- Canada

- /

- Metals and Mining

- /

- TSX:OGC

OceanaGold (TSX:OGC) Expands Nevada Footprint With New Headwater Gold Exploration Partnerships

Reviewed by Sasha Jovanovic

- Earlier this week, Headwater Gold announced a definitive agreement granting OceanaGold an option to earn up to a 75% interest in the TJ, Jake Creek, and Hot Creek projects in Nevada by committing up to US$65 million in staged exploration and completing pre-feasibility studies.

- This series of partnership agreements significantly expands OceanaGold's US exploration activities and signals a broader commitment to collaborative project advancement in key mining jurisdictions.

- We'll explore how these new exploration partnerships may influence OceanaGold's growth outlook and its evolving investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

OceanaGold Investment Narrative Recap

To invest in OceanaGold, you need to believe in the company’s ability to overcome operational challenges, like ore hardness and weather disruptions, while steadily expanding its resource base and gold output. The recent Nevada earn-in option with Headwater Gold points to a growing exploration footprint in the US, but this doesn’t materially shift the most immediate catalyst, which remains the ongoing ramp-up and productivity improvements at the Haile mine. Short-term risks, such as higher unit costs or unplanned delays at key sites, are still front-of-mind for investors.

One recent announcement especially relevant here is the September earn-in agreement for the Brewer Gold-Copper Project in South Carolina, which, like the Nevada projects, helps expand OceanaGold’s future production pipeline. These moves reinforce the production growth thesis that has fueled recent optimism, yet investors tracking progress at Haile will likely see these expansion efforts as supportive rather than principal drivers in the near term.

But while optimism is warranted, investors should be aware that adverse weather events at Didipio and subsequent operational disruptions could still...

Read the full narrative on OceanaGold (it's free!)

OceanaGold's outlook anticipates $2.2 billion in revenue and $764.2 million in earnings by 2028. Achieving this would require 12.7% annual revenue growth and a $388.4 million increase in earnings from the current $375.8 million.

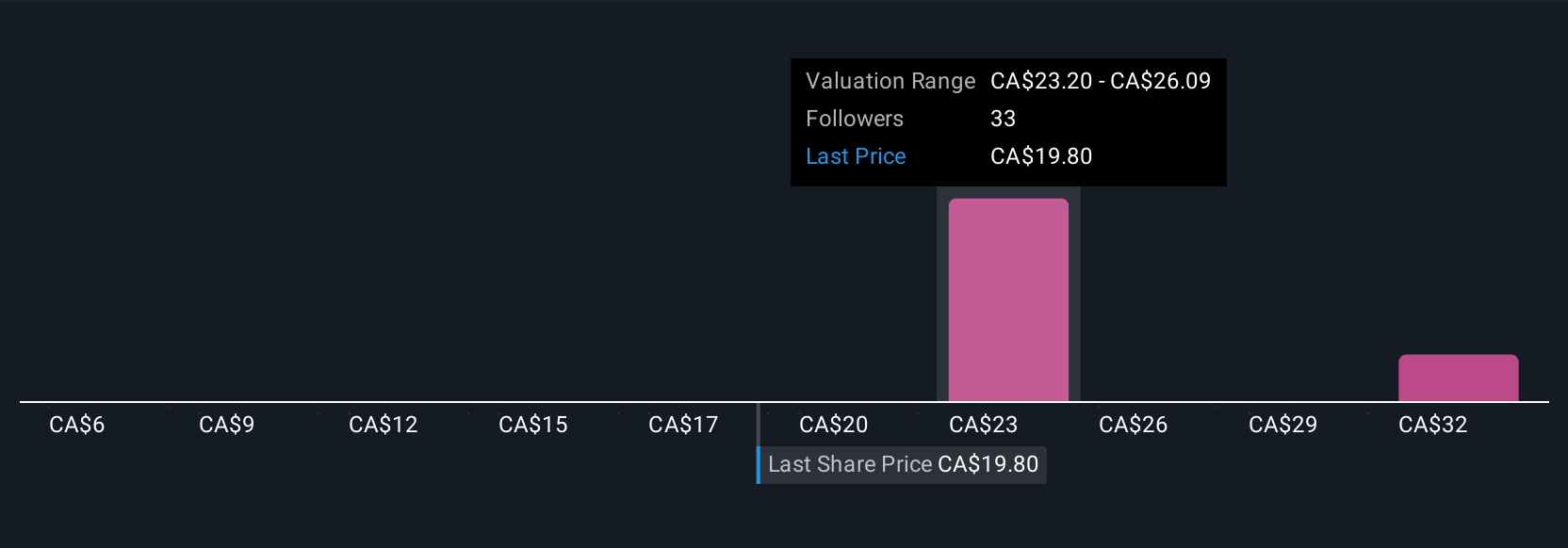

Uncover how OceanaGold's forecasts yield a CA$30.85 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Seven unique fair value estimates from the Simply Wall St Community span US$5.87 to US$53.99 per share. While production growth remains a strong catalyst, your outlook may shift depending on how you view the company’s ability to execute these expansion projects.

Explore 7 other fair value estimates on OceanaGold - why the stock might be worth as much as 52% more than the current price!

Build Your Own OceanaGold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanaGold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free OceanaGold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanaGold's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OGC

OceanaGold

A gold and copper producer, engages in exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives