How Investors May Respond To Methanex (TSX:MX) Expanding Methanol Bunkering Partnerships in Key Shipping Hubs

Reviewed by Sasha Jovanovic

- Methanex Corporation recently announced new partnerships in the Amsterdam-Rotterdam-Antwerp region and South Korea to expand methanol bunkering infrastructure, offering barge-to-ship refueling services through TankMatch and integrating previous arrangements from its OCI acquisition.

- This move highlights Methanex’s increasing leadership in supporting shipping companies with safer, low-carbon marine fuel options as global regulations and demand for sustainable energy solutions continue to evolve.

- We'll explore how Methanex's expanded marine fuel partnerships could influence analysts' expectations for future revenue growth and market reach.

Find companies with promising cash flow potential yet trading below their fair value.

Methanex Investment Narrative Recap

To be a Methanex shareholder, you need to believe in the continued expansion of low-carbon methanol as a key marine fuel amid stricter shipping emissions standards, and Methanex’s ability to convert this leadership into meaningful revenue. The recent bunkering partnerships in the ARA region and South Korea are positive steps for expanding market reach, but do not materially change the most important short term catalyst: integration of OCI’s operations; nor do they address the biggest risk, which remains gas supply reliability for production.

The most relevant recent announcement is Methanex’s takeover of OCI’s bunkering arrangements in Europe, directly tied to its operational scale in the marine fuel transition. This move consolidates its position in a growing segment, but the ongoing challenge of smoothly integrating OCI’s assets and operations into Methanex’s own processes remains central to the story, with implications for cost control and future earnings potential.

However, investors should be mindful that alongside the expanded marine partnerships, the risk of production disruptions due to gas supply constraints remains...

Read the full narrative on Methanex (it's free!)

Methanex's narrative projects $4.6 billion revenue and $421.9 million earnings by 2028. This requires 6.9% yearly revenue growth and a $257.9 million earnings increase from $164.0 million.

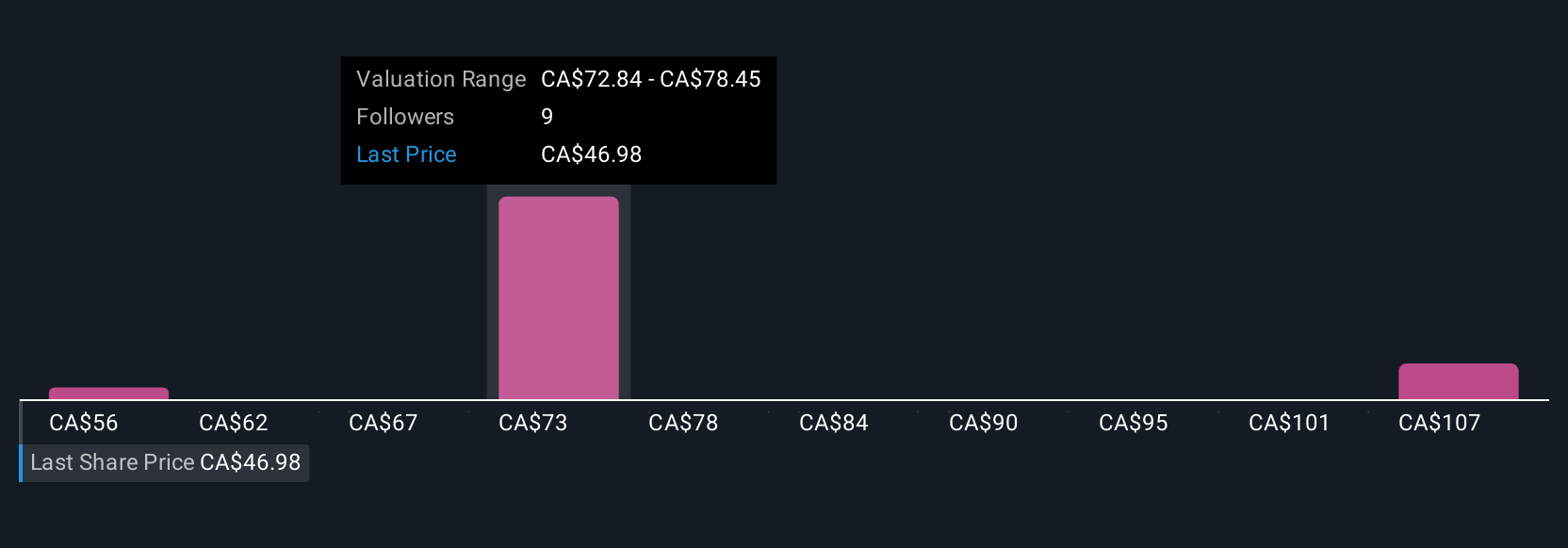

Uncover how Methanex's forecasts yield a CA$75.66 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members set Methanex’s fair value between CA$56 and CA$90.97, signaling almost CA$35,000 difference in opinion. As marine fuel demand rises, integration risks still weigh heavily on short to medium term outcomes, review different analyses to see which outlook matches your expectations.

Explore 3 other fair value estimates on Methanex - why the stock might be worth as much as 64% more than the current price!

Build Your Own Methanex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Methanex research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Methanex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Methanex's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives