- Canada

- /

- Metals and Mining

- /

- TSX:NGD

New Gold (TSX:NGD) Profit Margin Jumps to 20.1%, Significantly Outpacing Sector Narratives

Reviewed by Simply Wall St

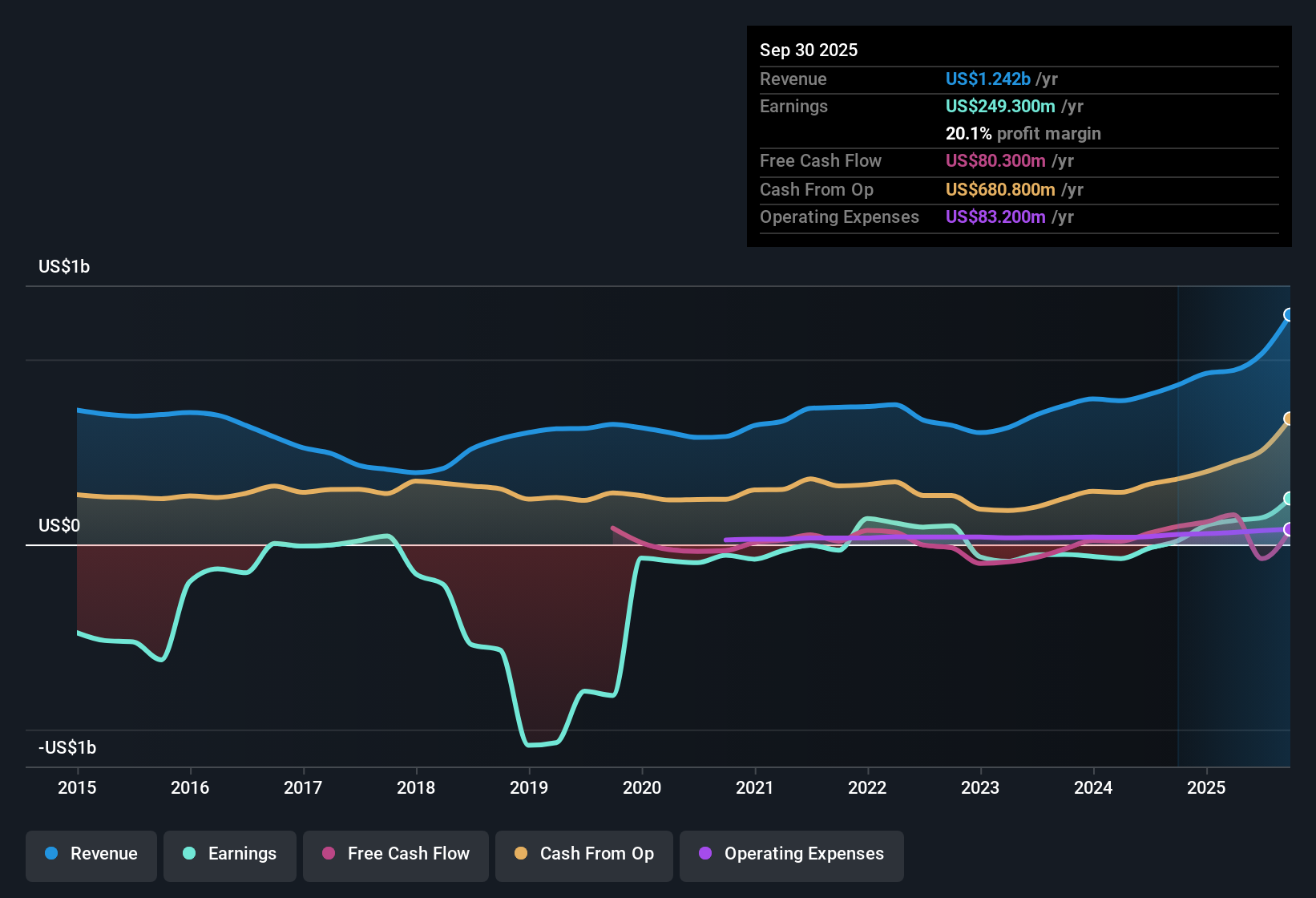

New Gold (TSX:NGD) surged to a net profit margin of 20.1% this year, up from 2.3% a year ago. The company has now achieved profitability over the past five years, with earnings rising by an average of 32.2% per year. Earnings growth over the last year was a remarkable 1,140.3%, significantly exceeding the company’s long-term trend. Forecasts indicate continued annual growth of 32.68% for earnings and 17.1% for revenue, both outpacing the broader Canadian market. These results demonstrate expanding profitability alongside strong growth prospects, positioning New Gold as a standout among sector peers.

See our full analysis for New Gold.Now, we will examine how these results align with the latest narratives and community expectations to determine which stories the numbers support and where surprises may arise.

See what the community is saying about New Gold

Production Ramp Drives Margin Upside

- Production efficiency gains and higher copper and gold output at Rainy River and New Afton are expected to increase profit margins from 14.0% today to a projected 45.1% in three years.

- Consensus narrative highlights that this operational shift provides leverage for sustained long-term growth,

- with new investments in resource expansion and mine development, especially at key zones like the C-Zone, supporting future reserve replacement,

- and revenue diversification enhanced by increased copper exposure, which benefits from global electrification trends.

Cost Controls and Capital Flexibility

- Recent cost reduction initiatives have resulted in declining all-in sustaining costs, while free cash flow has reached record levels and positioned New Gold with increased financial flexibility.

- Analysts' consensus view notes that stronger free cash flow and disciplined capital allocation support the case for potential shareholder returns,

- as reduced interest expenses and deeper cash reserves open the way for additional capital investments or potential debt reduction,

- but cautions remain around high capital demands for ongoing development and the need to manage credit facilities and gold prepayment obligations.

Consensus expectations for profit margin improvement and resource expansion continue to shape the view that New Gold is entering a new phase of durable growth, but investors should keep an eye on operational execution at both Rainy River and New Afton. 📈 Read the full New Gold Consensus Narrative.

Valuation Sits Between Fair Value and Analyst Target

- At a current share price of $9.81, New Gold trades slightly below the analyst price target of $12.34 and well under the DCF fair value of $28.96.

- Analysts' consensus view notes that the modest gap to the target price implies the market has already priced in much of the strong earnings trajectory,

- yet upside remains if forecasted revenue reaches $2.5 billion and earnings hit $1.1 billion by 2028,

- while ongoing profit margins and capital management must sustain this value for upside to be realized.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for New Gold on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh angle on the figures? Share your insights and create your own narrative about New Gold in under three minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding New Gold.

See What Else Is Out There

While New Gold’s outlook shines, ongoing high capital demands and debt obligations mean its financial flexibility may face challenges during tougher market conditions.

If you want companies with stronger fundamentals and less reliance on borrowing, our solid balance sheet and fundamentals stocks screener (1981 results) can help you spot investment ideas built for resilience and lower financial risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives