- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Silvercorp Metals (TSX:SVM) Is Down 9.2% After Q2 Revenue and Production Jump Has The Bull Case Changed?

Reviewed by Simply Wall St

- Silvercorp Metals Inc. recently reported consolidated operating and financial results for the quarter ended June 30, 2025, highlighting ore processing volume of 358,224 tonnes and a 13% year-over-year revenue increase to US$81.3 million.

- Gold production more than doubled compared to the same period last year, marking a significant operational improvement alongside broader gains in silver and lead output.

- We'll now explore how these stronger production figures and revenue gains may influence Silvercorp's investment narrative and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Silvercorp Metals Investment Narrative Recap

To be a Silvercorp Metals shareholder, you need to believe in the company’s ability to execute cost control and capitalize on rising metals prices, especially silver and gold, amid a backdrop of planned production growth. The latest quarterly news shows a solid boost in both gold output and ore processed, underpinning the short-term catalyst of higher volume and revenue, but it does not materially reduce the risk of rising production costs and capital spending still looming over margin stability.

The recent announcement of consolidated revenue rising 13% to US$81.3 million is particularly relevant, as it directly reflects stronger production output translating into improved financials, an important progression for supporting growth projects and managing expenditure. Continued advances in production, supported by realized gains in core metals, feed into investor optimism about sustained top-line momentum.

However, investors should be aware that despite higher production, cost pressures and the risk of escalating capital expenditures remain...

Read the full narrative on Silvercorp Metals (it's free!)

Silvercorp Metals' outlook anticipates $534.0 million in revenue and $122.4 million in earnings by 2028. This scenario is based on a 26.1% annual revenue growth rate and a $51.1 million increase in earnings from $71.3 million currently.

Exploring Other Perspectives

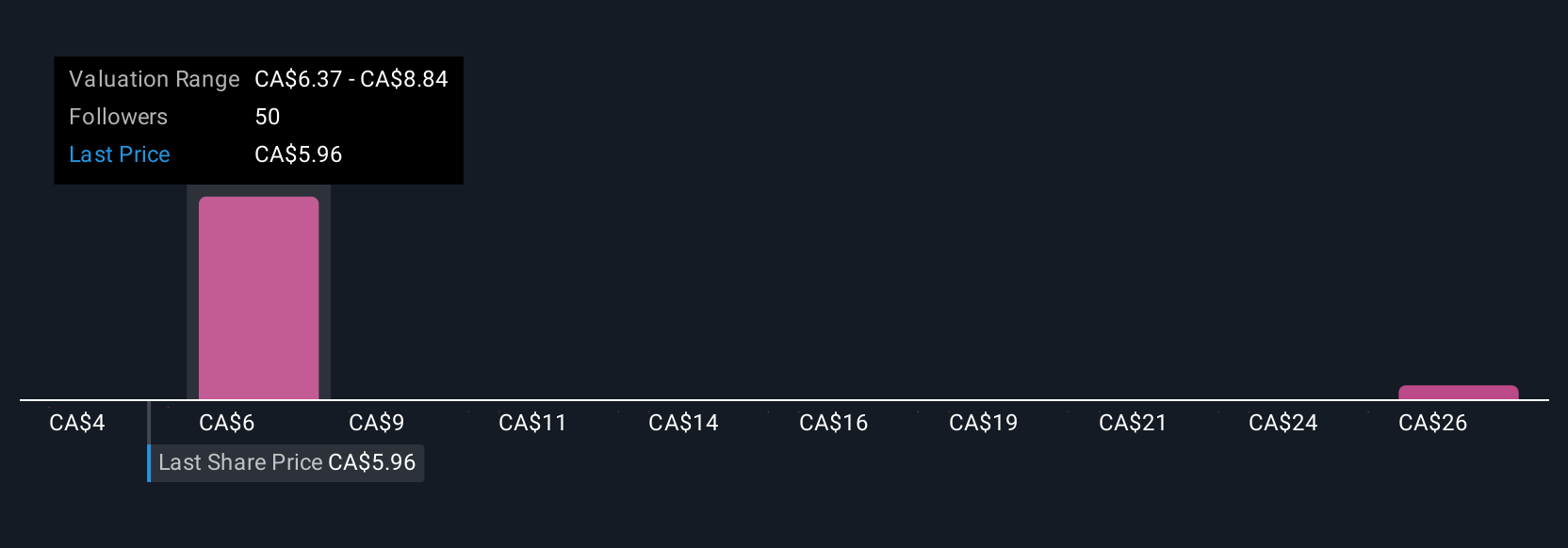

Six individual fair value estimates from the Simply Wall St Community for Silvercorp Metals range from US$0.30 to US$28.58 per share. While many see growth catalysts in production and revenue, some highlight the importance of closely monitoring margin risks as cost inflation and new project spending can impact overall returns.

Build Your Own Silvercorp Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silvercorp Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Silvercorp Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silvercorp Metals' overall financial health at a glance.

No Opportunity In Silvercorp Metals?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives