- Canada

- /

- Oil and Gas

- /

- TSXV:FMC

3 Canadian Penny Stocks On TSX Under CA$70M Market Cap

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of global trade tensions and economic uncertainties, investors are increasingly looking for opportunities that can offer both growth and resilience. Penny stocks, often seen as remnants of past market trends, continue to captivate investors with their potential for significant returns. Despite their vintage label, these smaller or newer companies can present compelling opportunities when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.58 | CA$60.69M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.40 | CA$64.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$1.02B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.75 | CA$407.32M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.57 | CA$269.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.60 | CA$174.43M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$531.2M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.40 | CA$69.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Headwater Exploration (TSX:HWX) | CA$4.91 | CA$1.24B | ✅ 5 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.50 | CA$15.18M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 942 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Nano One Materials (TSX:NANO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nano One Materials Corp. produces and sells cathode active materials for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics, with a market cap of CA$66.87 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$66.87M

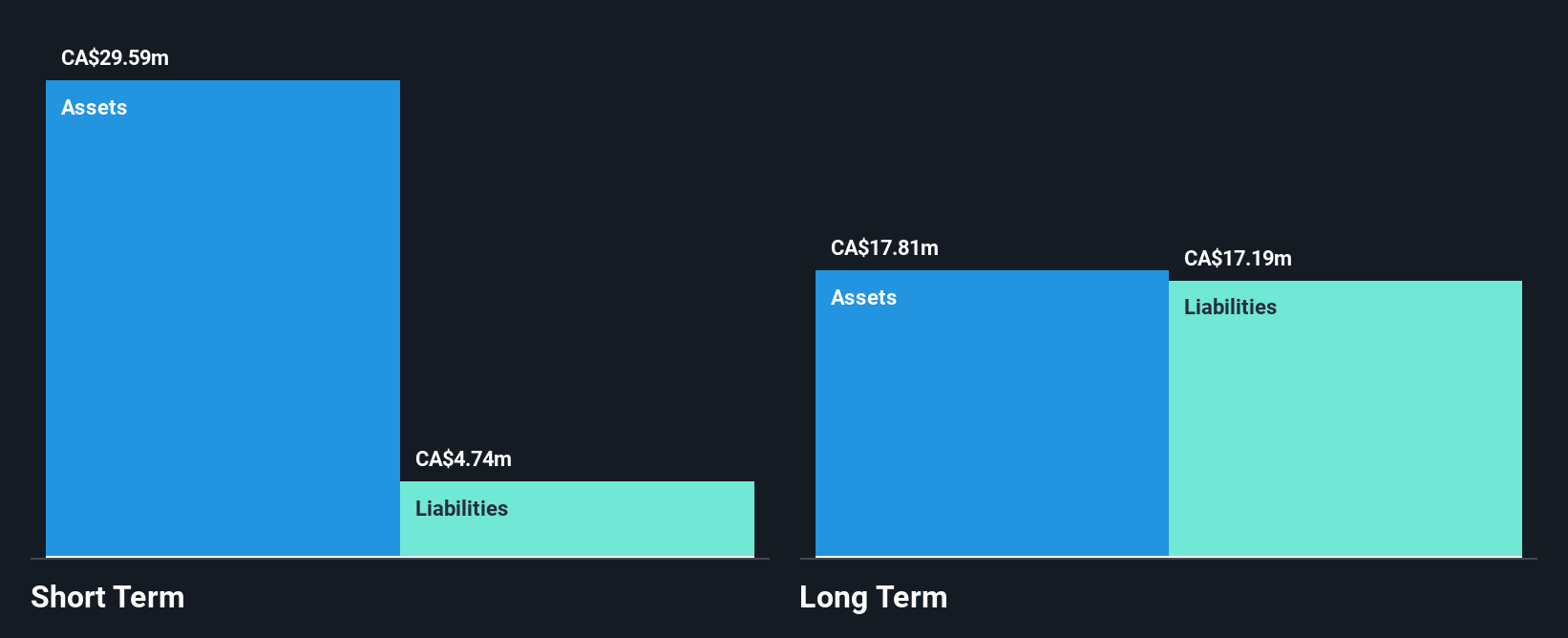

Nano One Materials Corp., with a market cap of CA$66.87 million, is pre-revenue and unprofitable, reporting a net loss of CA$29.22 million for 2024. The company has no debt and its short-term assets exceed both short- and long-term liabilities, but it faces less than a year of cash runway at current free cash flow rates. Despite these challenges, Nano One's leadership transition could bolster its technological capabilities as Dr. Guoxian Liang takes over R&D efforts with his extensive experience in lithium-ion cathode materials commercialization, potentially positioning the company for future growth in the battery sector.

- Navigate through the intricacies of Nano One Materials with our comprehensive balance sheet health report here.

- Examine Nano One Materials' earnings growth report to understand how analysts expect it to perform.

Forum Energy Metals (TSXV:FMC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Forum Energy Metals Corp. is involved in the evaluation, acquisition, exploration, and development of natural resource properties in Canada and the United States with a market cap of CA$13.92 million.

Operations: Forum Energy Metals Corp. has not reported any specific revenue segments.

Market Cap: CA$13.92M

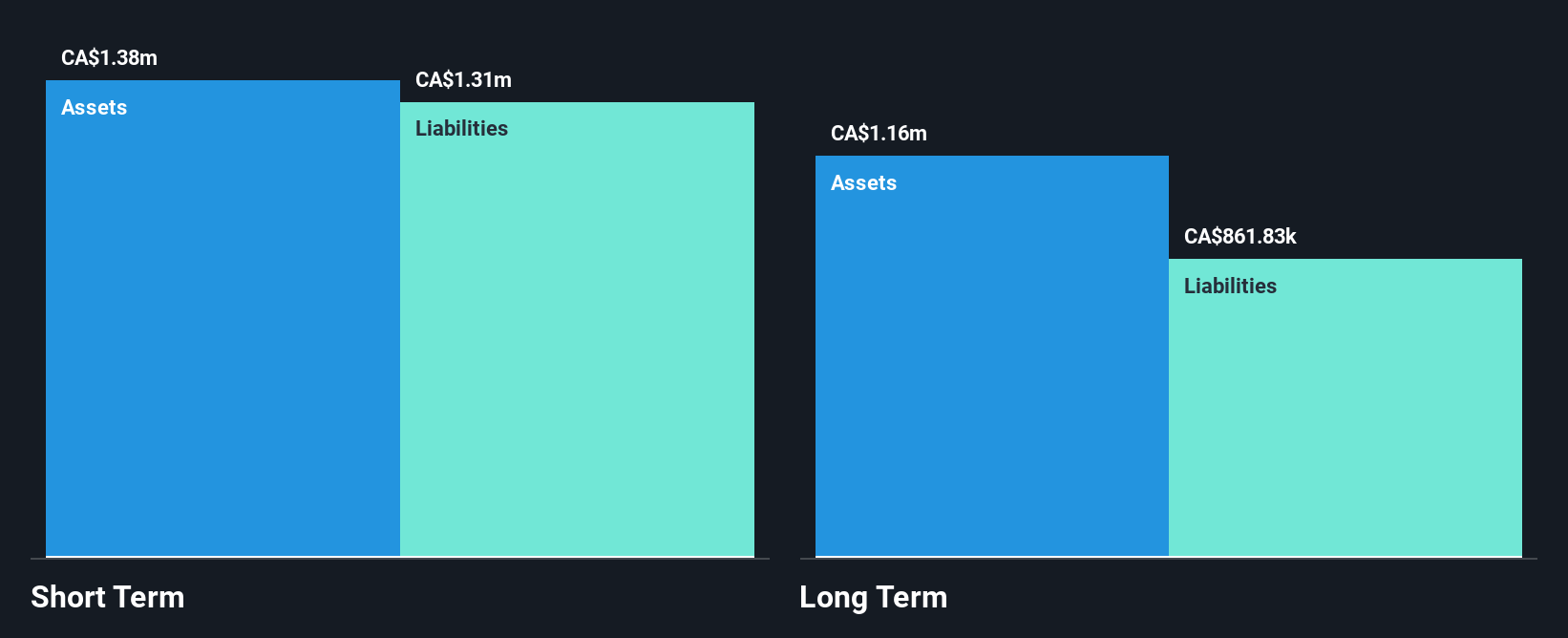

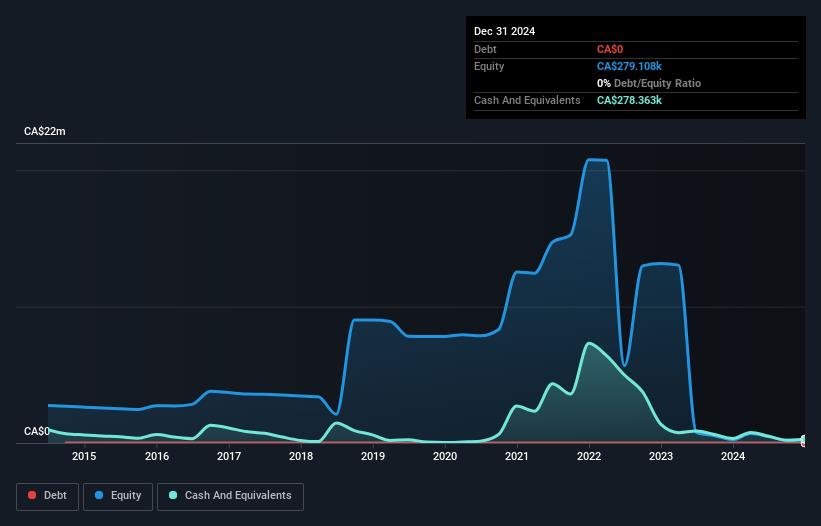

Forum Energy Metals Corp., with a market cap of CA$13.92 million, is pre-revenue and grappling with financial challenges, including short-term liabilities exceeding its assets and a negative equity return. Recent drilling initiatives at the Northwest Athabasca Project in Saskatchewan have shown promising uranium mineralization potential, particularly in the Ayra and Loki grids. However, the company's auditor has expressed doubts about its ability to continue as a going concern due to significant losses reported for 2024. Despite these hurdles, Forum's strategic partnerships aim to enhance exploration efforts across its projects.

- Unlock comprehensive insights into our analysis of Forum Energy Metals stock in this financial health report.

- Review our historical performance report to gain insights into Forum Energy Metals' track record.

Canstar Resources (TSXV:ROX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canstar Resources Inc. is involved in the acquisition, exploration, and development of mineral properties in Canada with a market cap of CA$5.95 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$5.95M

Canstar Resources, with a market cap of CA$5.95 million, is pre-revenue and focuses on mineral exploration in Canada. The company recently launched a geophysics program in the Buchans mining district, leveraging advanced technology to identify potential high-grade VMS deposits. Despite its unprofitability and limited cash runway, Canstar's strategic focus on refining drilling targets could enhance its exploration prospects significantly. Recent leadership changes include appointing Bob Patey as Vice President of Exploration to bolster operations in Newfoundland. While financial challenges persist with ongoing losses, these initiatives aim to position Canstar for potential future discoveries.

- Take a closer look at Canstar Resources' potential here in our financial health report.

- Evaluate Canstar Resources' historical performance by accessing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 939 TSX Penny Stocks now.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FMC

Forum Energy Metals

Engages in the evaluation, acquisition, exploration, and development of natural resource properties in Canada and the United States.

Medium-low risk with worrying balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.