- Canada

- /

- Metals and Mining

- /

- TSXV:LI

December 2024's Top TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As the Canadian market experiences a supportive backdrop with easing inflation and robust household spending, investors are keenly observing opportunities across various sectors. Penny stocks, though often seen as a relic of past trading days, continue to offer intriguing prospects for growth due to their affordability and potential for significant returns. With strong financials and solid fundamentals, these smaller or newer companies can present hidden value in today's evolving economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$159.29M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$283.52M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.47 | CA$13.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$118.56M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.61 | CA$339.15M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.13 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$1B | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$5.18M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$183.36M | ★★★★★☆ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Jaguar Mining (TSX:JAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jaguar Mining Inc. is a junior gold mining company focused on the acquisition, exploration, development, and operation of gold mineral properties in Brazil with a market cap of CA$299.78 million.

Operations: The company generates revenue of $152.14 million from its activities related to gold producing properties.

Market Cap: CA$299.78M

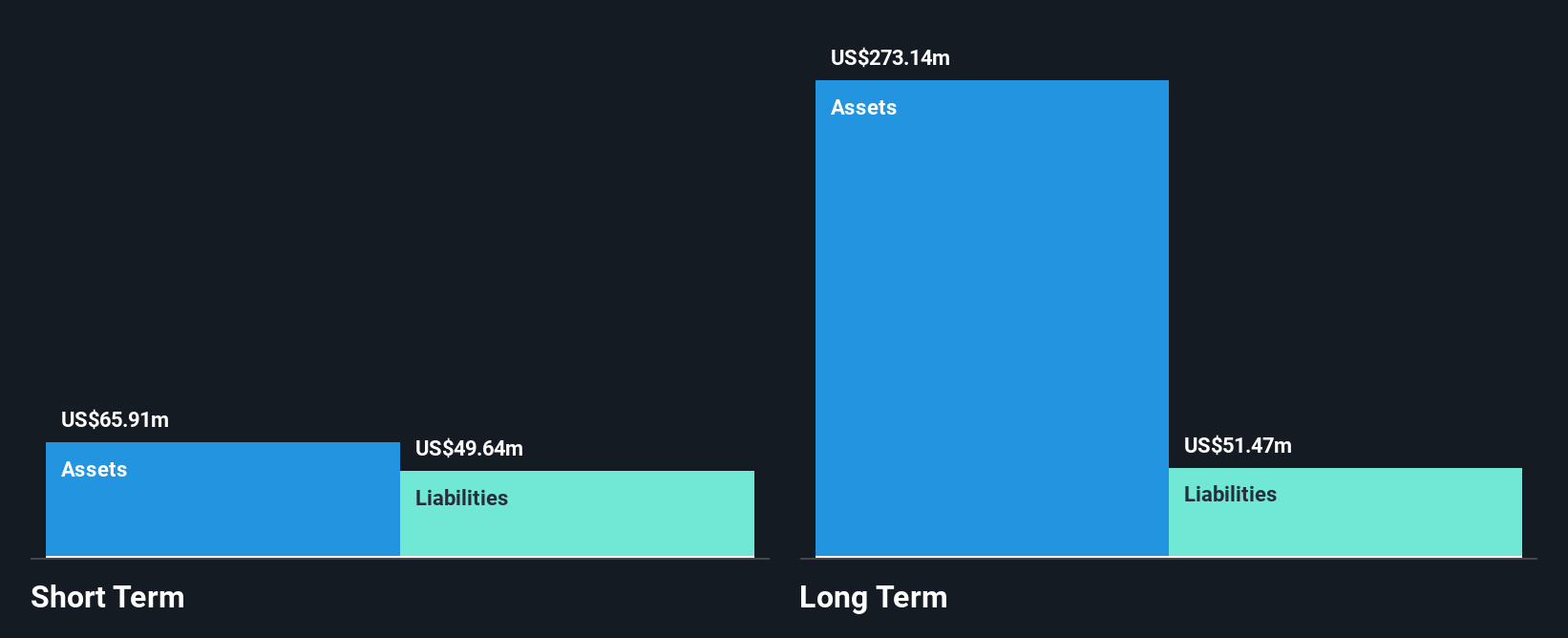

Jaguar Mining Inc. presents a compelling case within the penny stock segment due to its low Price-To-Earnings ratio of 7.3x, compared to the Canadian market average of 14.8x, suggesting potential undervaluation. The company has shown robust earnings growth of 75.7% over the past year, surpassing both its historical performance and industry averages, while maintaining high-quality earnings and improved profit margins at 19.3%. Its financial stability is underscored by short-term assets exceeding liabilities and a debt level well-covered by operating cash flow (1676.5%). Recent initiatives include a share repurchase program aimed at enhancing shareholder value amidst stable production levels and strategic focus on high-grade zones in Brazil's Pilar mine.

- Click here and access our complete financial health analysis report to understand the dynamics of Jaguar Mining.

- Examine Jaguar Mining's earnings growth report to understand how analysts expect it to perform.

RTG Mining (TSX:RTG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: RTG Mining Inc. is involved in the exploration and development of mineral properties, with a market cap of CA$39.50 million.

Operations: No revenue segments have been reported.

Market Cap: CA$39.5M

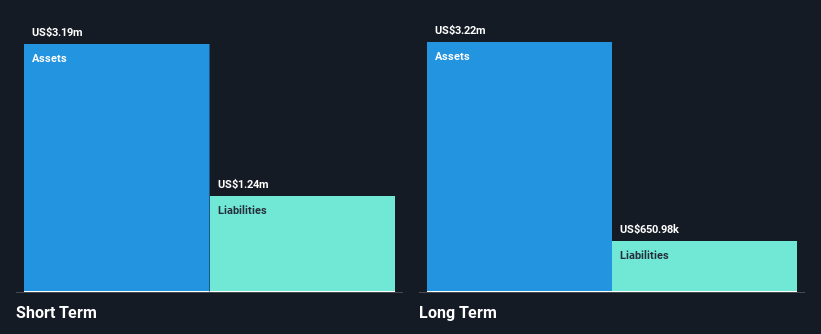

RTG Mining Inc. is a pre-revenue company with a market cap of CA$39.50 million, focusing on mineral exploration and development. Despite being unprofitable, it has reduced losses by 25% annually over the past five years. The company is debt-free and maintains financial stability, with short-term assets of $3.2M exceeding both its short-term liabilities ($1.2M) and long-term liabilities ($651K). However, RTG faces challenges with less than one year of cash runway based on current free cash flow levels. Its seasoned management team and board offer experienced leadership as they navigate these financial constraints.

- Unlock comprehensive insights into our analysis of RTG Mining stock in this financial health report.

- Gain insights into RTG Mining's historical outcomes by reviewing our past performance report.

American Lithium (TSXV:LI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, and developing mineral properties in North and South America, with a market cap of CA$209.07 million.

Operations: Currently, there are no reported revenue segments for this exploration and development stage company.

Market Cap: CA$209.07M

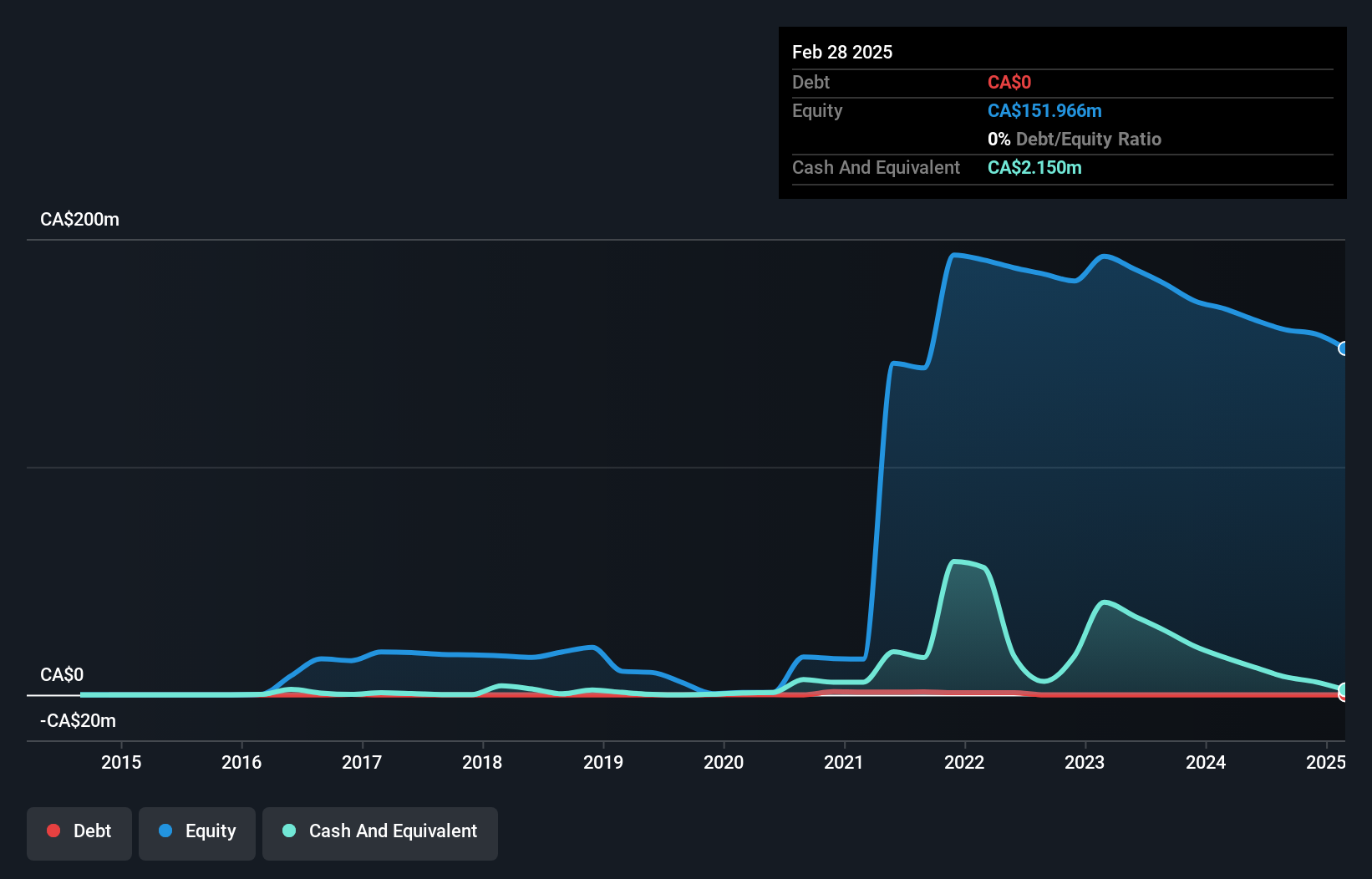

American Lithium Corp., with a market cap of CA$209.07 million, is a pre-revenue exploration and development stage company. Despite being debt-free, it faces financial constraints with less than a year of cash runway if current free cash flow trends persist. The company's short-term assets (CA$9.6M) cover its liabilities, yet it remains unprofitable with increasing losses over the past five years. Recent developments include significant progress in lithium and uranium projects across North and South America, aiming to enhance resource estimates and advance regulatory approvals, while potential spin-out opportunities for its Macusani Uranium Project are being explored to bolster financial stability.

- Click to explore a detailed breakdown of our findings in American Lithium's financial health report.

- Learn about American Lithium's future growth trajectory here.

Next Steps

- Gain an insight into the universe of 915 TSX Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LI

American Lithium

An exploration and development stage company, engages in the acquisition, exploration, and development of mineral properties in North and South America.

Moderate with adequate balance sheet.

Market Insights

Community Narratives