- Canada

- /

- Electrical

- /

- TSXV:SPRQ

TSX Penny Stocks Spotlight: Nano One Materials And Two More Picks

Reviewed by Simply Wall St

The Canadian market is navigating a period of uncertainty as central banks in both Canada and the U.S. signal a data-driven approach to future interest rate decisions, creating potential volatility around economic indicators. In such conditions, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking stability amid fluctuations. Penny stocks, often overlooked due to their vintage label, can still offer significant opportunities when backed by solid financials; this article shines a light on three promising examples from the TSX that may hold hidden value for discerning investors.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.86 | CA$72.3M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.79 | CA$23.16M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.335 | CA$2.8M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.32 | CA$48.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.18 | CA$785.05M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.41 | CA$389.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.36 | CA$170.54M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.11 | CA$200.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.70 | CA$8.71M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Nano One Materials (TSX:NANO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nano One Materials Corp. focuses on producing and selling cathode active materials for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics, with a market cap of CA$114.86 million.

Operations: There are no reported revenue segments for this company.

Market Cap: CA$114.86M

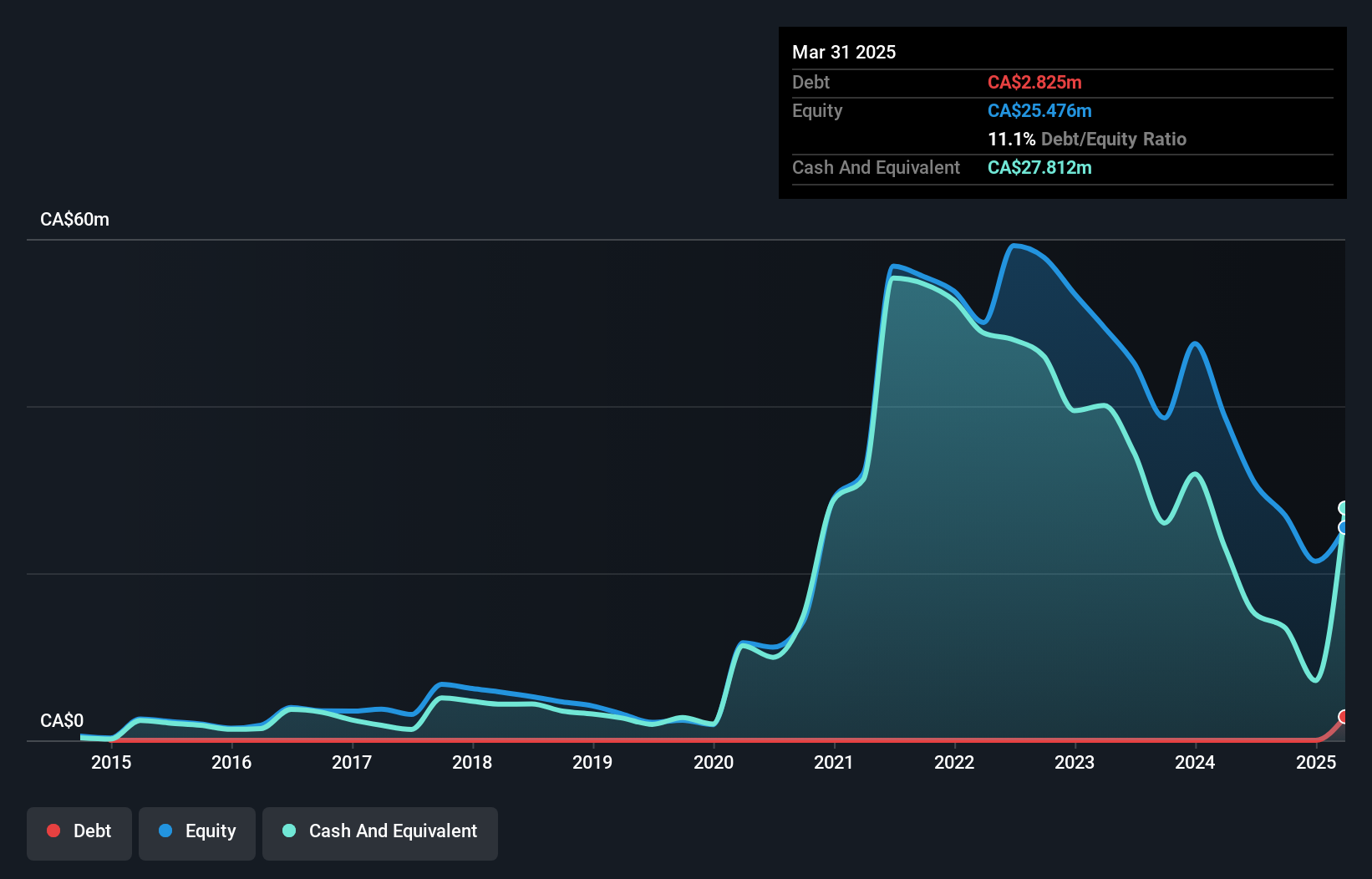

Nano One Materials Corp. is a pre-revenue company focused on lithium-ion battery materials, with recent strategic developments that could enhance its market position. The collaboration with Sumitomo Metal Mining aims to commercialize Nano One's technology, while the installation of a high-efficiency agitator in Quebec improves production capabilities and cost performance. Despite being unprofitable, Nano One maintains a stable cash runway and has not significantly diluted shareholders over the past year. Recent equity offerings and strategic partnerships, including participation in the Arkansas Lithium Technology Accelerator, highlight efforts to strengthen its supply chain and expand visibility in North America.

- Click to explore a detailed breakdown of our findings in Nano One Materials' financial health report.

- Gain insights into Nano One Materials' historical outcomes by reviewing our past performance report.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Critical Elements Lithium Corporation focuses on the acquisition, exploration, and development of mining properties in Canada with a market cap of CA$91.50 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$91.5M

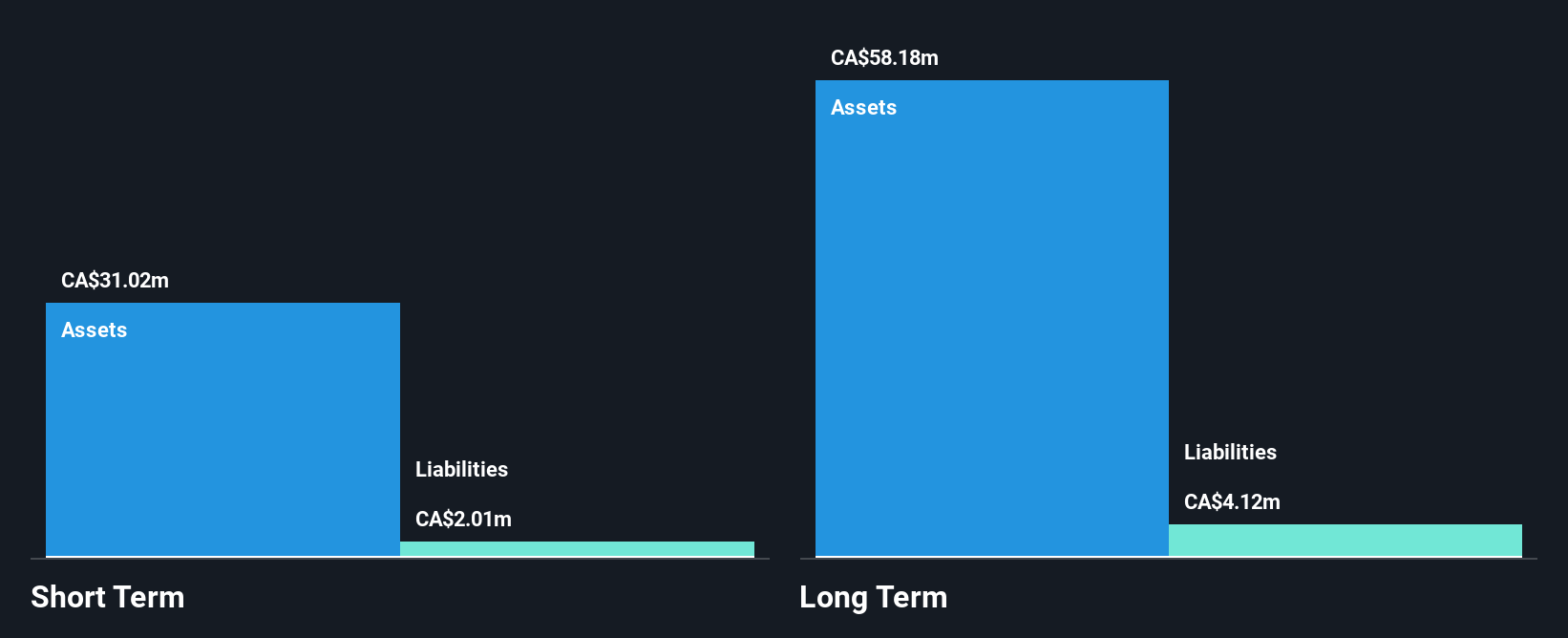

Critical Elements Lithium Corporation, a pre-revenue entity with a market cap of CA$91.50 million, is advancing its high-purity Rose Lithium-Tantalum project in Quebec. Recent exploration at the Nemaska Belt properties aims to refine drill targets for nickel-copper-PGE and lithium mineralization. The company maintains a strong financial position with no debt and sufficient cash runway, though it reported a net loss of CA$5.86 million for Q3 2025. With experienced management and board members, Critical Elements focuses on securing funding for its projects while retaining strategic interests in other ventures like Power Metallic Mines Inc.'s Nisk property.

- Take a closer look at Critical Elements Lithium's potential here in our financial health report.

- Gain insights into Critical Elements Lithium's future direction by reviewing our growth report.

SPARQ Systems (TSXV:SPRQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SPARQ Systems Inc. designs, manufactures, and sells single-phase microinverters for residential and commercial solar electric applications with a market cap of CA$87.70 million.

Operations: The company generates revenue from its Electric Equipment segment, totaling CA$1.80 million.

Market Cap: CA$87.7M

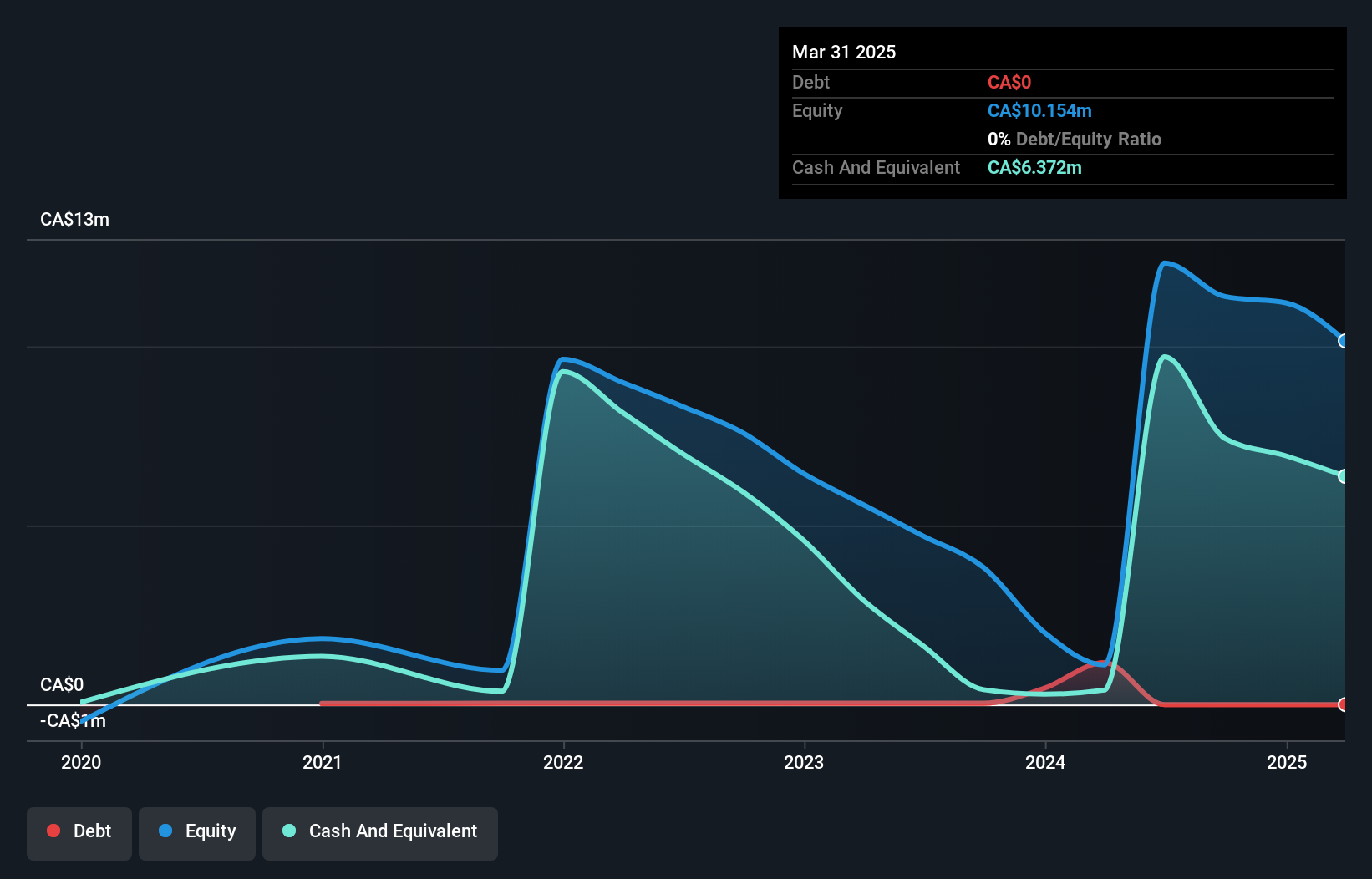

SPARQ Systems Inc., with a market cap of CA$87.70 million, reported second-quarter sales of CA$0.16 million, reflecting significant growth from the previous year. Despite being unprofitable, its net loss has decreased to CA$1.54 million from CA$2.77 million a year ago. The company benefits from an experienced board and maintains a strong financial position with short-term assets exceeding liabilities and no debt burden. Although trading at 88.6% below estimated fair value suggests potential undervaluation, its revenue remains limited at CA$2 million, highlighting challenges in achieving meaningful profitability amidst stable volatility and sufficient cash runway for over a year.

- Navigate through the intricacies of SPARQ Systems with our comprehensive balance sheet health report here.

- Understand SPARQ Systems' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Jump into our full catalog of 411 TSX Penny Stocks here.

- Curious About Other Options? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SPRQ

SPARQ Systems

Engages in the design, manufacture, and sale of single-phase microinverters for residential and commercial solar electric applications.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives