- Canada

- /

- Metals and Mining

- /

- TSX:QRC

We Think Queen's Road Capital Investment (TSE:QRC) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Queen's Road Capital Investment Ltd. (TSE:QRC) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Queen's Road Capital Investment

How Much Debt Does Queen's Road Capital Investment Carry?

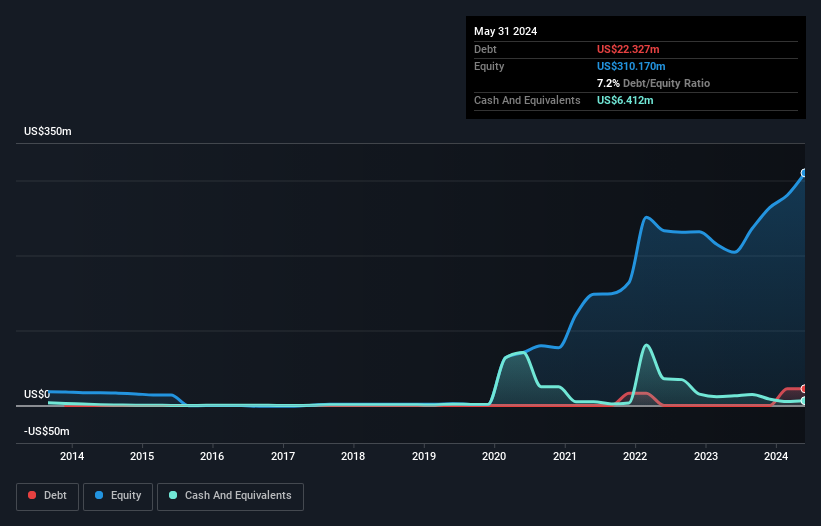

You can click the graphic below for the historical numbers, but it shows that as of May 2024 Queen's Road Capital Investment had US$22.3m of debt, an increase on none, over one year. On the flip side, it has US$6.41m in cash leading to net debt of about US$15.9m.

How Strong Is Queen's Road Capital Investment's Balance Sheet?

We can see from the most recent balance sheet that Queen's Road Capital Investment had liabilities of US$23.7m falling due within a year, and liabilities of US$18.3k due beyond that. On the other hand, it had cash of US$6.41m and US$3.77m worth of receivables due within a year. So it has liabilities totalling US$13.5m more than its cash and near-term receivables, combined.

Since publicly traded Queen's Road Capital Investment shares are worth a total of US$233.4m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Queen's Road Capital Investment has a low net debt to EBITDA ratio of only 0.14. And its EBIT covers its interest expense a whopping 94.2 times over. So we're pretty relaxed about its super-conservative use of debt. It was also good to see that despite losing money on the EBIT line last year, Queen's Road Capital Investment turned things around in the last 12 months, delivering and EBIT of US$111m. When analysing debt levels, the balance sheet is the obvious place to start. But it is Queen's Road Capital Investment's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Queen's Road Capital Investment reported free cash flow worth 5.2% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Queen's Road Capital Investment's interest cover was a real positive on this analysis, as was its net debt to EBITDA. But truth be told its conversion of EBIT to free cash flow had us nibbling our nails. Considering this range of data points, we think Queen's Road Capital Investment is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Queen's Road Capital Investment (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Queen's Road Capital Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QRC

Queen's Road Capital Investment

A resource focused investment company, invests in privately held and publicly traded resource companies.

Adequate balance sheet and fair value.