- Canada

- /

- Metals and Mining

- /

- TSX:NGD

Investors Still Aren't Entirely Convinced By New Gold Inc.'s (TSE:NGD) Revenues Despite 43% Price Jump

New Gold Inc. (TSE:NGD) shareholders would be excited to see that the share price has had a great month, posting a 43% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 55%.

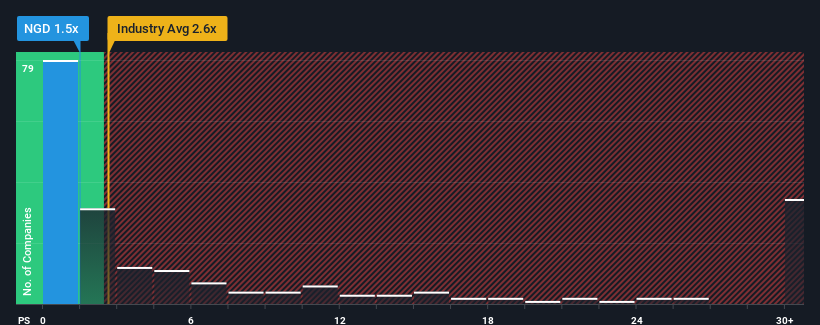

Although its price has surged higher, New Gold's price-to-sales (or "P/S") ratio of 1.5x might still make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 2.6x and even P/S above 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for New Gold

How New Gold Has Been Performing

With revenue growth that's superior to most other companies of late, New Gold has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on New Gold.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, New Gold would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. As a result, it also grew revenue by 22% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 15% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 7.4% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that New Gold's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From New Gold's P/S?

The latest share price surge wasn't enough to lift New Gold's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at New Gold's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for New Gold with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives