Is Methanex’s Dividend Declaration Altering The Investment Case For Methanex (TSX:MX)?

Reviewed by Simply Wall St

- Methanex Corporation's Board of Directors recently declared a quarterly dividend of US$0.185 per share, payable on September 30, 2025 to shareholders of record as of September 16, 2025.

- This ongoing dividend affirmation is often interpreted by the market as a sign of steady financial health and management’s confidence in the company’s future prospects.

- We'll explore how Methanex's continued dividend payments reflect on its investment narrative and reinforce signals of business stability.

Methanex Investment Narrative Recap

To own shares of Methanex, investors typically look for belief in the long-term global methanol demand story, solid free cash flow and potential operational upside from capacity expansions and acquisitions. The recent dividend affirmation signals business stability, but it does not significantly alter the near-term outlook, since major catalysts such as production ramp-up at Geismar and OCI integration, along with risks like gas supply disruptions, remain central to the stock’s immediate direction.

A standout recent announcement was the successful restart of the Geismar 3 facility after an unplanned outage. Bringing G3 back online is especially relevant to near-term growth drivers, as its operational status directly impacts production volumes and earnings, aligning with investors’ focus on robust supply and uninterrupted operations.

However, against these strengths, investors should remain mindful of supply chain risks, especially regarding Methanex’s reliance on contracted gas for production in key regions like Chile and New Zealand, as ...

Read the full narrative on Methanex (it's free!)

Methanex's outlook anticipates $4.6 billion in revenue and $421.9 million in earnings by 2028. This scenario assumes annual revenue growth of 6.9% and an earnings increase of $257.9 million from current earnings of $164.0 million.

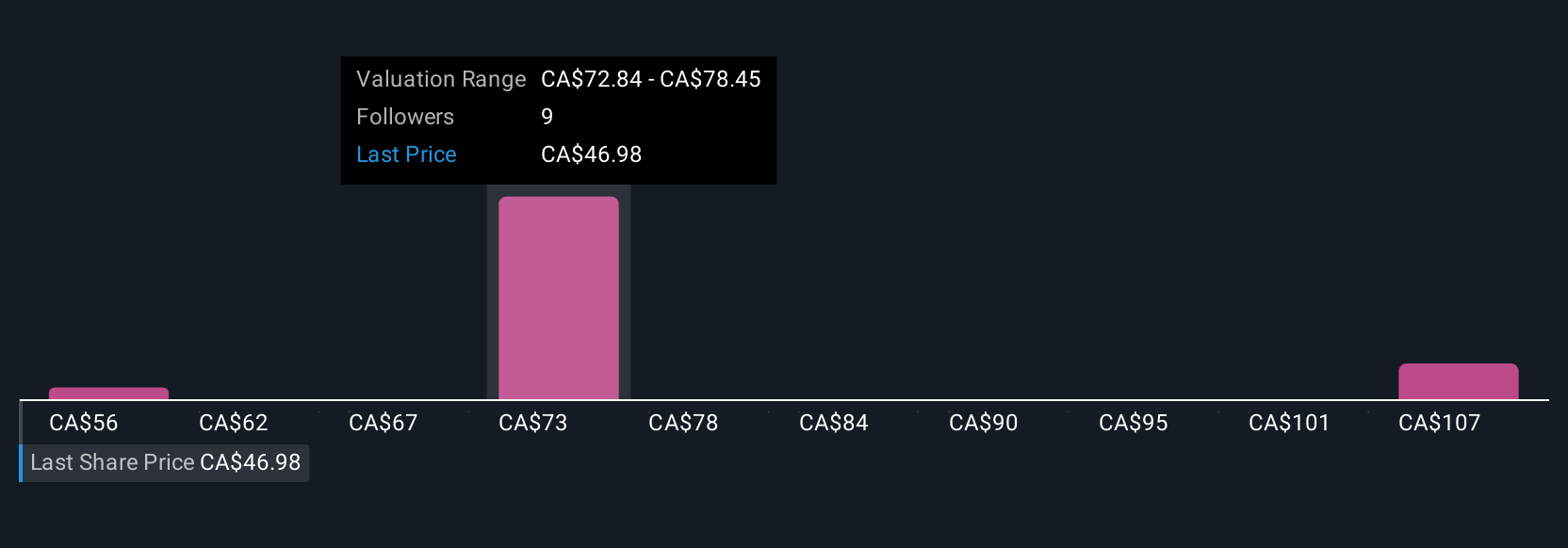

Uncover how Methanex's forecasts yield a CA$75.66 fair value, a 62% upside to its current price.

Exploring Other Perspectives

Fair value opinions from the Simply Wall St Community range from CA$56 to CA$110.87, with three unique perspectives. Amidst this wide spread, the potential for production curtailment in core regions due to gas supply remains a risk that could weigh on company performance.

Build Your Own Methanex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Methanex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Methanex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Methanex's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives