- Canada

- /

- Metals and Mining

- /

- TSX:ORE

Could Orezone Gold’s (TSX:ORE) New Hard Rock Plant Redefine Its Long-Term Cost Advantage?

Reviewed by Sasha Jovanovic

- Orezone Gold has reported past shallow, high-grade drill results from the P17 Zone at its Bomboré mine and progressed commissioning of its new hard rock plant, with first gold production from this plant now moving closer.

- The confirmation of near-surface, high-grade ore at P17 ahead of hard rock processing provides potentially higher-margin mill feed that could materially influence Bomboré’s long-term production mix and cost profile.

- We’ll now examine how the new hard rock plant commissioning and upcoming P17 ore feed might reshape Orezone Gold’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Orezone Gold Investment Narrative Recap

To own Orezone Gold, you need to believe Bomboré can keep growing production and cash flow while managing single-asset and Burkina Faso risk. The key near term catalyst is a smooth ramp up of the new hard rock plant, and the latest shallow, high grade P17 results appear to support that outcome rather than change it. The biggest current risk remains execution and cost control as Orezone scales hard rock capacity in a challenging operating jurisdiction.

Among recent announcements, the update that Bomboré’s stage 1 hard rock plant is being commissioned, with P17 expected to be a primary mill feed source in 2026, ties most directly to this news. The combination of plant start up and shallow, high grade P17 ore is central to the production growth story, but it also concentrates ramp up, power reliability, and cost inflation risk into the same period when expectations are highest.

Yet behind this production growth story, there is still the question of Bomboré’s single asset exposure that investors should be aware of...

Read the full narrative on Orezone Gold (it's free!)

Orezone Gold's narrative projects $949.4 million revenue and $421.3 million earnings by 2028. This requires 41.1% yearly revenue growth and about a $354.3 million earnings increase from $67.0 million today.

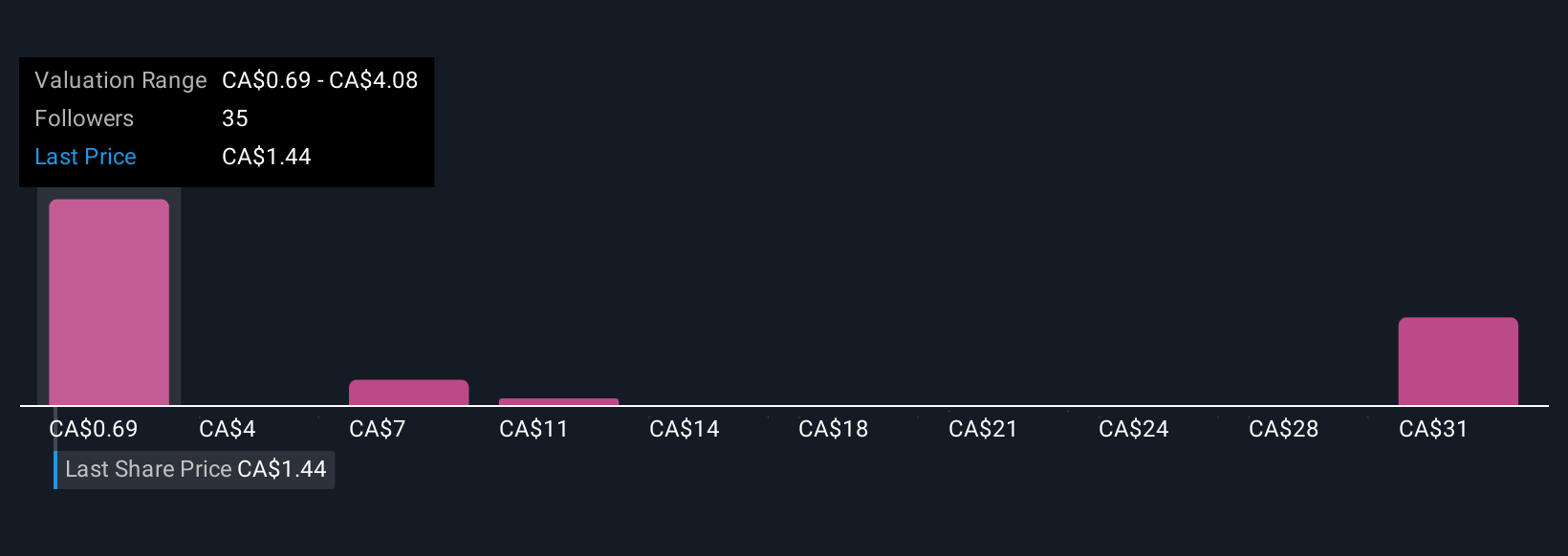

Uncover how Orezone Gold's forecasts yield a CA$2.42 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates for Orezone span from CA$0.73 to CA$103.66, underlining how differently individual investors view the same business. Set this wide range against the looming hard rock ramp up risk and you can see why it pays to weigh several perspectives before forming your own view.

Explore 9 other fair value estimates on Orezone Gold - why the stock might be a potential multi-bagger!

Build Your Own Orezone Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orezone Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Orezone Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Orezone Gold's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ORE

Orezone Gold

Engages in the mining, exploration, and development of gold properties.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026