- Canada

- /

- Metals and Mining

- /

- TSX:NGD

Is New Gold’s 185% Rally Backed by Strong Value After Latest Rainy River Updates?

Reviewed by Bailey Pemberton

- If you have ever wondered whether New Gold might be a hidden value play or just caught up in hype, you are in the right place.

- New Gold’s stock has jumped by 185.2% in the last year and is up a staggering 170.1% year-to-date, with more modest gains of 4.7% and 1.8% over the last 7 and 30 days respectively.

- Recently, upbeat sentiment around gold prices combined with operational updates on the Rainy River project and positive assessments on production have made headlines for New Gold, fueling its remarkable run. Media coverage is also highlighting increased interest from institutional investors as gold remains a hot commodity amid global market uncertainty.

- When we break down New Gold’s fundamentals, it scores a 4 out of 6 on our value checks, showing it is undervalued by several common measures. We will dive into exactly how that conclusion is reached using standard tools, and later, we will share a unique perspective that goes beyond just the numbers.

Approach 1: New Gold Discounted Cash Flow (DCF) Analysis

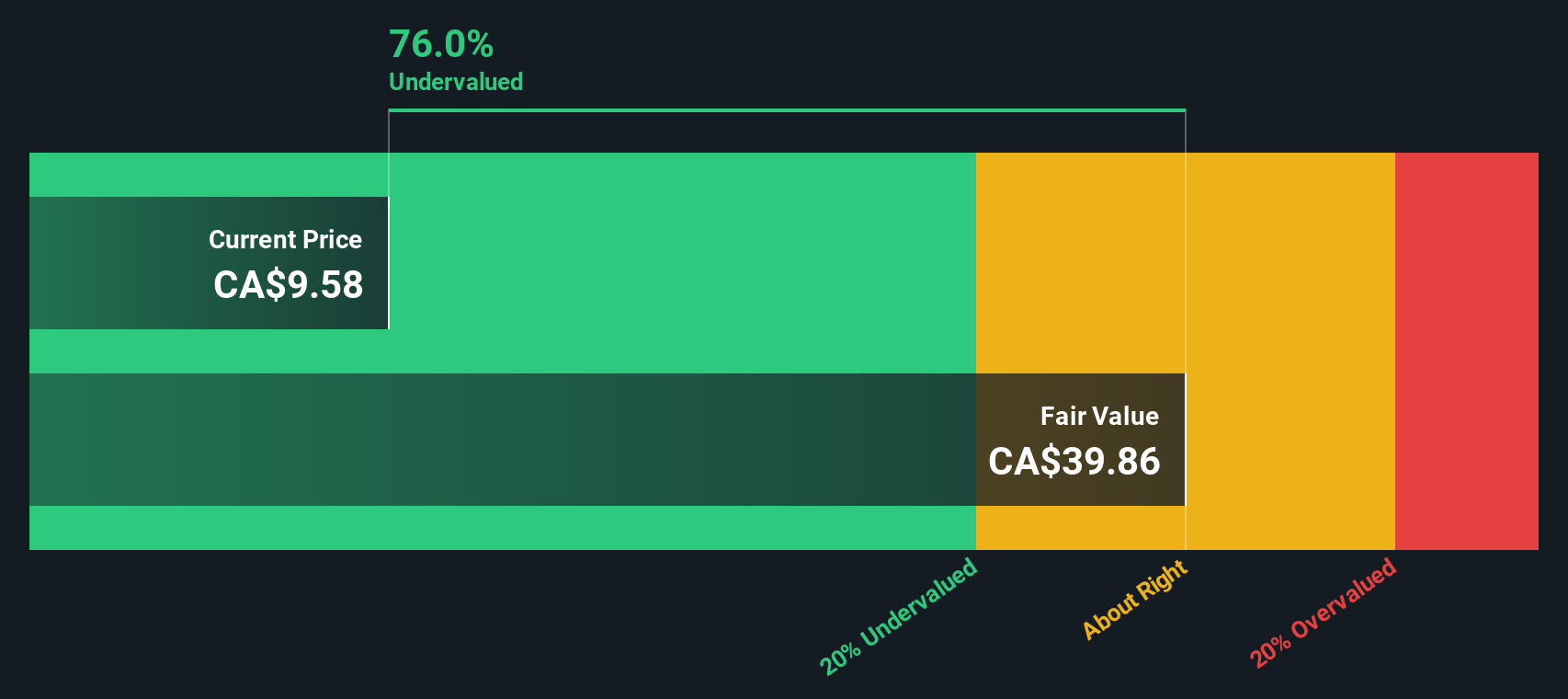

The Discounted Cash Flow (DCF) model is a valuation tool that estimates the intrinsic value of a company by forecasting its future free cash flows and discounting them back to today’s value. It helps assess what New Gold is truly worth, based on the cash it is expected to generate over time.

According to the latest numbers, New Gold reported trailing twelve-month free cash flow of $188.5 million. Analysts project steady growth in free cash flow, with estimates reaching $1.18 billion by the end of 2028. While forecast data from analysts only covers a handful of years, Simply Wall St has extrapolated projections up to 2035, showing continued strength in free cash flow generation.

Based on the 2 Stage Free Cash Flow to Equity model and after applying appropriate discount rates, the estimated intrinsic value for New Gold stands at $37.22 per share. With the DCF calculation showing the stock trades at a 72.6% discount to its fair value, the data points toward significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests New Gold is undervalued by 72.6%. Track this in your watchlist or portfolio, or discover 885 more undervalued stocks based on cash flows.

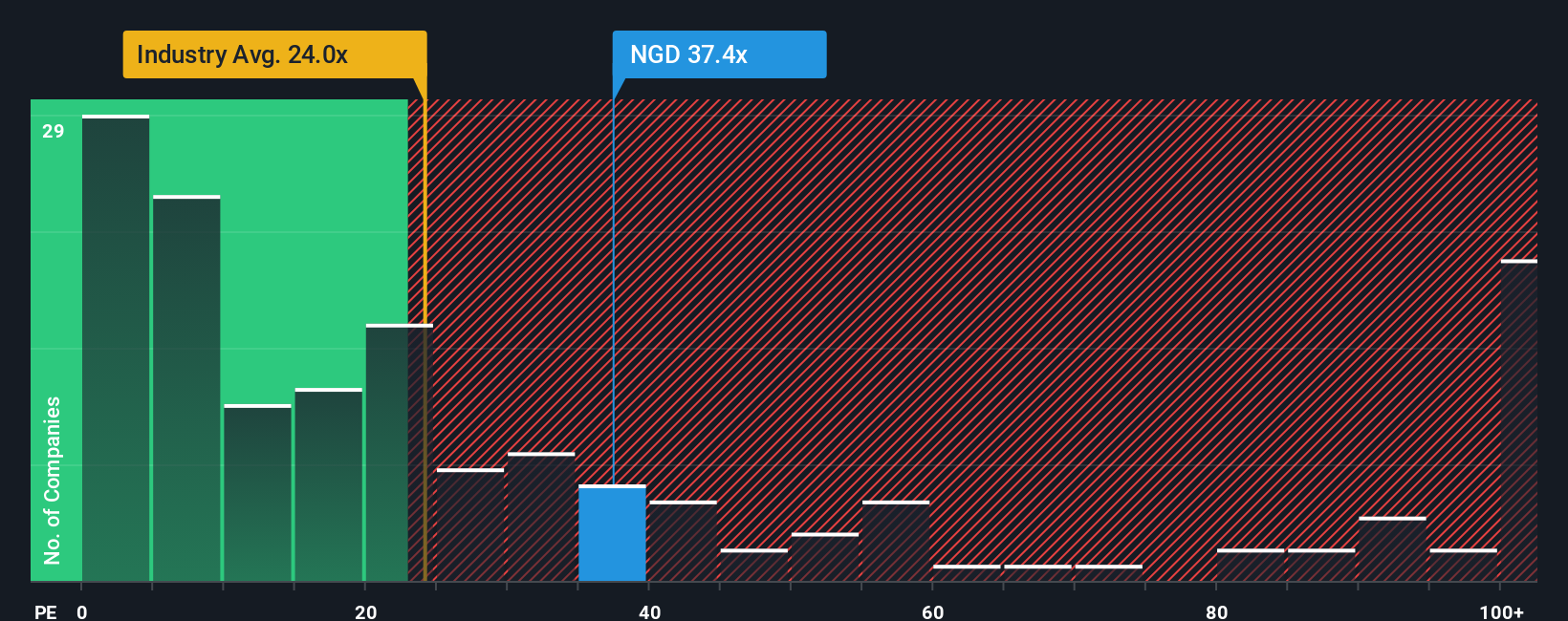

Approach 2: New Gold Price vs Earnings

The Price-to-Earnings (PE) ratio is a trusted tool for valuing profitable companies like New Gold, as it reflects how much investors are willing to pay for each dollar of current earnings. A PE ratio helps compare companies across the same industry and gauge whether a stock is reasonably priced, especially when profits are consistent.

It is important to remember that a “normal” or “fair” PE ratio varies depending on expectations for future growth and underlying business risks. Higher growth prospects often justify a loftier PE ratio, while added risk should hold it back.

