How Methanex's New Marine Fuel Partnerships Could Shape the Long-Term Outlook for TSX:MX Investors

Reviewed by Sasha Jovanovic

- Methanex recently announced new strategic partnerships in the ARA (Amsterdam-Rotterdam-Antwerp) region and South Korea to expand marine fuel operations, including collaboration with TankMatch for barge-to-ship methanol bunkering and enhanced local capacity following its OCI acquisition.

- The company's expertise in methanol-fueled shipping and the development of robust safety protocols positions it as a leading player supporting the marine industry's transition to low-carbon fuels amid tightening global regulations.

- We'll explore how Methanex's expanded marine fuel partnerships could influence its long-term investment narrative and demand outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Methanex Investment Narrative Recap

Owning Methanex stock means believing in its ability to grow through expanding demand for low-carbon methanol, operational scale, and execution on acquisitions like OCI. The recent expansion of marine fuel partnerships in Europe and Asia builds on Methanex’s core expertise, but does not materially alter the short-term focus on maximizing supply reliability or relieve risks tied to feedstock gas access, which remains pivotal for near-term margins and volumes.

Among Methanex’s updates, the September 2025 partnership with TankMatch for methanol bunkering stands out, as it could strengthen the case for marine fuel-driven growth catalysts, particularly as global decarbonization accelerates. However, the most impactful underlying drivers remain operational efficiency at key sites and successful integration of OCI, ongoing efforts that anchor Methanex’s performance beyond market headlines.

By contrast, investors should be cautious of risks related to feedstock gas supply issues in Chile or Egypt, as these...

Read the full narrative on Methanex (it's free!)

Methanex's narrative projects $4.6 billion revenue and $421.9 million earnings by 2028. This requires 6.9% yearly revenue growth and a $257.9 million earnings increase from $164.0 million today.

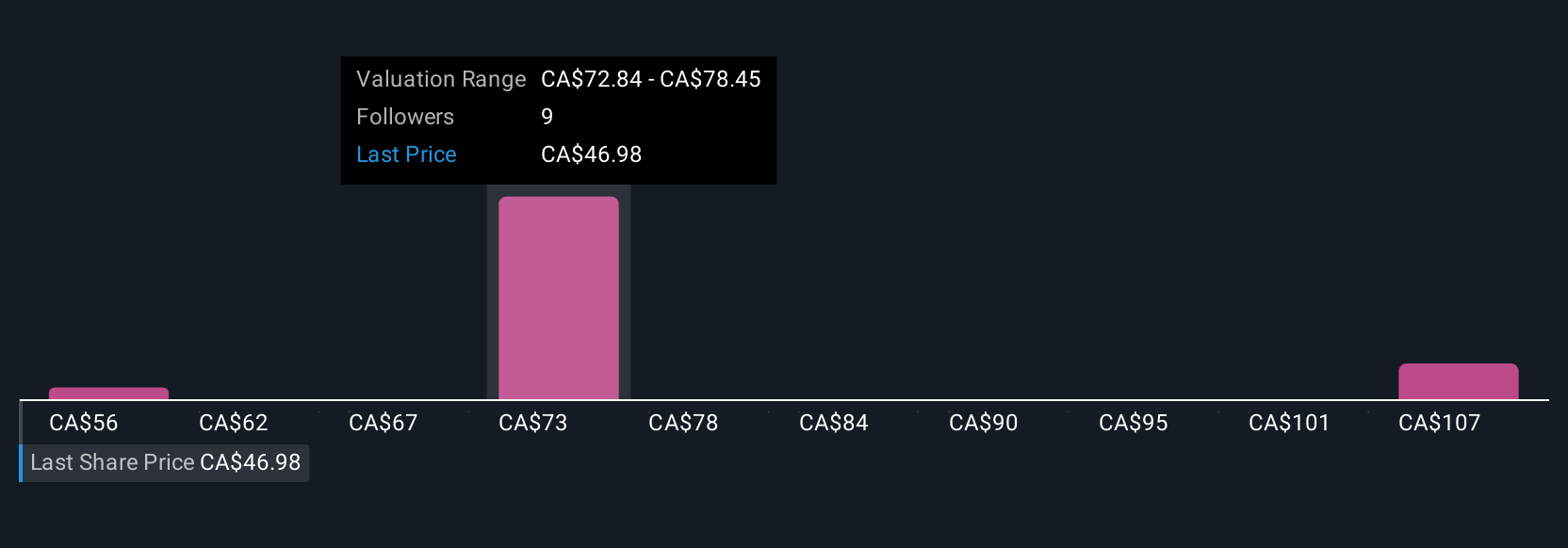

Uncover how Methanex's forecasts yield a CA$75.66 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Three individual members from the Simply Wall St Community provided fair value estimates ranging from CA$56 to CA$91.99 per share. While opinions differ broadly on Methanex’s potential, risks around feedstock gas contracts could be a focal point for anyone considering the stock’s ability to sustain future production and earnings.

Explore 3 other fair value estimates on Methanex - why the stock might be worth just CA$56.00!

Build Your Own Methanex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Methanex research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Methanex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Methanex's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives