- Canada

- /

- Metals and Mining

- /

- TSX:NGD

How Investors Are Reacting To New Gold (TSX:NGD) Surging Production and Fivefold Net Income Growth

Reviewed by Simply Wall St

- New Gold Inc. announced its second quarter and half-year 2025 results, with gold production rising year-over-year in the latest quarter to 78,595 ounces and sales for the second quarter reaching US$308.4 million, both ahead of last year's figures.

- An interesting insight is that net income for the first half of 2025 grew more than fivefold compared to the same period last year, reflecting stronger operational and financial performance.

- We'll examine how a surge in half-year net income shapes expectations for New Gold’s growth and operational resilience moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

New Gold Investment Narrative Recap

Being a New Gold shareholder often hinges on belief in the company’s ability to increase production and control costs across its core Rainy River and New Afton mines. The latest earnings, with a significant jump in half-year net income and stronger-than-expected Q2 sales, reinforce confidence in improved operational execution. However, these results have not materially reduced central risks like high sustaining costs at Rainy River and uncertainties tied to future resource replacement. Among recent developments, the full consolidation of New Afton mine ownership stands out as a move that could influence both production scale and earnings resilience, especially as new zones come online and resource expansion remains a focus. This context matters for near-term catalysts around growing output and timely project ramp-up, but persistent cost pressures and exploration risk continue to shape the outlook. By contrast, investors should also be aware that Rainy River’s high all-in sustaining costs remain a concern if...

Read the full narrative on New Gold (it's free!)

New Gold's outlook anticipates $1.7 billion in revenue and $592.5 million in earnings by 2028. This scenario requires 17.4% annual revenue growth and a $447.6 million increase in earnings from the current $144.9 million.

Uncover how New Gold's forecasts yield a CA$8.46 fair value, a 44% upside to its current price.

Exploring Other Perspectives

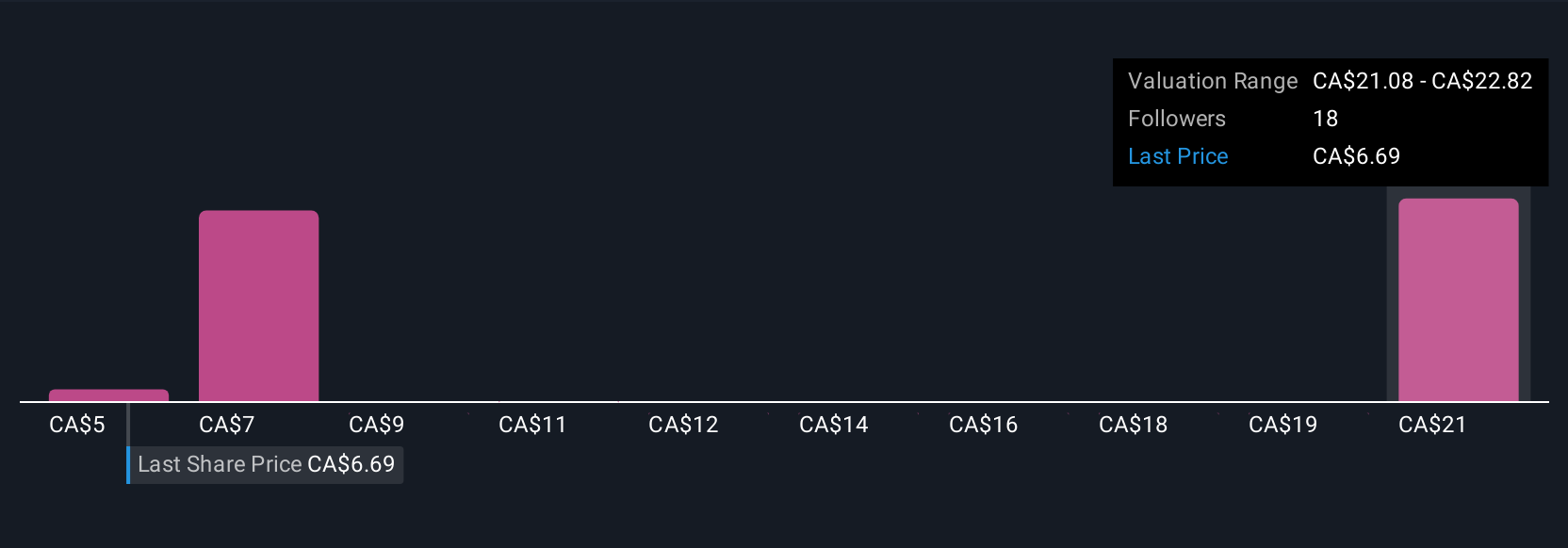

Six different retail investors in the Simply Wall St Community placed their fair values for New Gold stock between CA$5.47 and CA$23.92. While such varied viewpoints exist, remember that ramping up higher-grade ore production is still a central catalyst likely impacting future performance.

Explore 6 other fair value estimates on New Gold - why the stock might be worth 7% less than the current price!

Build Your Own New Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Gold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free New Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Gold's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives