How Investors May Respond To Methanex (TSX:MX) Quarterly Dividend Announcement and Capital Allocation Strategy

Reviewed by Simply Wall St

- Methanex Corporation recently declared a quarterly dividend of US$0.185 per share, payable on September 30, 2025, to shareholders of record as of September 16, 2025.

- This dividend declaration highlights the company's emphasis on shareholder returns even as it manages industry opportunities and expansion efforts.

- We'll explore how the quarterly dividend underscores Methanex's approach to balancing capital allocation with its ongoing investment narrative.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Methanex Investment Narrative Recap

To invest in Methanex, you need to believe in the long-term global demand for methanol, the company's ability to maintain efficient operations, and the successful integration of new capacity from its OCI acquisition. The latest dividend announcement supports Methanex's ongoing commitment to shareholder returns but does not materially change the short-term focus on restoring production volumes or reduce the underlying risk from gas supply disruptions in key producing regions.

Among recent company updates, the restart of the Geismar 3 plant after an unplanned outage stands out. This operational milestone is closely tied to Methanex’s goal of meeting its revised production targets and supports potential earnings stability, factors that are much more influential as near-term catalysts than the dividend itself.

But in contrast to the stable dividend, the risk of production curtailment in regions like Chile remains a key concern investors should be aware of...

Read the full narrative on Methanex (it's free!)

Methanex's outlook points to $4.6 billion in revenue and $421.9 million in earnings by 2028. This projection assumes a 6.9% annual revenue growth rate and a $257.9 million increase in earnings from the current $164.0 million.

Uncover how Methanex's forecasts yield a CA$75.66 fair value, a 61% upside to its current price.

Exploring Other Perspectives

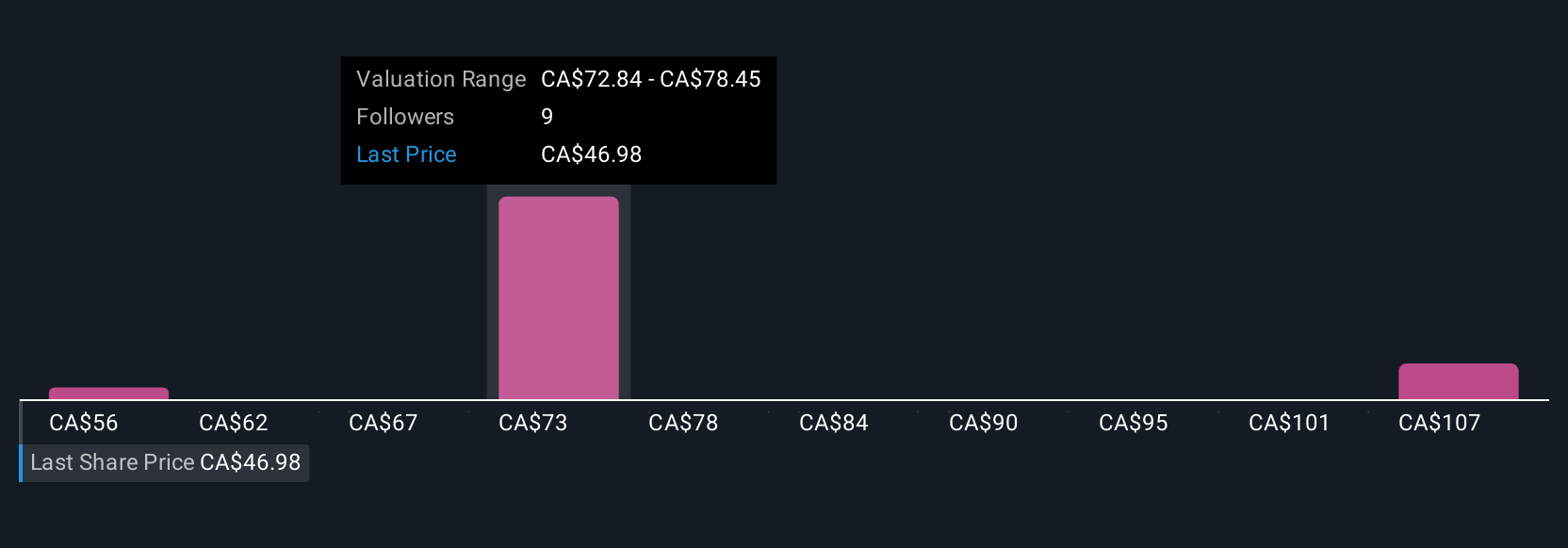

Simply Wall St Community members shared 3 fair value estimates for Methanex, ranging from CA$56 to CA$110.98. While some see significant upside, recurring production risks still weigh on the outlook for future returns.

Build Your Own Methanex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Methanex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Methanex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Methanex's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives