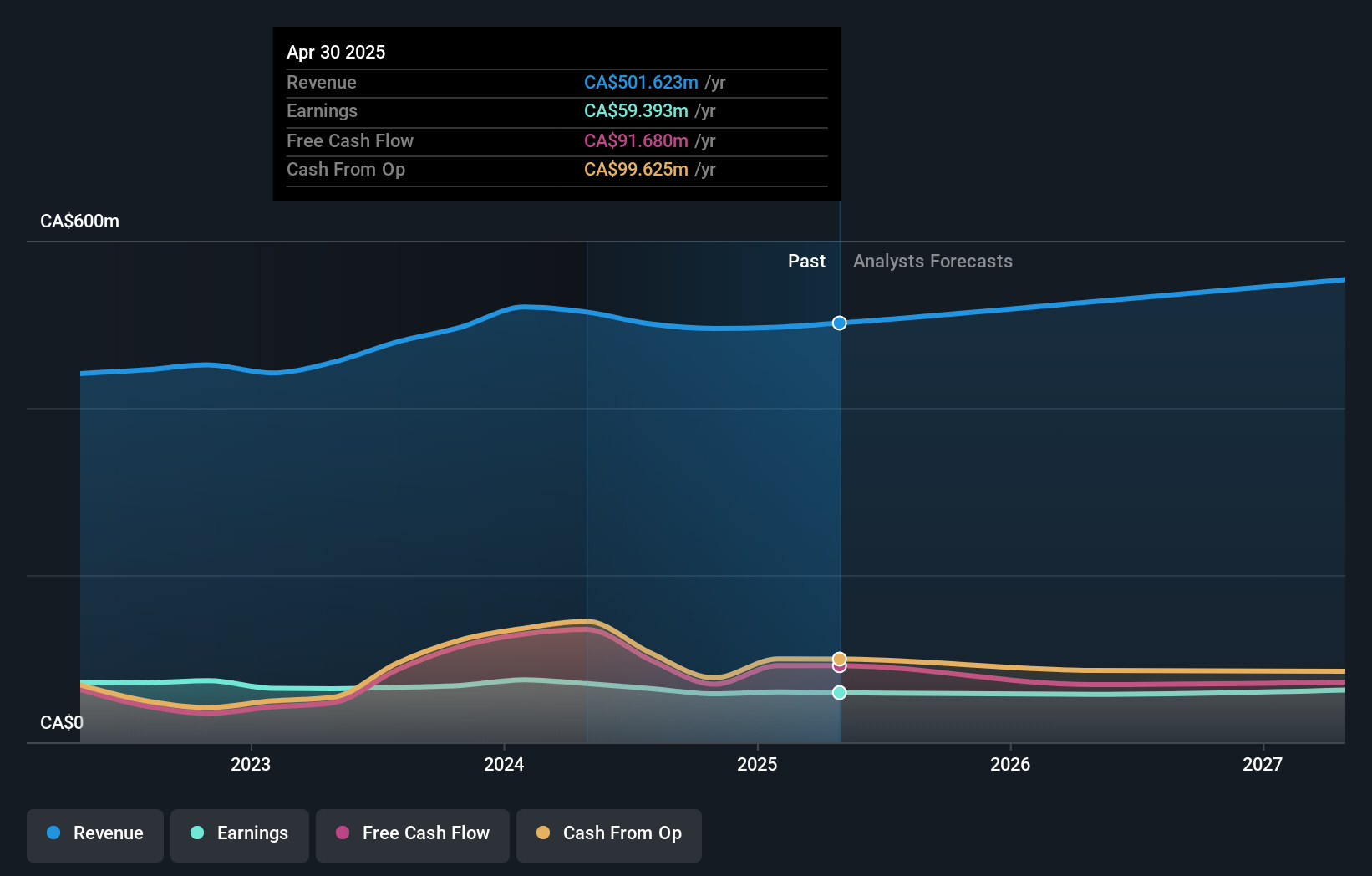

Operations: Revenue from the Television Broadcast Equipment Market stands at CA$496.59 million.

Evertz Technologies, a nimble player in the tech space, is capitalizing on the rising demand for IP and cloud solutions, which could drive its projected 5.1% annual revenue growth. Despite facing challenges like declining international revenue and increased R&D costs that may squeeze profit margins from 12.1% to 10.5%, Evertz's debt-free status offers financial flexibility. The company reported Q3 sales of CA$136.92 million with net income at CA$20.92 million, reflecting a slight improvement over last year’s figures. A robust order backlog exceeding $269 million suggests strong future demand, while analysts set a price target of CA$13.5 against the current share price of CA$9.67, indicating potential undervaluation in market perception.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer providing food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.38 billion.

Operations: North West generates revenue primarily from retailing food and everyday products and services, with total sales amounting to CA$2.54 billion.

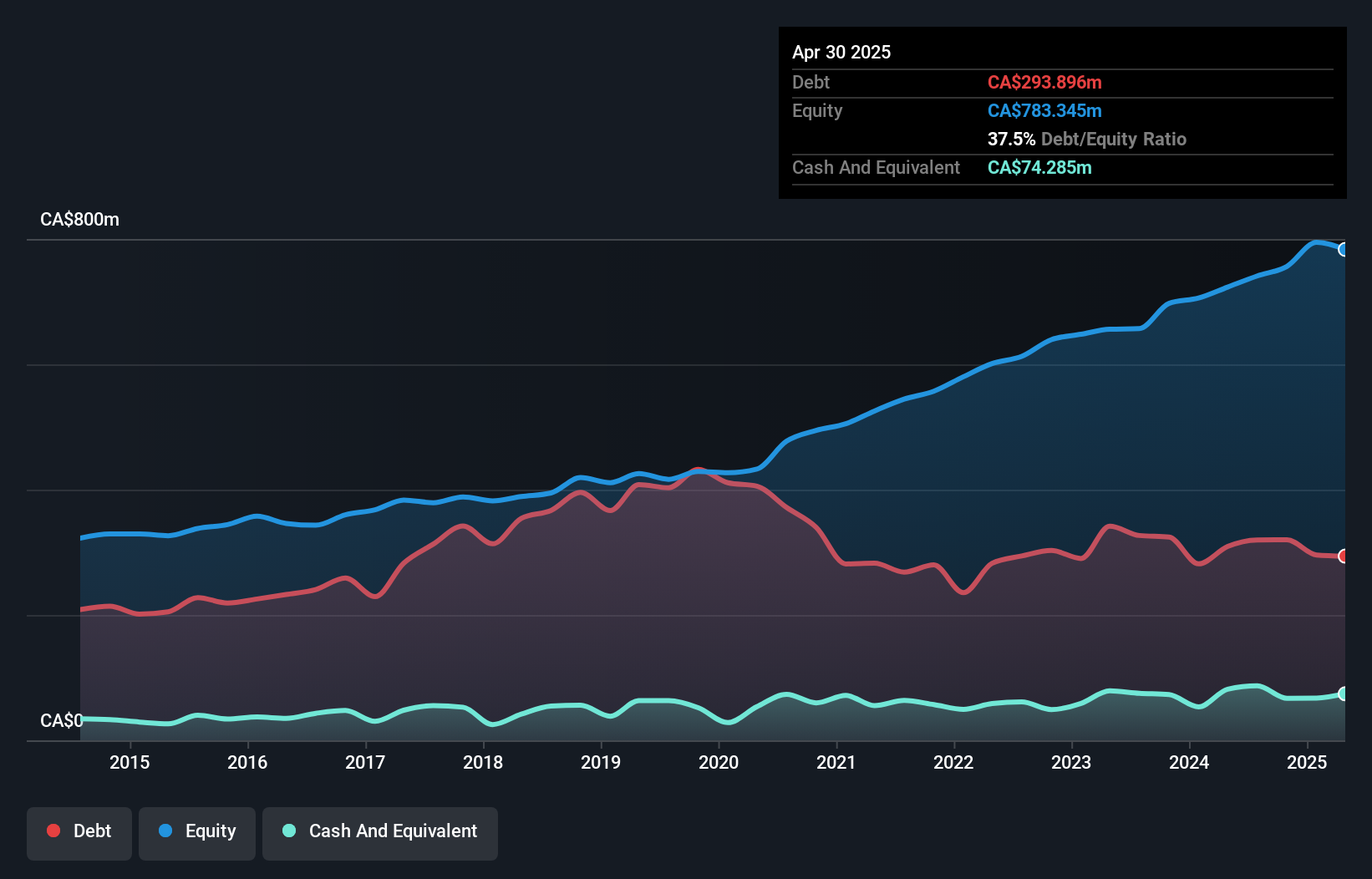

North West has shown resilience with earnings growing by 1.4% over the past year, outperforming the Consumer Retailing industry, which saw a -12.1%. The company’s net debt to equity ratio stands at a satisfactory 33.5%, reflecting prudent financial management as it reduced from 100.8% to 42.3% in five years. Recent earnings announcements revealed sales of C$2,576 million for the full year ending January 2025, up from C$2,472 million previously, and net income rose to C$137 million from C$129 million last year. Trading at a significant discount of 47% below estimated fair value suggests potential upside for investors seeking value in this space.

- Dive into the specifics of North West here with our thorough health report.

Examine North West's past performance report to understand how it has performed in the past.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Silvercorp Metals Inc. is involved in the acquisition, exploration, development, and mining of mineral properties with a market cap of CA$1 billion.

