- Canada

- /

- Metals and Mining

- /

- TSX:NCU

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Nevada Copper Corp.'s (TSE:NCU) CEO For Now

Key Insights

- Nevada Copper's Annual General Meeting to take place on 12th of June

- Total pay for CEO Randy Buffington includes US$458.3k salary

- The overall pay is 1,009% above the industry average

- Over the past three years, Nevada Copper's EPS fell by 13% and over the past three years, the total loss to shareholders 99%

In the past three years, the share price of Nevada Copper Corp. (TSE:NCU) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also poor, despite revenues growing. The AGM coming up on 12th of June will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

See our latest analysis for Nevada Copper

Comparing Nevada Copper Corp.'s CEO Compensation With The Industry

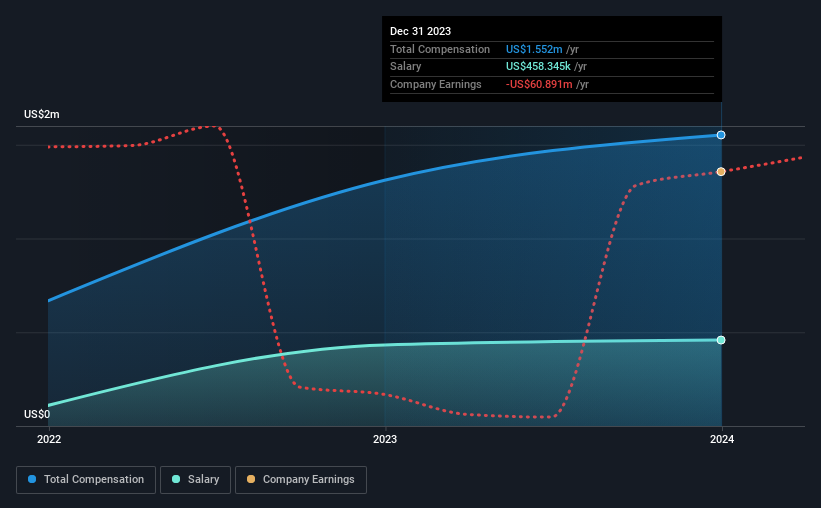

Our data indicates that Nevada Copper Corp. has a market capitalization of CA$129m, and total annual CEO compensation was reported as US$1.6m for the year to December 2023. We note that's an increase of 18% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$458k.

On comparing similar-sized companies in the Canadian Metals and Mining industry with market capitalizations below CA$273m, we found that the median total CEO compensation was US$140k. This suggests that Randy Buffington is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$458k | US$433k | 30% |

| Other | US$1.1m | US$878k | 70% |

| Total Compensation | US$1.6m | US$1.3m | 100% |

On an industry level, roughly 94% of total compensation represents salary and 6% is other remuneration. It's interesting to note that Nevada Copper allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Nevada Copper Corp.'s Growth

Over the last three years, Nevada Copper Corp. has shrunk its earnings per share by 13% per year. Its revenue is up 103% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Nevada Copper Corp. Been A Good Investment?

The return of -99% over three years would not have pleased Nevada Copper Corp. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 5 warning signs for Nevada Copper (2 are potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Nevada Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NCU

Nevada Copper

Engages in the exploration, development, and operation of mineral properties in Nevada.

Moderate with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.