Presently, New Gold trades at a PE ratio of 23.1x. This compares closely to the Metals and Mining industry average of 22.7x and is slightly below the average PE of peer companies, which sits at 25.5x. These figures suggest New Gold is reasonably valued when looking at classic benchmarks.

Simply Wall St, however, calculates a proprietary "Fair Ratio" for every company. This refines the PE estimate based on factors like New Gold’s earnings growth, profit margins, specific industry dynamics, company size, and risk profile. This allows for a more nuanced and accurate assessment than a blanket peer or industry comparison.

In New Gold’s case, its Fair Ratio is calculated at 27.7x. Since the current PE of 23.1x is noticeably lower than the Fair Ratio, this suggests New Gold’s shares are undervalued when all important fundamentals are considered.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

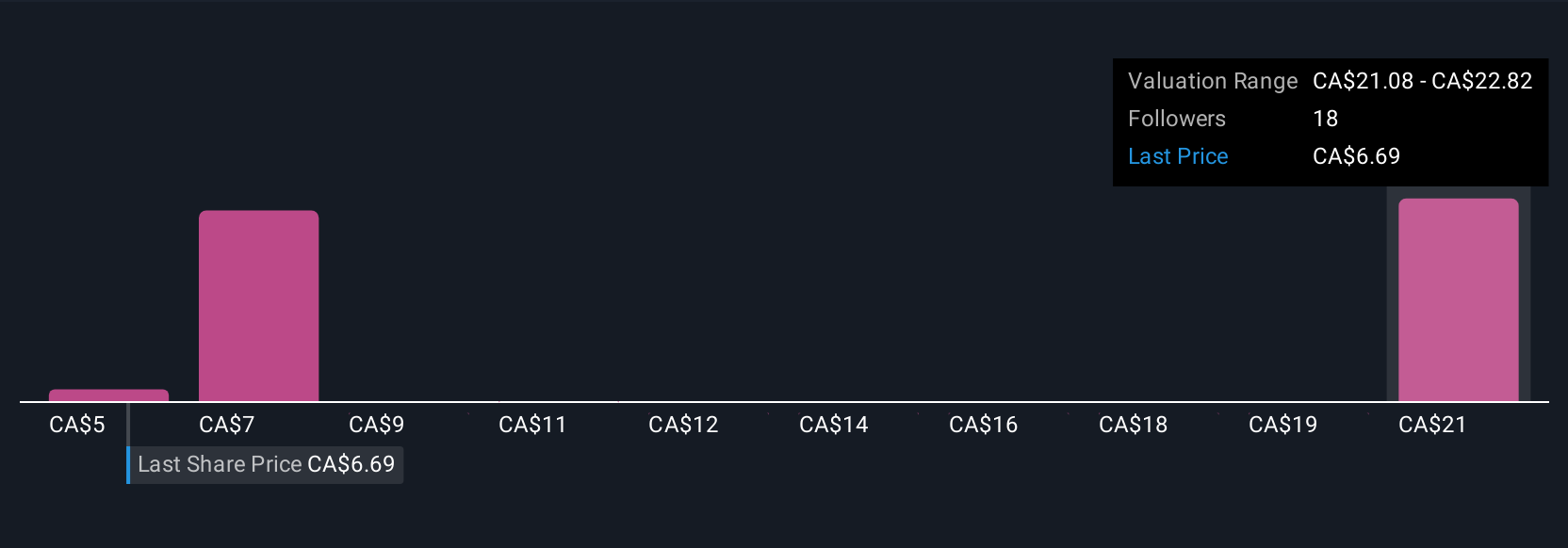

Upgrade Your Decision Making: Choose your New Gold Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company that connects what you believe (about its business, management, industry trends, or risks) to measurable future outcomes like revenue, earnings, and profit margins. This way, you are not just looking at numbers; you are explaining why you think those numbers make sense, and how they support your idea of fair value for the stock.

Narratives allow you to translate your perspective into a dynamic financial model, helping you visualize whether New Gold is currently overpriced or undervalued compared to what you think it’s really worth. On Simply Wall St’s Community page, millions of investors use Narratives because they make it easy and accessible to craft, share, or compare these stories, and they automatically evolve as new data or news is released.

For example, one investor may write a Narrative built around New Gold’s surging production efficiency and copper exposure, forecasting robust long-term growth and significantly higher earnings, while another might focus on rising costs and potential resource depletion, predicting flat or even falling profitability. By comparing your fair value estimate from your Narrative to today’s price, you gain clarity on whether now is a good time to buy, hold, or sell.

Do you think there's more to the story for New Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives