- Canada

- /

- Metals and Mining

- /

- TSX:OGC

OceanaGold Corporation (TSE:OGC) Held Back By Insufficient Growth Even After Shares Climb 26%

Despite an already strong run, OceanaGold Corporation (TSE:OGC) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 119% following the latest surge, making investors sit up and take notice.

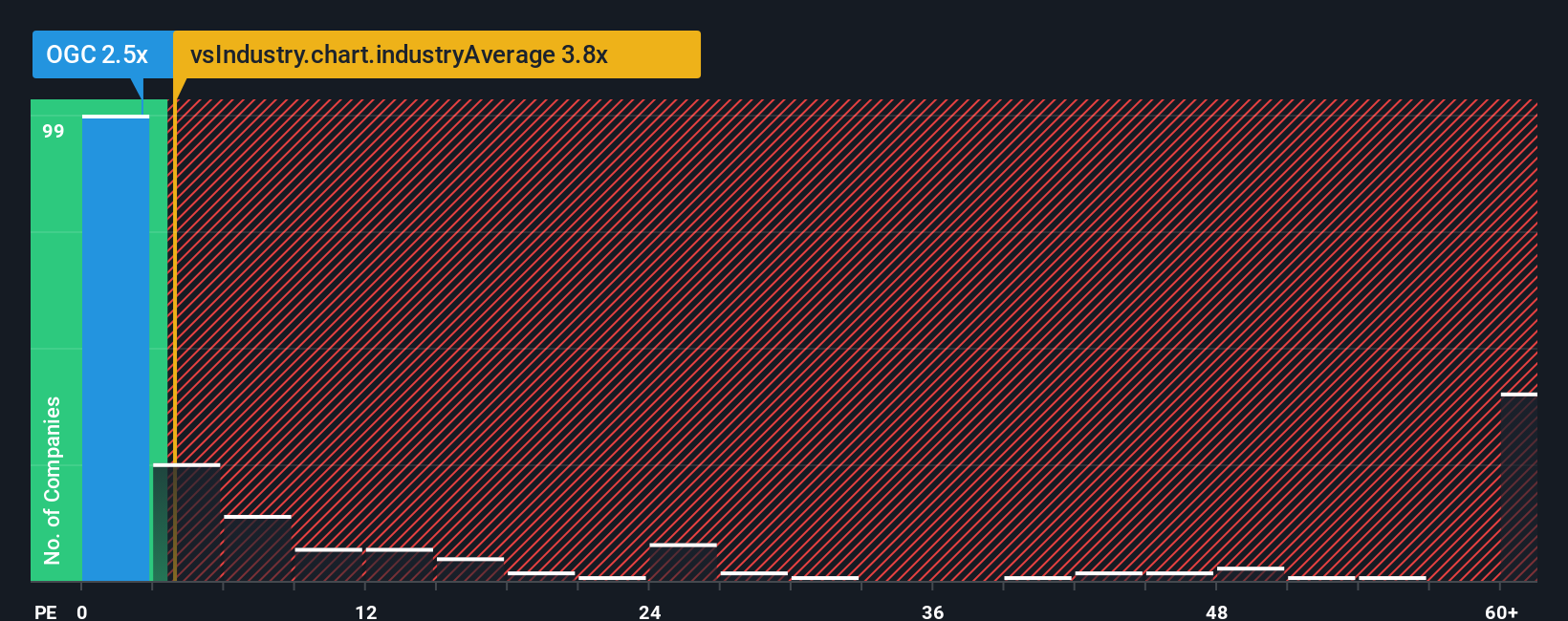

In spite of the firm bounce in price, OceanaGold may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.5x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 3.8x and even P/S higher than 27x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for OceanaGold

What Does OceanaGold's Recent Performance Look Like?

OceanaGold certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on OceanaGold will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For OceanaGold?

There's an inherent assumption that a company should underperform the industry for P/S ratios like OceanaGold's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 56% last year. The strong recent performance means it was also able to grow revenue by 69% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the five analysts following the company. That's shaping up to be materially lower than the 42% growth forecast for the broader industry.

In light of this, it's understandable that OceanaGold's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From OceanaGold's P/S?

OceanaGold's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of OceanaGold's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for OceanaGold with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on OceanaGold, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:OGC

OceanaGold

A gold and copper producer, engages in exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026