Operations: Silvercorp Metals generates revenue primarily through the sale of silver, lead, and zinc concentrates. The company's cost structure includes mining and milling costs, which are significant components impacting its financial performance. Notably, Silvercorp's gross profit margin has shown fluctuations over recent periods.

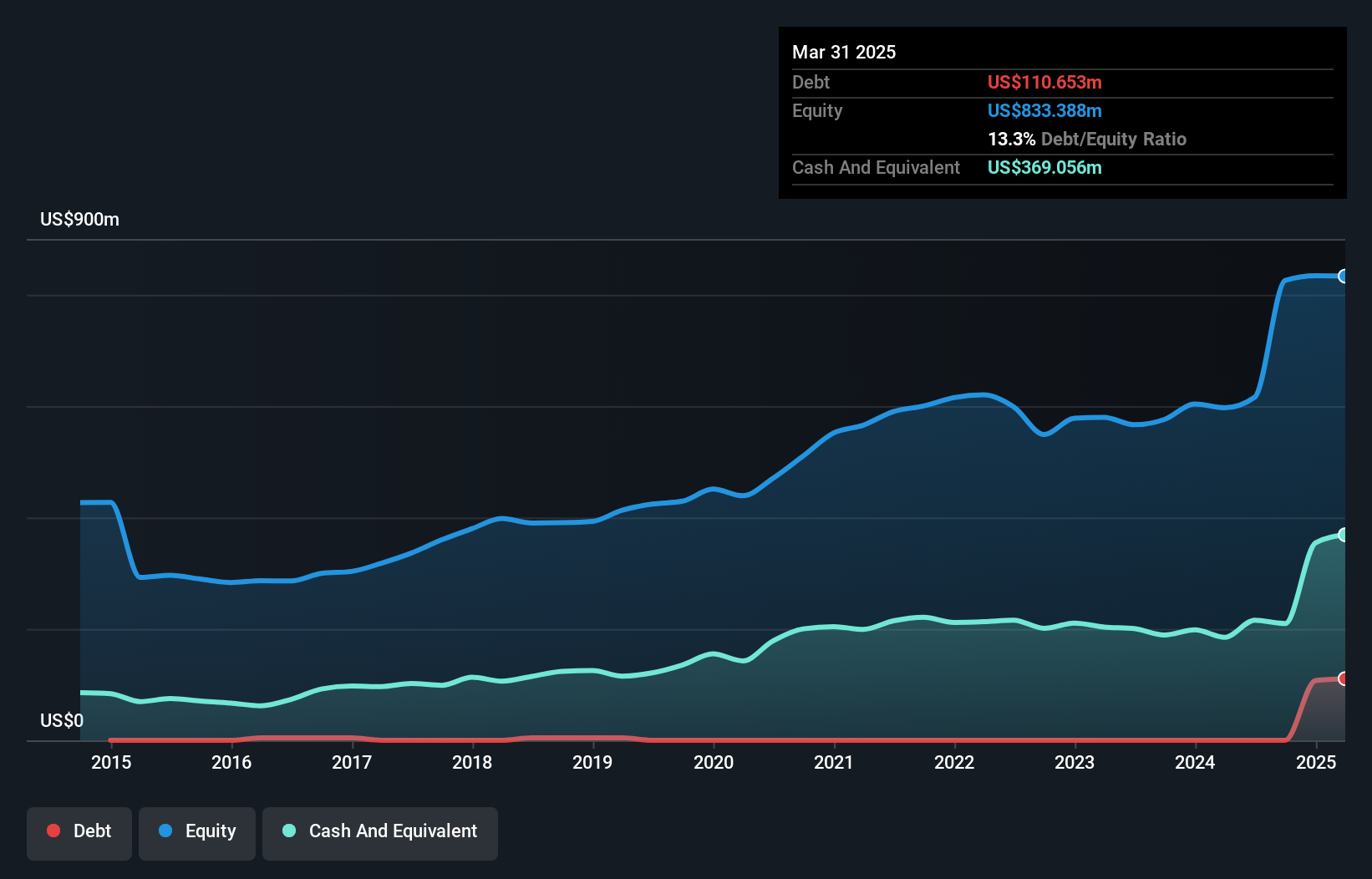

Silvercorp Metals is making strides with its flagship Ying Mine, where production capacity has expanded to 4,000 tonnes per day. This increase in operational scale comes alongside a new mill that enhances output potential. The company reported third-quarter sales of US$83.61 million, up from US$58.51 million the previous year, while net income rose to US$26.13 million from US$10.51 million, reflecting strong performance amid rising metals prices. However, challenges like increased production costs and geopolitical risks remain concerns for profitability despite a favorable price-to-earnings ratio of 11x compared to the Canadian market's average of 14.4x.

Next Steps

- Unlock more gems! Our TSX Undiscovered Gems With Strong Fundamentals screener has unearthed 31 more companies for you to explore.Click here to unveil our expertly curated list of 34 TSX Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives